10, Aug 2023

Form 202: A Comprehensive Guide To The Department Of Labor’s Annual Wage And Hour Report

Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report

Related Articles: Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report

- 2025 UK Election Prediction: A Comprehensive Analysis

- Wiki Winter Olympics 2030

- Print Design Trends For 2025: Embracing Innovation And Sustainability

- 2025 Dodge: A Glimpse Into The Future Of American Muscle

- Home Prices In 2025: A Comprehensive Forecast

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report

Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report

Introduction

Form 202, also known as the Annual Wage and Hour Report, is a mandatory reporting form issued by the United States Department of Labor (DOL). It requires certain employers to provide detailed information about their employees’ wages, hours worked, and benefits. The data collected through Form 202 is essential for the DOL to enforce wage and hour laws, conduct industry-wide research, and inform policy decisions.

Who Must File Form 202?

The following employers are required to file Form 202:

- Employers with 500 or more employees at any time during the calendar year

- Employers subject to the Fair Labor Standards Act (FLSA) that have 100 or more employees during the calendar year

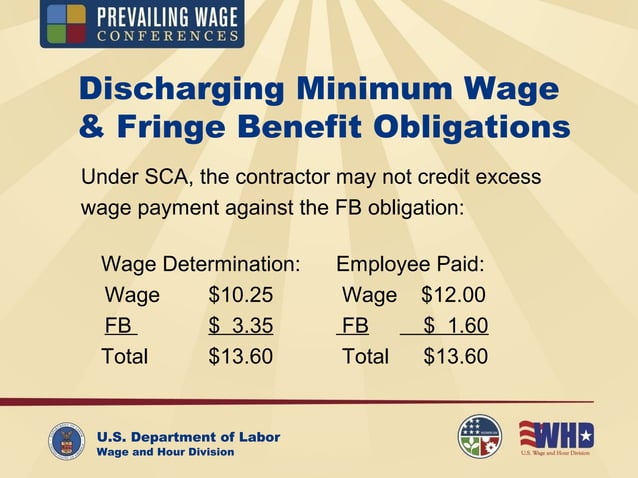

- Employers subject to the Davis-Bacon Act or the Service Contract Act that have 25 or more employees during the calendar year

When and Where to File Form 202

Form 202 must be filed electronically by March 1st of each year for the previous calendar year. The electronic filing system is accessible through the DOL’s website.

What Information is Required on Form 202?

Form 202 requires employers to provide the following information:

- Establishment information (name, address, industry classification)

- Employee information (number of employees, wages and hours worked, benefits)

- Demographic information (race, gender, ethnicity)

Specific Data Elements

The following are some of the key data elements that employers must report on Form 202:

- Total Hours Worked: The total number of hours worked by all employees during the year, including overtime hours.

- Total Wages Paid: The total amount of wages paid to all employees during the year, including overtime pay.

- Average Hourly Wage: The average hourly wage paid to all employees during the year.

- Benefits: The total amount of benefits provided to employees during the year, including health insurance, retirement plans, and paid leave.

- Demographics: The number of employees in each racial, gender, and ethnic category.

Purpose of Form 202 Data

The data collected through Form 202 serves several important purposes:

- Wage and Hour Enforcement: The DOL uses Form 202 data to identify potential violations of wage and hour laws, such as minimum wage and overtime pay violations.

- Industry Analysis: The data is analyzed to provide insights into industry trends, such as wage growth, employee compensation, and workforce demographics.

- Policy Development: The information collected through Form 202 helps inform policy decisions related to labor laws, minimum wage adjustments, and workforce development programs.

- Research and Analysis: Researchers and analysts use Form 202 data to conduct studies on topics such as wage inequality, labor market trends, and the impact of government policies on employment.

Consequences of Non-Compliance

Employers who fail to file Form 202 or provide inaccurate information may face penalties, including fines and other enforcement actions by the DOL.

How to Prepare for Form 202 Reporting

To ensure accurate and timely filing of Form 202, employers should:

- Gather the necessary data from payroll records and other sources.

- Review the instructions carefully and familiarize themselves with the reporting requirements.

- Use the electronic filing system to submit the report.

- Keep records of the data submitted for future reference.

Conclusion

Form 202 is an essential reporting tool for the DOL to enforce wage and hour laws, conduct industry-wide research, and inform policy decisions. Employers who are required to file Form 202 should understand the reporting requirements, gather the necessary data, and submit the report accurately and on time to avoid penalties and ensure compliance with federal labor laws.

Closure

Thus, we hope this article has provided valuable insights into Form 202: A Comprehensive Guide to the Department of Labor’s Annual Wage and Hour Report. We appreciate your attention to our article. See you in our next article!

- 0

- By admin