29, Dec 2023

2025 Tax Tables: A Comprehensive Guide To The Updated Tax Rates And Standard Deductions

2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions

Related Articles: 2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions

- Verse 2025 Ordinary Level: A Comprehensive Guide

- International Roofing Expo 2025: A Global Gathering For The Roofing Industry

- Honda Accord 2025 All Carpet: A Refined And Luxurious Sedan

- Will 2032 Work For 2025?

- Chinese New Year 2025, 2026, And 2027: Celebrations And Traditions

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions

2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions

The Internal Revenue Service (IRS) recently released the 2025 tax tables, which reflect the changes made by the Tax Cuts and Jobs Act (TCJA) of 2017. These changes have a significant impact on the amount of taxes individuals and businesses owe, and it is important to be aware of them in order to avoid overpaying or underpaying your taxes.

Key Changes in the 2025 Tax Tables

- Increased standard deductions: The standard deduction is the amount of income that you can deduct from your taxable income before calculating your taxes. For 2025, the standard deduction has been increased to $13,850 for single filers and $27,700 for married couples filing jointly.

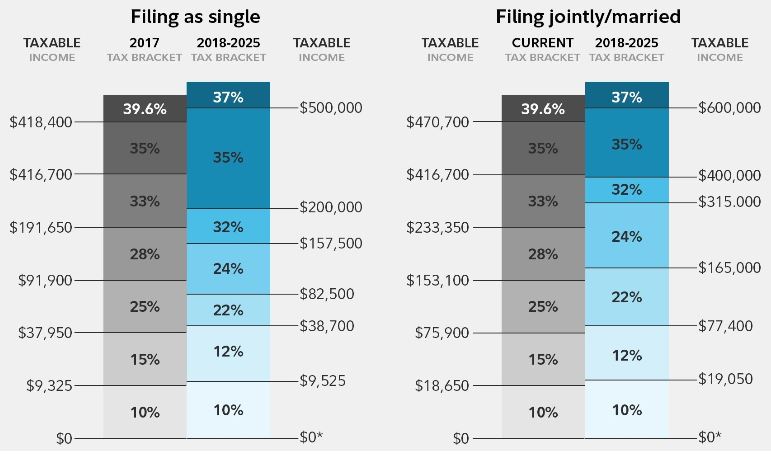

- Lower tax rates: The TCJA lowered the tax rates for all income brackets. The top marginal tax rate has been reduced from 39.6% to 37%.

- Modified child tax credit: The child tax credit has been increased to $2,000 per child under the age of 17. The credit is phased out for higher-income taxpayers.

- Elimination of personal exemptions: The TCJA eliminated personal exemptions, which were previously deducted from taxable income. This change has the effect of increasing the amount of taxes that many taxpayers owe.

How to Use the 2025 Tax Tables

To use the 2025 tax tables, you will need to know your filing status, taxable income, and the appropriate tax table. The tax tables are divided into four filing statuses: single, married filing jointly, married filing separately, and head of household.

Once you have determined your filing status and taxable income, you can find the corresponding tax table in the IRS publication 17, Your Federal Income Tax. The tax table will show you the amount of taxes that you owe based on your filing status and taxable income.

Example

Let’s say that you are a single taxpayer with a taxable income of $50,000. To calculate your taxes using the 2025 tax tables, you would find the tax table for single filers. You would then find the row in the tax table that corresponds to your taxable income of $50,000. The tax table would show that you owe $9,700 in taxes.

Additional Resources

The IRS provides a number of resources to help you understand the 2025 tax tables and calculate your taxes. These resources include:

- IRS Publication 17, Your Federal Income Tax

- IRS Tax Withholding Estimator

- IRS Interactive Tax Assistant

Conclusion

The 2025 tax tables reflect the significant changes made by the TCJA. These changes have a major impact on the amount of taxes that individuals and businesses owe. It is important to be aware of these changes in order to avoid overpaying or underpaying your taxes.

Closure

Thus, we hope this article has provided valuable insights into 2025 Tax Tables: A Comprehensive Guide to the Updated Tax Rates and Standard Deductions. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin