5, Nov 2023

2025 Income Tax Brackets Expire: Implications For Taxpayers

2025 Income Tax Brackets Expire: Implications for Taxpayers

Related Articles: 2025 Income Tax Brackets Expire: Implications for Taxpayers

- Invictus Games 2025: Call For Volunteers To Inspire And Support

- Crimes Against Children Conference 2025: Addressing The Global Crisis

- Formula 1 2025 Results: A Glimpse Into The Future

- IR 2025 Receita Federal: Transforming Brazil’s Tax System For A Digital Future

- Cheap Flights To Lanzarote 2025: Escape To The Canary Islands Paradise

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Income Tax Brackets Expire: Implications for Taxpayers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Income Tax Brackets Expire: Implications for Taxpayers

2025 Income Tax Brackets Expire: Implications for Taxpayers

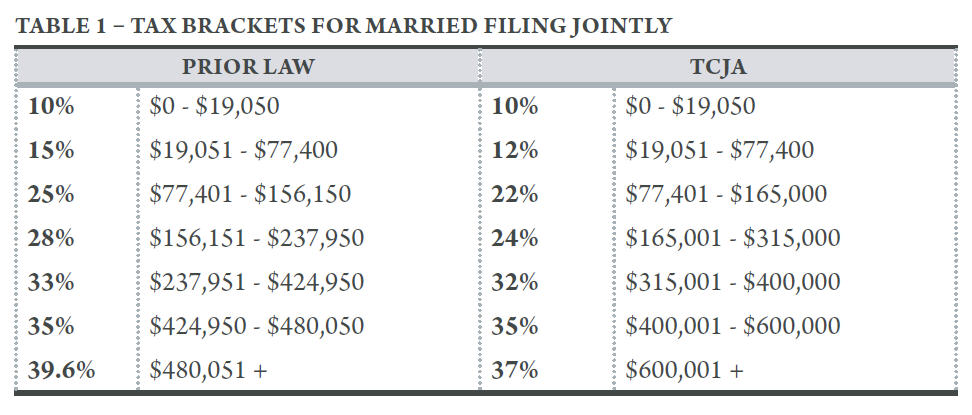

The Tax Cuts and Jobs Act of 2017 introduced significant changes to the federal income tax system, including the creation of new tax brackets and the reduction of tax rates. These changes were initially set to expire in 2025, but the expiration date has since been extended to 2026.

The expiration of the tax brackets would have a significant impact on taxpayers, as it would result in higher taxes for many individuals and families. The current tax brackets are as follows:

| Tax Bracket | Taxable Income | Marginal Tax Rate |

|---|---|---|

| 10% | $0 – $10,275 | 10% |

| 12% | $10,275 – $41,775 | 12% |

| 22% | $41,775 – $89,075 | 22% |

| 24% | $89,075 – $170,050 | 24% |

| 32% | $170,050 – $215,950 | 32% |

| 35% | $215,950 – $539,900 | 35% |

| 37% | $539,900 – $1,077,350 | 37% |

| 39.6% | $1,077,350 and above | 39.6% |

If the tax brackets expire, the rates would revert to the pre-2017 levels, which were as follows:

| Tax Bracket | Taxable Income | Marginal Tax Rate |

|---|---|---|

| 10% | $0 – $9,325 | 10% |

| 15% | $9,325 – $37,950 | 15% |

| 25% | $37,950 – $91,900 | 25% |

| 28% | $91,900 – $191,650 | 28% |

| 33% | $191,650 – $416,700 | 33% |

| 35% | $416,700 – $418,400 | 35% |

| 39.6% | $418,400 and above | 39.6% |

The expiration of the tax brackets would result in higher taxes for individuals and families in all tax brackets except the lowest two. For example, a single taxpayer with a taxable income of $50,000 would see their taxes increase by $1,200 if the tax brackets expire.

The expiration of the tax brackets would also have a significant impact on the federal budget. The Tax Policy Center estimates that the expiration would increase federal revenue by $1.3 trillion over the next decade. This increase in revenue would help to reduce the federal deficit, but it would also come at the expense of taxpayers.

The expiration of the tax brackets is a major issue that will have a significant impact on taxpayers and the federal budget. It is important to be aware of the potential consequences of the expiration and to plan accordingly.

What can taxpayers do to prepare for the expiration of the tax brackets?

There are a number of things that taxpayers can do to prepare for the expiration of the tax brackets. These include:

- Reviewing your tax situation. Determine how the expiration of the tax brackets will affect your taxes. You can use a tax calculator to estimate your taxes under the current law and under the law if the tax brackets expire.

- Making adjustments to your withholding. If you are having too much or too little withheld from your paycheck, you can adjust your withholding to ensure that you are paying the correct amount of taxes.

- Saving for higher taxes. If you expect your taxes to increase significantly when the tax brackets expire, you can start saving now to cover the additional costs.

- Contacting your tax advisor. If you have any questions about the expiration of the tax brackets, you should contact your tax advisor for guidance.

The expiration of the tax brackets is a complex issue with a number of potential consequences. By being aware of the potential impact and taking steps to prepare, taxpayers can minimize the financial burden of higher taxes.

Closure

Thus, we hope this article has provided valuable insights into 2025 Income Tax Brackets Expire: Implications for Taxpayers. We appreciate your attention to our article. See you in our next article!

- 0

- By admin