20, Dec 2023

California Income Tax Rates For 2025: A Comprehensive Guide

California Income Tax Rates for 2025: A Comprehensive Guide

Related Articles: California Income Tax Rates for 2025: A Comprehensive Guide

- U20 Rugby World Cup 2025: A Tournament Of Thrills And Surprises

- Morocco To Host 2025 Africa Cup Of Nations

- Amazon 2025 Diary: Unlocking The Future Of E-commerce

- 2025 Canadian Olympic Curling Trials: A Preview Of The Road To Milan

- 2025 Nissan GT-R: A Silver Bullet For The Future

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to California Income Tax Rates for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about California Income Tax Rates for 2025: A Comprehensive Guide

California Income Tax Rates for 2025: A Comprehensive Guide

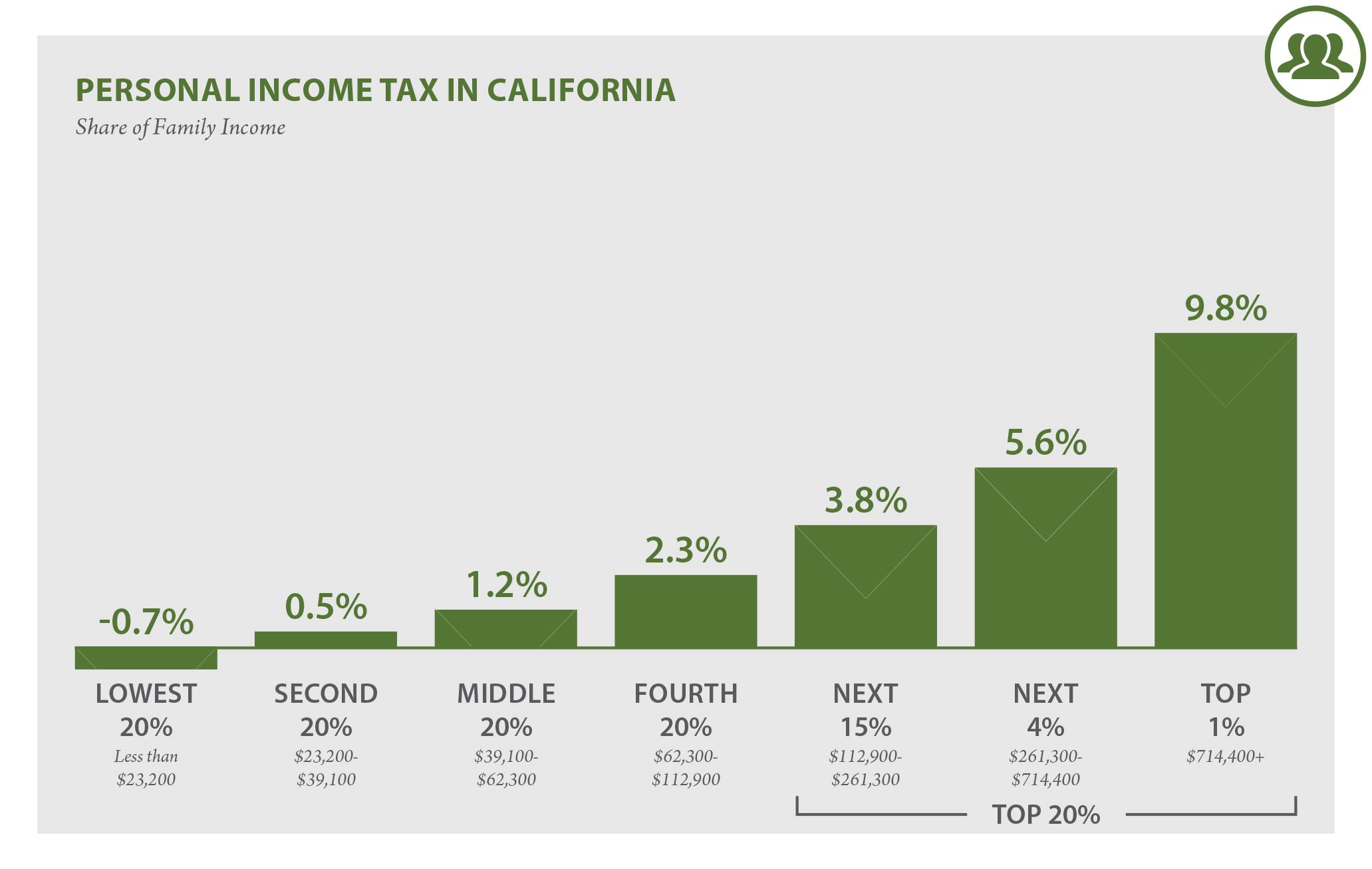

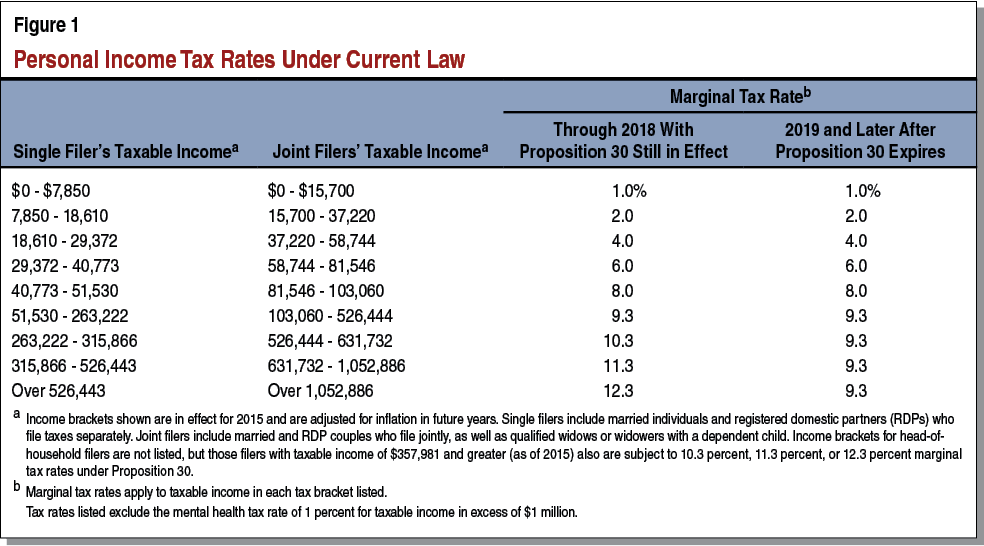

California’s personal income tax is a progressive tax, meaning that the higher your income, the higher the percentage of your income you will pay in taxes. The state’s income tax rates are set by the California Legislature and are subject to change each year.

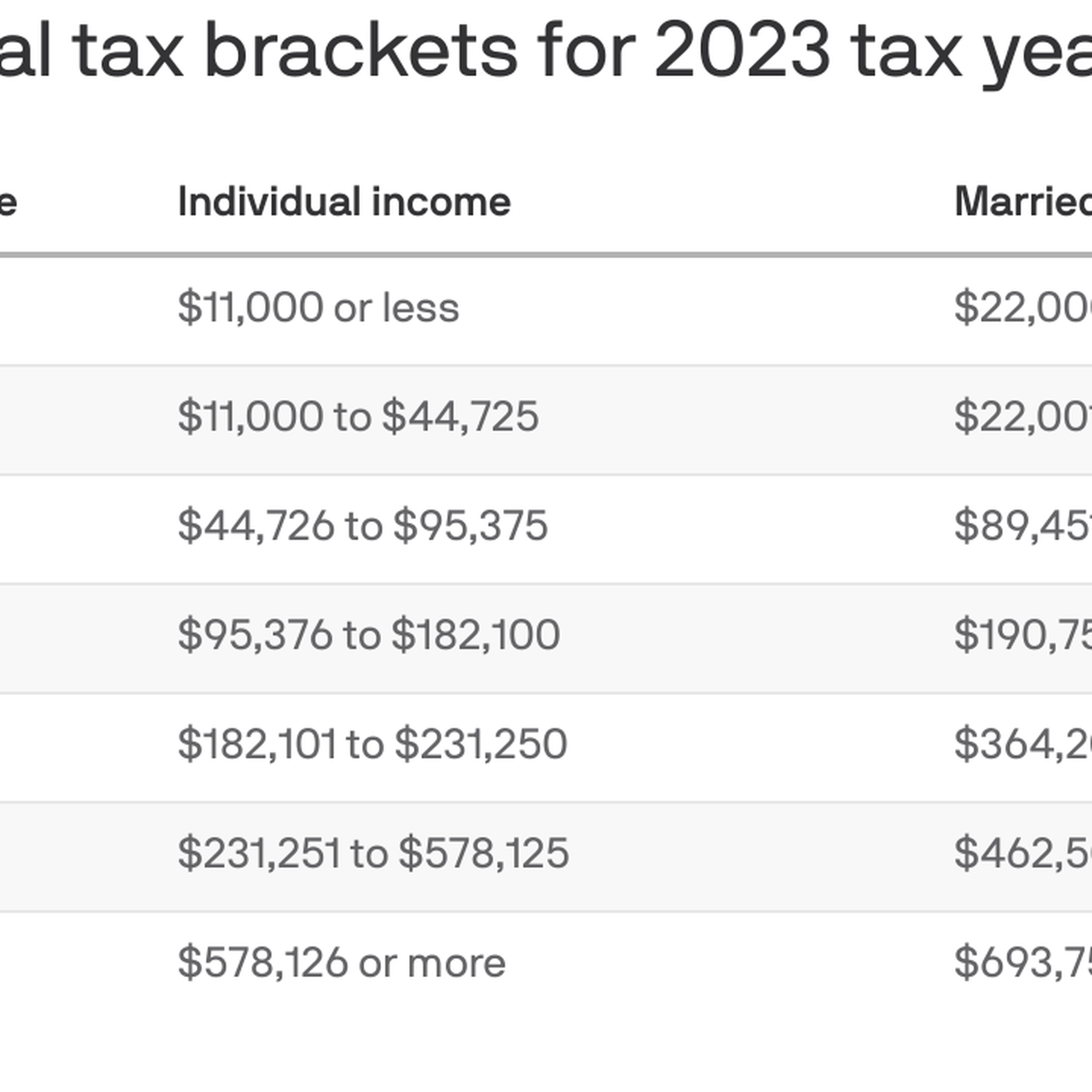

For the 2025 tax year, the California income tax rates are as follows:

| Taxable Income | Marginal Tax Rate |

|---|---|

| $0 – $9,325 | 1% |

| $9,326 – $22,150 | 2% |

| $22,151 – $34,975 | 4% |

| $34,976 – $48,800 | 6% |

| $48,801 – $63,575 | 8% |

| $63,576 – $79,225 | 9.3% |

| $79,226 – $104,050 | 10.3% |

| $104,051 – $131,525 | 11.3% |

| $131,526 – $162,250 | 12.3% |

| $162,251 – $215,950 | 13.3% |

| $215,951 – $262,900 | 14.3% |

| $262,901 – $332,050 | 15.3% |

| $332,051 and up | 16.3% |

The marginal tax rate is the percentage of your income that you will pay in taxes for each additional dollar you earn. For example, if you are in the 4% marginal tax bracket, you will pay 4% in taxes on every dollar you earn over $22,150.

In addition to the state income tax, California residents may also be subject to local income taxes. Local income taxes are imposed by cities and counties and can vary significantly from one jurisdiction to another.

To calculate your California income tax liability, you will need to use the following formula:

Tax Liability = (Taxable Income x Marginal Tax Rate) - Tax CreditsTax credits are deductions from your tax liability that can reduce the amount of taxes you owe. There are a number of different tax credits available to California residents, including the Earned Income Tax Credit, the Child Tax Credit, and the Senior Citizen Tax Credit.

You can find more information about California income taxes on the California Franchise Tax Board website: https://www.ftb.ca.gov/

Example Calculations

Here are a few examples of how to calculate your California income tax liability:

- Example 1: You are a single taxpayer with a taxable income of $50,000. Your marginal tax rate is 8%. Your tax liability is $4,000.

- Example 2: You are a married couple filing jointly with a taxable income of $100,000. Your marginal tax rate is 10.3%. Your tax liability is $10,300.

- Example 3: You are a single taxpayer with a taxable income of $200,000. Your marginal tax rate is 14.3%. Your tax liability is $28,600.

Tax Withholding

California employers are required to withhold state income taxes from your paycheck. The amount of withholding is based on your income and withholding allowances. You can use the California Franchise Tax Board’s withholding calculator to determine how much withholding you should claim: https://www.ftb.ca.gov/online-services/online-withholding-calculator/

Estimated Tax Payments

If you expect to owe more than $1,000 in California income taxes, you may be required to make estimated tax payments. Estimated tax payments are due on April 15, June 15, September 15, and January 15 of the following year. You can use the California Franchise Tax Board’s estimated tax payment calculator to determine how much estimated tax you should pay: https://www.ftb.ca.gov/online-services/online-estimated-tax-payment-calculator/

Tax Refunds

If you overpaid your California income taxes, you may be entitled to a tax refund. You can file a tax return to claim your refund. The California Franchise Tax Board typically issues refunds within 4 to 6 weeks of receiving your tax return.

Tax Penalties

If you fail to file your California income tax return or pay your taxes on time, you may be subject to penalties. The California Franchise Tax Board can impose a penalty of up to 10% of the tax due for each month that your return is late. You may also be subject to a penalty of up to 25% of the tax due if you fail to pay your taxes on time.

Conclusion

California’s personal income tax is a complex system. The rates and rules can change from year to year. It is important to stay up-to-date on the latest changes to ensure that you are paying the correct amount of taxes. If you have any questions about California income taxes, you should contact the California Franchise Tax Board.

Closure

Thus, we hope this article has provided valuable insights into California Income Tax Rates for 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

- 0

- By admin