7, Nov 2023

2025 IRMAA Brackets Based On 2025 Income

2025 IRMAA Brackets Based on 2025 Income

Related Articles: 2025 IRMAA Brackets Based on 2025 Income

- Solar Flare 2025: A Probable Catastrophe

- 2025 Telephone Switch-Off: A Comprehensive Guide

- When Do A-Levels Finish In 2025? A Comprehensive Guide

- Tokyo 2025 World Athletics Championships: A Blueprint For The Future Of Track And Field

- World Population By 2025: Projections, Trends, And Implications

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 IRMAA Brackets Based on 2025 Income. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets Based on 2025 Income

2025 IRMAA Brackets Based on 2025 Income

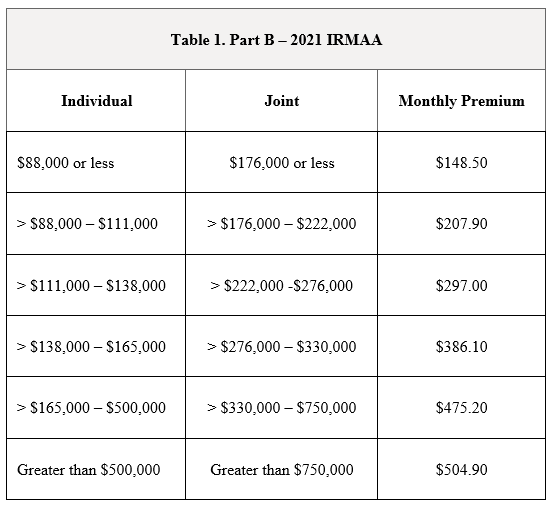

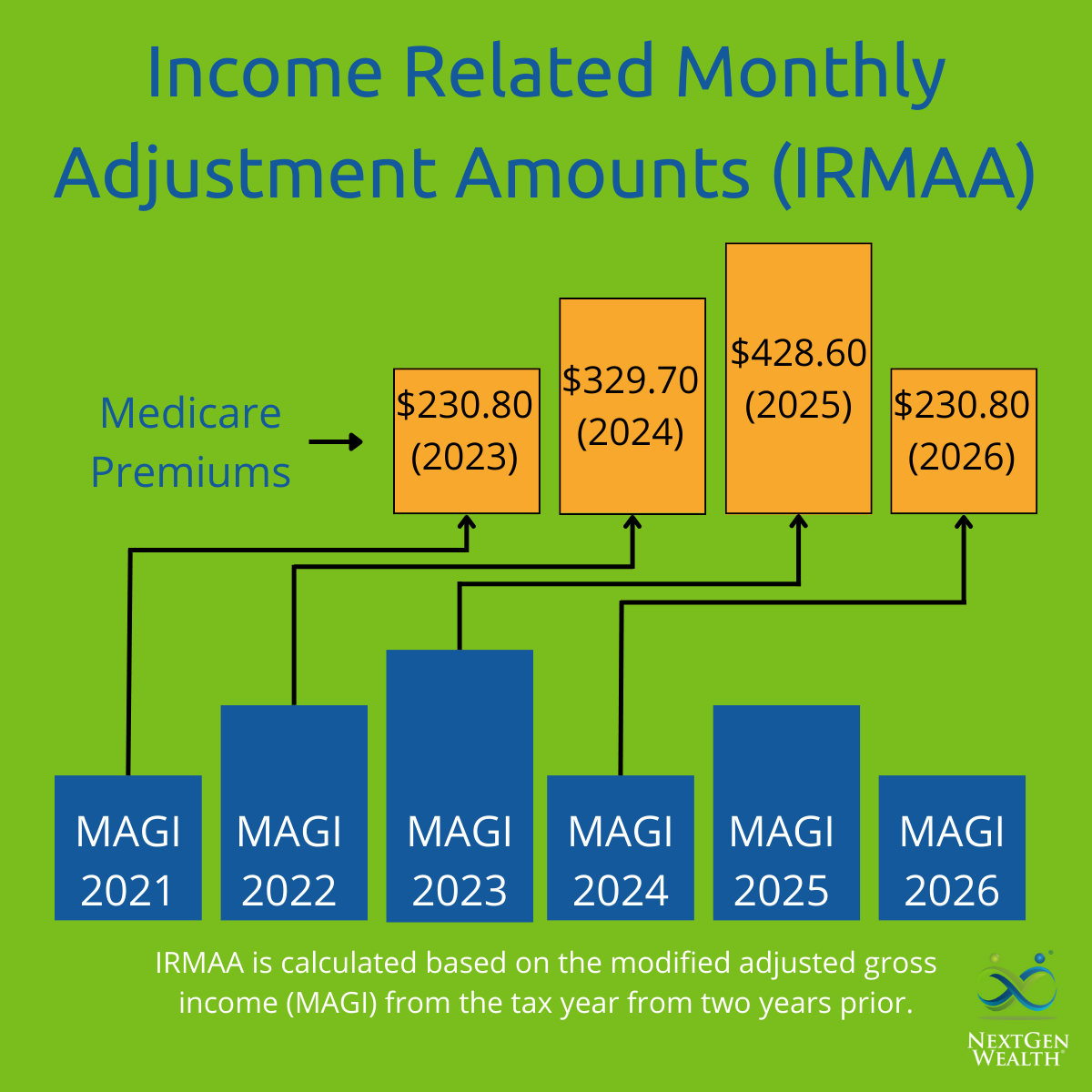

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to Medicare Part B and Part D premiums for high-income earners. IRMAA brackets are adjusted annually based on the previous year’s income. The following are the IRMAA brackets for 2025, based on 2025 income:

Medicare Part B IRMAA Brackets

| Filing Status | Single | Married Filing Jointly |

|---|---|---|

| Below $97,000 | $0 | $194,000 |

| $97,000 – $129,000 | $121.80 | $243,600 |

| $129,000 – $161,000 | $162.60 | $324,000 |

| $161,000 – $193,000 | $203.40 | $406,800 |

| $193,000 and above | $244.20 | $489,600 |

Medicare Part D IRMAA Brackets

| Filing Status | Single | Married Filing Jointly |

|---|---|---|

| Below $91,000 | $0 | $182,000 |

| $91,000 – $122,000 | $12.40 | $244,000 |

| $122,000 – $153,000 | $32.60 | $306,000 |

| $153,000 – $184,000 | $42.80 | $368,000 |

| $184,000 and above | $53.00 | $432,000 |

How IRMAA Works

If your income exceeds the IRMAA thresholds, you will pay a higher monthly premium for Medicare Part B and Part D. The IRMAA surcharge is added to the standard premium amount. For example, in 2025, the standard premium for Medicare Part B is $164.90 per month. If you are single and your income is $130,000, you would pay an additional $162.60 per month in IRMAA surcharges, for a total monthly premium of $327.50.

Income Thresholds

The IRMAA income thresholds are based on your modified adjusted gross income (MAGI). MAGI is your adjusted gross income (AGI) plus tax-exempt interest and certain other adjustments. You can find your MAGI on line 11 of your federal income tax return (Form 1040).

Calculating Your IRMAA Surcharge

To calculate your IRMAA surcharge, use the following formula:

- Part B: IRMAA surcharge = (IRMAA percentage) x (standard Part B premium)

- Part D: IRMAA surcharge = (IRMAA percentage) x (standard Part D premium)

The IRMAA percentages for 2025 are as follows:

| Filing Status | Part B | Part D |

|---|---|---|

| Single | 50% | 25% |

| Married Filing Jointly | 75% | 50% |

| Married Filing Separately | 100% | 75% |

| Head of Household | 75% | 50% |

Example

Let’s say you are single and your MAGI for 2025 is $130,000. The standard Part B premium for 2025 is $164.90. Your IRMAA surcharge for Part B would be:

- IRMAA surcharge = (50%) x ($164.90) = $82.45

Your total monthly premium for Part B would be:

- Total premium = $164.90 + $82.45 = $247.35

Paying IRMAA Surcharges

IRMAA surcharges are paid along with your regular Medicare premiums. You can pay your premiums online, by mail, or by phone. If you are enrolled in automatic premium deduction, your IRMAA surcharges will be automatically deducted from your bank account.

Avoiding IRMAA Surcharges

There are a few ways to avoid paying IRMAA surcharges:

- Reduce your income. This can be done by contributing more to tax-advantaged retirement accounts, such as 401(k)s and IRAs.

- Claim dependents. If you have dependents, you can claim them on your tax return to reduce your MAGI.

- File a married filing separately return. If you are married, filing a married filing separately return can help you avoid IRMAA surcharges, but it can also result in higher overall taxes.

Conclusion

IRMAA surcharges are an important factor to consider when planning for your Medicare expenses. If you are a high-income earner, you should be aware of the IRMAA brackets and how they will affect your premiums. By taking steps to reduce your income or claim dependents, you may be able to avoid paying IRMAA surcharges.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets Based on 2025 Income. We appreciate your attention to our article. See you in our next article!

- 0

- By admin