23, Sep 2023

FORM 202 SPAIN: A Comprehensive Guide For Foreigners

FORM 202 SPAIN: A Comprehensive Guide for Foreigners

Related Articles: FORM 202 SPAIN: A Comprehensive Guide for Foreigners

- Turkey’s Future In 2025: A Comprehensive Outlook

- Inauguration Day 2025: A Historic Moment For The United States

- Lee County School Calendar 2024-2025: A Comprehensive Guide

- Wiki Winter Olympics 2030

- Williams Preston: A Premier Destination For Sophisticated Living In West Houston

Introduction

With great pleasure, we will explore the intriguing topic related to FORM 202 SPAIN: A Comprehensive Guide for Foreigners. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FORM 202 SPAIN: A Comprehensive Guide for Foreigners

FORM 202 SPAIN: A Comprehensive Guide for Foreigners

Introduction

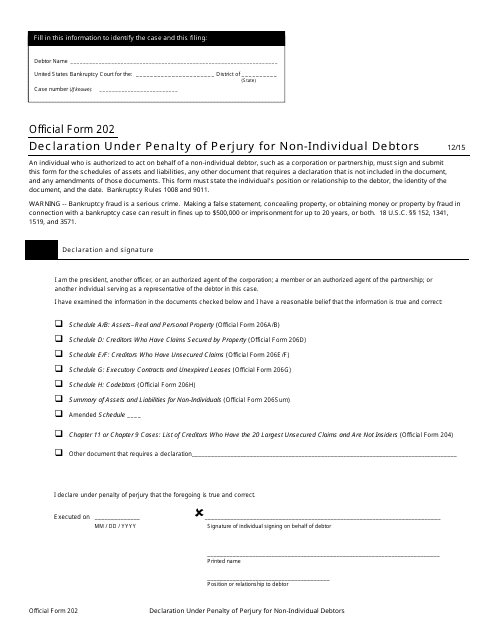

Form 202 Spain, also known as the "Declaración de la Renta de No Residentes" or "Non-Resident Income Tax Return," is a mandatory tax form that must be filed by non-resident taxpayers in Spain. It is used to declare income earned in Spain during the previous calendar year. This comprehensive guide will provide a thorough understanding of Form 202 Spain, its purpose, who is required to file it, the necessary documentation, and step-by-step instructions for completing the form.

Who Must File Form 202 Spain?

Non-resident taxpayers are individuals who do not reside in Spain for more than 183 days during a calendar year. They are required to file Form 202 Spain if they have obtained income from Spanish sources, such as:

- Employment income

- Rental income

- Business or professional income

- Capital gains from the sale of real estate or shares

- Interest and dividends

Exemptions

Certain non-residents may be exempt from filing Form 202 Spain. These exemptions include:

- Students and researchers who stay in Spain for less than 183 days and receive scholarships or grants.

- Diplomats and consular officials.

- Individuals who receive income from employment or professional activities carried out in Spain for less than 183 days and their income is below a certain threshold.

Necessary Documentation

Before completing Form 202 Spain, it is essential to gather the necessary documentation, including:

- Your Non-Resident Tax Identification Number (NIE)

- A certificate of income from your Spanish employer or other sources of income

- Proof of expenses related to the income declared

- Any relevant tax treaties or agreements between Spain and your country of residence

Step-by-Step Instructions for Completing Form 202 Spain

Step 1: Obtain Your NIE

If you do not already have a Non-Resident Tax Identification Number (NIE), you must obtain one from the Spanish authorities before filing Form 202.

Step 2: Gather Your Documentation

Collect all the necessary documentation mentioned in the previous section.

Step 3: Access the Form

You can download Form 202 Spain from the website of the Spanish Tax Agency (Agencia Tributaria).

Step 4: Fill Out Section 1: Taxpayer Information

This section includes your personal information, such as name, address, NIE, and contact details.

Step 5: Fill Out Section 2: Income

Declare all income earned in Spain during the previous calendar year, including employment income, rental income, business income, capital gains, and interest and dividends.

Step 6: Fill Out Section 3: Deductions and Allowances

List any expenses or deductions related to the income declared, such as expenses incurred in generating business income or rental expenses.

Step 7: Fill Out Section 4: Tax Calculation

Calculate the amount of tax owed based on the income and deductions declared.

Step 8: Fill Out Section 5: Payment Information

Provide details of how you intend to pay the tax, such as bank transfer or direct debit.

Step 9: Submit the Form

You can submit Form 202 Spain online through the Spanish Tax Agency website or in person at a tax office.

Deadlines for Filing Form 202 Spain

The deadline for filing Form 202 Spain is typically April 30th of the year following the tax year. However, it is advisable to file the form as early as possible to avoid any penalties or interest charges.

Penalties for Late Filing

Failure to file Form 202 Spain on time may result in penalties and interest charges. The amount of the penalty will depend on the delay in filing.

Additional Information

- Non-resident taxpayers may be entitled to certain tax deductions and allowances, such as the personal allowance and the deduction for expenses related to obtaining income.

- The Spanish Tax Agency offers assistance to non-residents in completing Form 202 Spain. You can contact them through their website or by phone.

- It is recommended to seek professional tax advice if you are unsure about any aspect of Form 202 Spain or your tax obligations as a non-resident in Spain.

Conclusion

Form 202 Spain is an important tax form that non-resident taxpayers in Spain must file to declare their income earned in Spain. By understanding the requirements, gathering the necessary documentation, and following the step-by-step instructions outlined in this guide, non-residents can ensure that they fulfill their tax obligations accurately and on time.

Closure

Thus, we hope this article has provided valuable insights into FORM 202 SPAIN: A Comprehensive Guide for Foreigners. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin