28, Mar 2024

2025 85: A Comprehensive Guide To The Sort Code

2025 85: A Comprehensive Guide to the Sort Code

Related Articles: 2025 85: A Comprehensive Guide to the Sort Code

- 2025 Tamil Calendar: A Comprehensive Guide

- Flag Day: A Symbol Of National Pride And Unity

- Pictures Of 2025 Toyota Camry: A Glimpse Into The Future Of Sedans

- 2025 Calendar With Indian Holidays PDF

- 2025 Infiniti QX80: A Comprehensive Overview Of The Used Luxury SUV

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 85: A Comprehensive Guide to the Sort Code. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 85: A Comprehensive Guide to the Sort Code

2025 85: A Comprehensive Guide to the Sort Code

Introduction

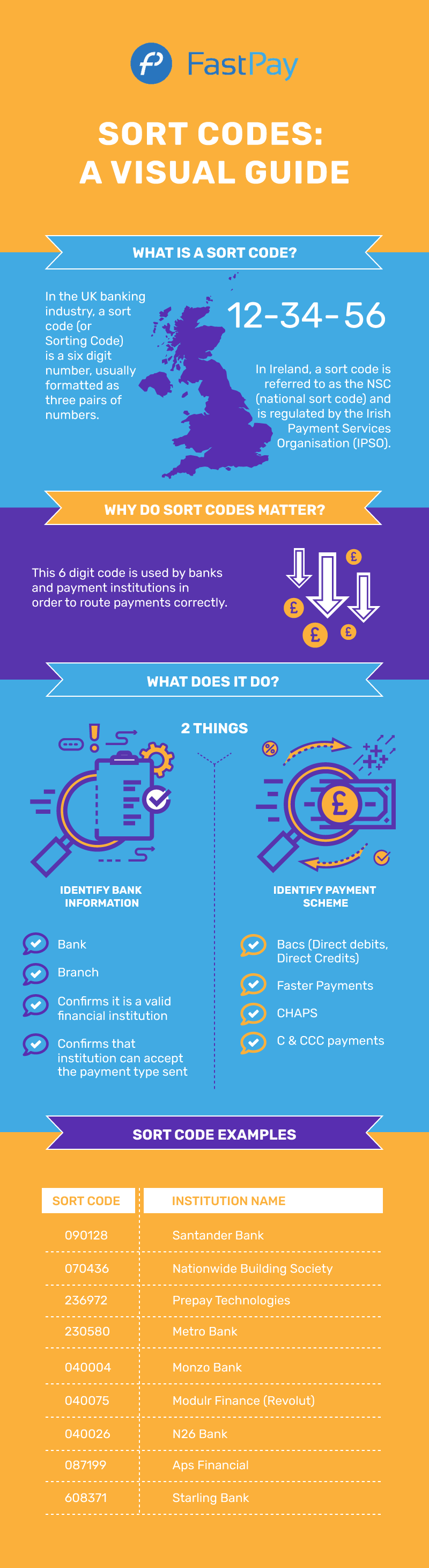

The sort code is a crucial element in the UK banking system. It serves as a unique identifier for each branch of a bank, facilitating the efficient routing of funds between financial institutions. The 2025 85 sort code is associated with Lloyds Bank and is used for specific transactions and services. This article delves into the nuances of the 2025 85 sort code, exploring its purpose, usage, and underlying mechanisms.

Understanding the Sort Code

The sort code comprises six digits, each representing a specific aspect of the banking infrastructure. The first two digits (20) denote the clearing house responsible for processing transactions involving the branch. The next two digits (25) identify the specific bank, in this case, Lloyds Bank. The final two digits (85) pinpoint the individual branch where the account is held.

Purpose of the Sort Code

The primary purpose of the sort code is to ensure accurate and timely transfer of funds between bank accounts. When initiating a payment, the payer’s bank uses the recipient’s sort code to determine the recipient’s bank and branch. This information enables the funds to be routed to the correct destination without delay.

Usage of the 2025 85 Sort Code

The 2025 85 sort code is primarily used for the following types of transactions:

- Direct Debit: This is a payment method where a company is authorized to collect payments directly from a customer’s bank account on a regular basis. The sort code is used to identify the customer’s bank and branch, ensuring the funds are transferred correctly.

- Standing Orders: Similar to Direct Debits, standing orders are regular payments made from one account to another. The sort code is essential for setting up and managing these payments.

- Bank Transfers: When transferring funds between accounts held at different banks, the sort code is required to identify the recipient’s bank and branch, facilitating the smooth transfer of funds.

- Cheque Payments: Although becoming less common, cheques still require the sort code to be written on the cheque. This information helps the recipient’s bank identify the drawer’s bank and branch, enabling the cheque to be processed efficiently.

Obtaining the Correct Sort Code

It is crucial to use the correct sort code for all financial transactions. Incorrect sort codes can lead to delays, errors, or even failed payments. The following methods can be used to obtain the correct sort code:

- Bank Statement: The sort code is typically printed on bank statements, usually alongside the account number.

- Online Banking: Most banks provide online banking services that display the sort code for the account.

- Bank Website: The sort code can often be found on the bank’s website, either on the homepage or in the FAQs section.

- Contacting the Bank: If other methods fail, customers can contact their bank directly to inquire about the sort code for their account.

Additional Considerations

- Sort Codes and Branch Closures: If a bank branch closes, the sort code associated with that branch may become invalid. In such cases, customers may need to update their sort code to reflect the new branch where their account is held.

- Sort Codes and Bank Mergers: When banks merge, the sort codes of the acquired bank may change. Customers affected by such mergers should contact their bank for updated sort code information.

- International Payments: The 2025 85 sort code is primarily used for domestic transactions within the UK. For international payments, the International Bank Account Number (IBAN) and SWIFT code are typically required.

Conclusion

The 2025 85 sort code plays a vital role in the UK banking system, ensuring the efficient and accurate transfer of funds. By understanding the purpose, usage, and mechanics of the sort code, individuals can ensure their financial transactions are processed smoothly and securely. It is important to always use the correct sort code and to stay informed about any changes that may affect its validity.

Closure

Thus, we hope this article has provided valuable insights into 2025 85: A Comprehensive Guide to the Sort Code. We appreciate your attention to our article. See you in our next article!

- 0

- By admin