18, Aug 2023

Form 202 Online Submission: A Comprehensive Guide

Form 202 Online Submission: A Comprehensive Guide

Related Articles: Form 202 Online Submission: A Comprehensive Guide

- 2025 Ram 1500 Trim Levels: A Comprehensive Guide

- 2025 Ford Explorer Police: Unveiling The Future Of Law Enforcement

- ACT 2025 School Holidays: A Comprehensive Guide For Planning Your Family’s Time Off

- R&A Golf Course 2030: A Vision For The Future Of Golf

- IRFC Share Price Forecast 2025: A Comprehensive Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Form 202 Online Submission: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form 202 Online Submission: A Comprehensive Guide

Form 202 Online Submission: A Comprehensive Guide

Introduction

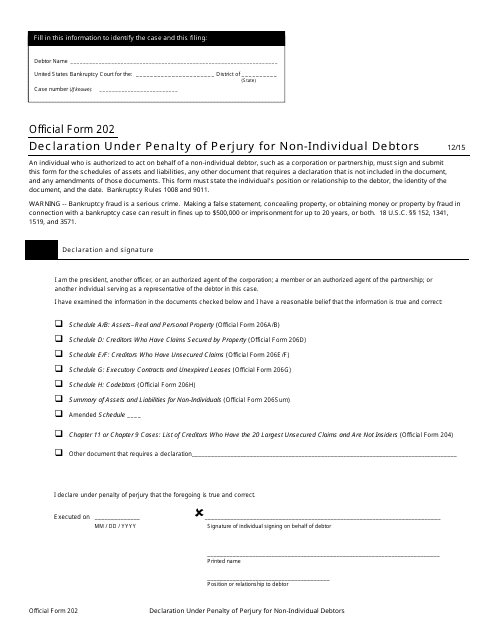

Form 202, also known as the Annual Return of Income, is a crucial document that taxpayers in India must file with the Income Tax Department. It provides a detailed account of an individual’s income, deductions, and tax liability for a particular financial year. Traditionally, Form 202 was filed manually, involving a tedious and time-consuming process. However, the advent of online submission has revolutionized the process, making it more convenient, efficient, and secure.

Benefits of Online Submission

Online submission of Form 202 offers numerous benefits over manual filing, including:

- Convenience: Taxpayers can file their returns from the comfort of their homes or offices, at any time of the day or night.

- Efficiency: The online system streamlines the filing process, reducing the risk of errors and omissions.

- Security: The Income Tax Department employs robust security measures to protect taxpayer data and ensure confidentiality.

- Faster Processing: Online returns are processed faster than manual submissions, resulting in quicker refunds or tax assessments.

- Reduced Paperwork: Online submission eliminates the need for printing, mailing, and storing physical documents.

Eligibility for Online Submission

To be eligible for online submission of Form 202, taxpayers must meet certain criteria:

- Individuals with a valid Permanent Account Number (PAN)

- Income below Rs. 50 lakhs (excluding business income)

- Not required to file an audit report

- Not claiming a refund of more than Rs. 1 lakh

Steps for Online Submission

The online submission process for Form 202 can be completed in a few simple steps:

- Visit the Income Tax Department’s e-Filing Portal: Access the portal at https://incometaxindiaefiling.gov.in/home.

- Login: Enter your PAN and password to login to your account. If you do not have an account, you will need to register first.

- Select Return Type: From the dashboard, select the "Income Tax Returns" option and choose "File Income Tax Return" for the relevant assessment year.

- Select Filing Method: Choose "Prepare and Submit Online" to initiate the online submission process.

- Fill in Your Details: Enter your personal and financial information as required by the form.

- Upload Documents: Upload any necessary supporting documents, such as income certificates or investment proofs.

- Verify and Submit: Once all details are entered, verify the information and click "Submit" to file your return.

Required Documents for Submission

Depending on the nature of your income and deductions, you may need to upload the following documents along with your Form 202:

- Form 16 (Salary Certificate)

- Form 16A (Interest Certificate)

- Form 16C (TDS Certificate)

- Income and Investment Certificates

- Proof of Deductions (e.g., medical bills, rent receipts)

Post-Submission Process

After submitting your Form 202 online, you will receive an acknowledgment number. This number serves as proof of filing and can be used to track the status of your return.

The Income Tax Department will process your return and may request additional information or documents if necessary. Taxpayers can view the status of their return and respond to any queries through the e-Filing portal.

Consequences of Late Filing

Failure to file Form 202 by the due date can result in penalties and interest charges. Taxpayers are advised to file their returns on time to avoid any legal complications.

Conclusion

Online submission of Form 202 has significantly simplified the tax filing process for individuals in India. By leveraging this convenient and secure method, taxpayers can fulfill their legal obligations efficiently, minimize errors, and enjoy the benefits of faster processing. With the availability of online support and guidance, taxpayers can confidently navigate the process and ensure timely and accurate submission of their annual income returns.

Closure

Thus, we hope this article has provided valuable insights into Form 202 Online Submission: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin