17, Oct 2023

2025, 2026, 2027 Tax Brackets: A Comprehensive Overview

2025, 2026, 2027 Tax Brackets: A Comprehensive Overview

Related Articles: 2025, 2026, 2027 Tax Brackets: A Comprehensive Overview

- Pictures Of 2025 Toyota Camry: A Glimpse Into The Future Of Sedans

- BMW X3 Electric 2025: A Comprehensive Overview

- Soul Train Cruise 2016: A Musical Odyssey With Legendary Performers

- Countdown To 2025: The Race To Achieve The Sustainable Development Goals

- 2025 Toyota RAV4 Prime: A Pinnacle Of Hybrid Innovation

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025, 2026, 2027 Tax Brackets: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025, 2026, 2027 Tax Brackets: A Comprehensive Overview

2025, 2026, 2027 Tax Brackets: A Comprehensive Overview

The tax brackets for 2025, 2026, and 2027 have been released by the Internal Revenue Service (IRS). These brackets determine the amount of income tax you owe based on your taxable income.

Understanding Tax Brackets

Tax brackets are a series of income ranges, each with its own tax rate. As your taxable income increases, you move into higher tax brackets, resulting in a higher percentage of your income being taxed.

2025, 2026, 2027 Tax Brackets

The tax brackets for 2025, 2026, and 2027 are identical for all three years. They are as follows:

| Tax Bracket | Taxable Income (Single) | Taxable Income (Married Filing Jointly) | Tax Rate |

|---|---|---|---|

| 10% | $0 – $10,275 | $0 – $20,550 | 10% |

| 12% | $10,276 – $41,775 | $20,551 – $83,550 | 12% |

| 22% | $41,776 – $89,075 | $83,551 – $178,150 | 22% |

| 24% | $89,076 – $170,500 | $178,151 – $356,300 | 24% |

| 32% | $170,501 – $215,950 | $356,301 – $431,900 | 32% |

| 35% | $215,951 – $539,900 | $431,901 – $1,079,800 | 35% |

| 37% | $539,901+ | $1,079,801+ | 37% |

Standard Deductions

The standard deduction is a fixed amount that reduces your taxable income. The standard deduction amounts for 2025, 2026, and 2027 are as follows:

| Filing Status | 2025 | 2026 | 2027 |

|---|---|---|---|

| Single | $13,850 | $14,250 | $14,650 |

| Married Filing Jointly | $27,700 | $28,500 | $29,300 |

| Head of Household | $20,800 | $21,400 | $22,000 |

Personal Exemptions

Personal exemptions have been eliminated for the 2025, 2026, and 2027 tax years.

Calculating Your Tax Liability

To calculate your tax liability, you need to:

- Determine your taxable income: Subtract your standard deduction and any other eligible deductions from your gross income.

- Identify your tax bracket: Find the tax bracket that corresponds to your taxable income.

- Calculate your tax: Multiply your taxable income by the tax rate for your bracket.

Example

Let’s say you are a single taxpayer with a taxable income of $50,000 in 2025.

- Your taxable income is $50,000 – $13,850 (standard deduction) = $36,150.

- You fall into the 24% tax bracket, which applies to taxable incomes between $89,076 and $170,500.

- Your tax liability is $36,150 x 0.24 = $8,676.

Other Considerations

- Tax Credits: Tax credits directly reduce your tax liability dollar-for-dollar. Some common tax credits include the child tax credit and the earned income tax credit.

- Itemized Deductions: If your itemized deductions (e.g., mortgage interest, charitable contributions) exceed your standard deduction, you may benefit from itemizing on your tax return.

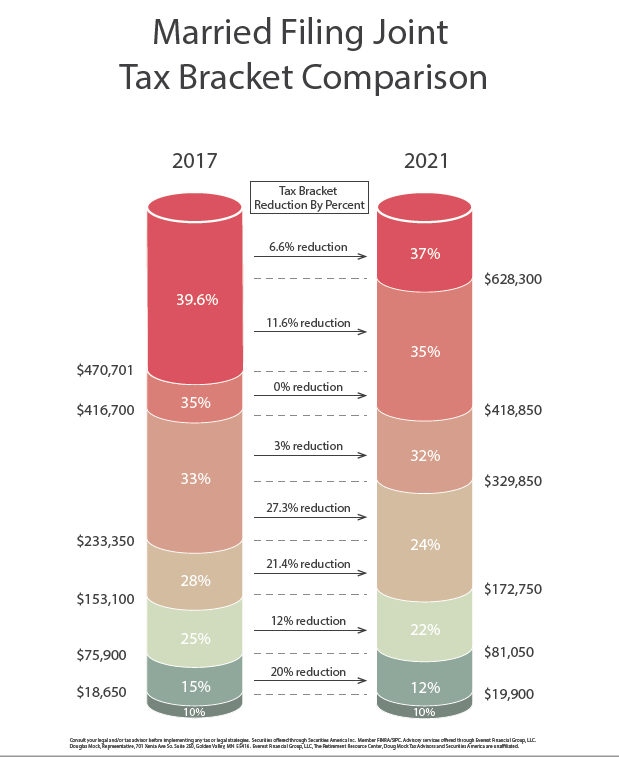

- Tax Reform Act of 2017: The Tax Reform Act of 2017 made significant changes to the tax code, including increasing the standard deduction and eliminating personal exemptions. These changes are reflected in the 2025, 2026, and 2027 tax brackets.

Conclusion

The 2025, 2026, and 2027 tax brackets provide a framework for calculating your income tax liability. By understanding your tax bracket and other applicable deductions and credits, you can accurately determine your tax obligation and plan your financial affairs accordingly.

Closure

Thus, we hope this article has provided valuable insights into 2025, 2026, 2027 Tax Brackets: A Comprehensive Overview. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin