28, Aug 2023

FSA Maximum Rollover 2025: What You Need To Know

FSA Maximum Rollover 2025: What You Need to Know

Related Articles: FSA Maximum Rollover 2025: What You Need to Know

- When Is The 2025 Kia K5 Coming Out?

- Dodge Challenger 2025: Build And Price In Canada

- Buying A House In 2024: A Comprehensive Guide

- 2025 Toyota Camry Redesign: A Comprehensive Overview

- Gran Turismo 2025: A Revolutionary Preview Into The Future Of Racing Simulations

Introduction

With great pleasure, we will explore the intriguing topic related to FSA Maximum Rollover 2025: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FSA Maximum Rollover 2025: What You Need to Know

FSA Maximum Rollover 2025: What You Need to Know

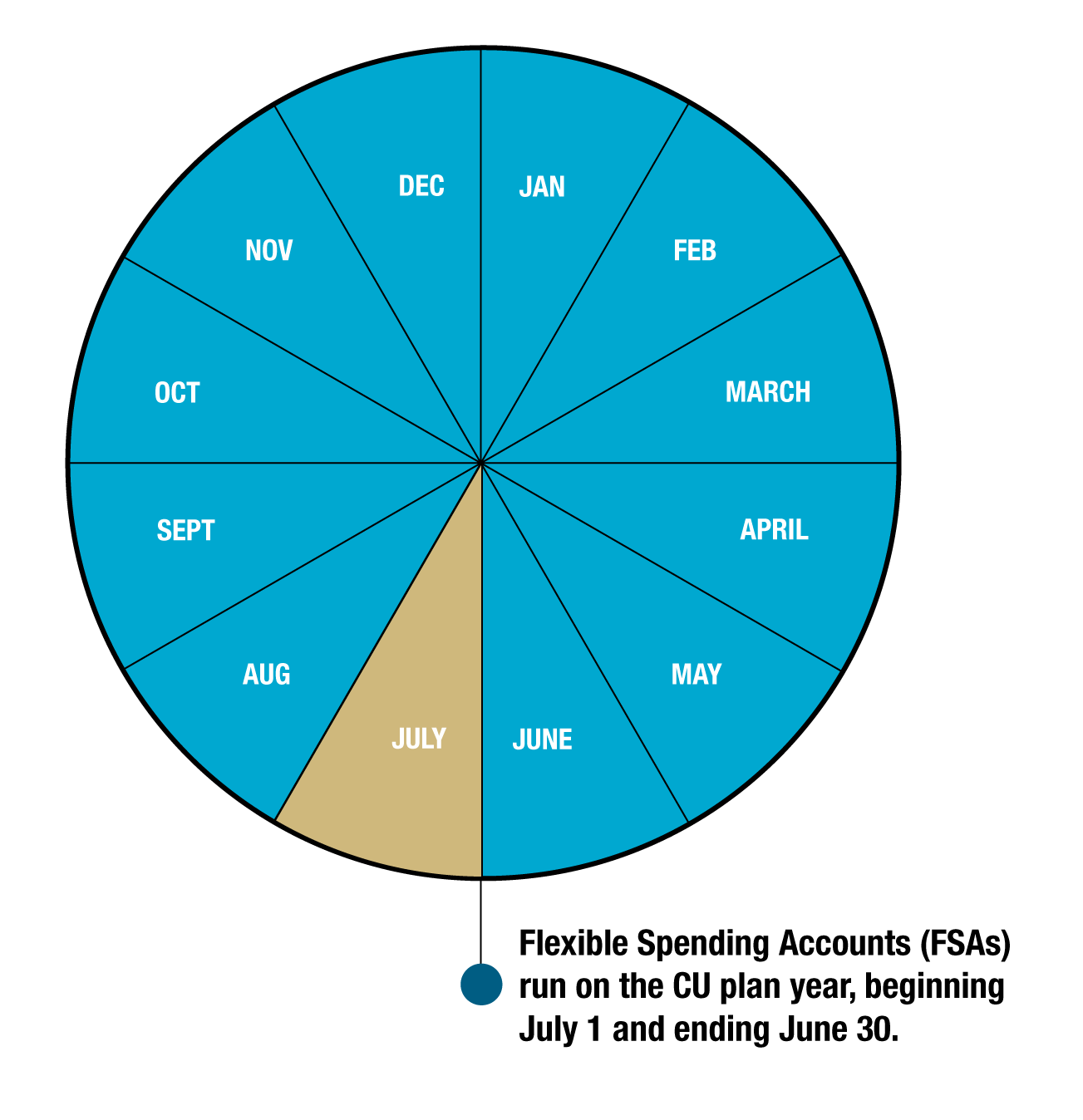

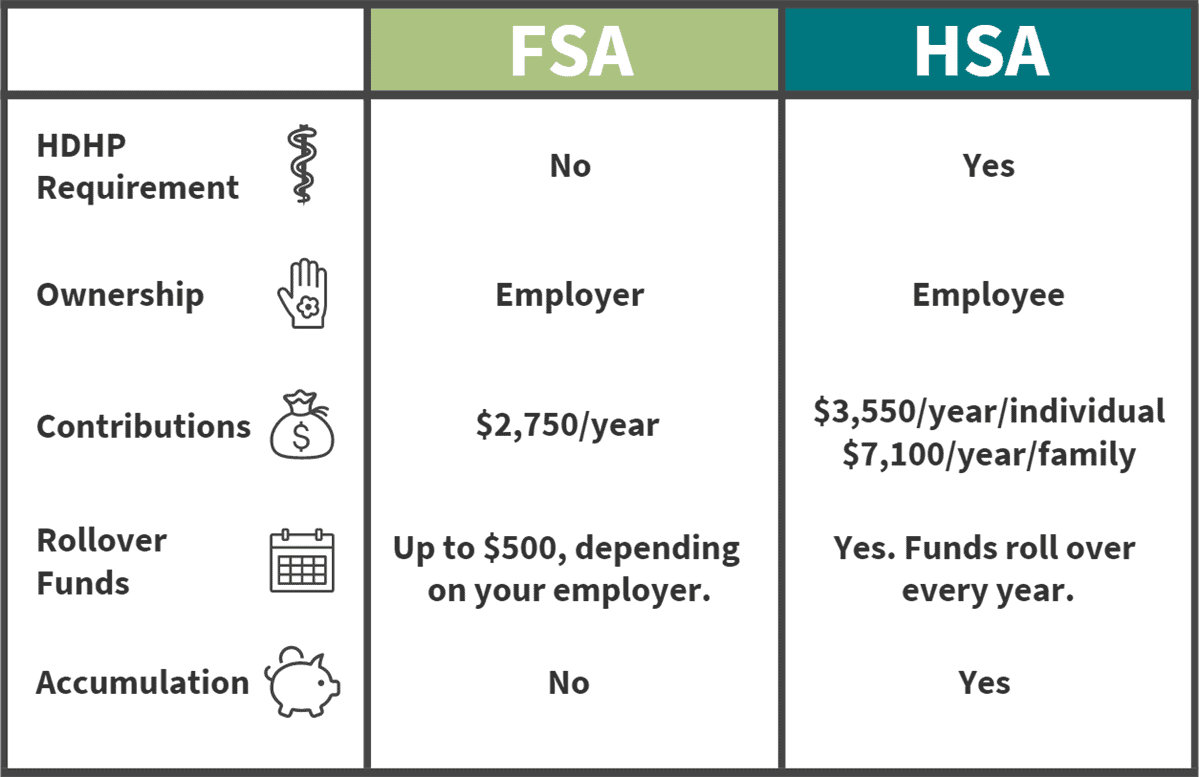

Flexible Spending Accounts (FSAs) are a popular employee benefit that allows individuals to set aside pre-tax dollars to pay for qualified medical expenses. In 2025, the maximum amount that can be contributed to an FSA will increase significantly. This article provides an overview of the FSA maximum rollover limit for 2025 and its implications for employers and employees.

FSA Maximum Rollover Limit for 2025

The maximum amount that can be rolled over from an FSA to the following year will increase from $550 to $610 in 2025. This means that employees who have unused funds in their FSA at the end of the plan year will be able to carry over more money into the next year.

Implications for Employers

The increase in the FSA maximum rollover limit has several implications for employers:

- Increased flexibility: Employers can offer more flexibility to employees by allowing them to roll over more unused funds into the next year. This can help employees manage their healthcare expenses more effectively.

- Reduced expenses: By allowing employees to roll over unused funds, employers can reduce their potential liability for unused FSA funds.

- Improved employee satisfaction: Employees who have the ability to roll over unused FSA funds may be more satisfied with their benefits package.

Implications for Employees

The increase in the FSA maximum rollover limit also has several implications for employees:

- Increased savings: Employees who have unused FSA funds can roll over more money into the next year, which can increase their savings.

- Reduced financial burden: By rolling over unused funds, employees can reduce their financial burden by spreading out their healthcare expenses over a longer period of time.

- Greater peace of mind: Knowing that they can roll over unused funds can give employees peace of mind that they will not lose their money if they do not use it all in one year.

FSA Contribution Limits for 2025

In addition to the increase in the FSA maximum rollover limit, the IRS has also announced the FSA contribution limits for 2025:

- Health FSA: The maximum contribution limit for health FSAs will increase from $2,850 to $3,050.

- Dependent Care FSA: The maximum contribution limit for dependent care FSAs will remain at $5,000.

Key Considerations for Employers and Employees

When considering the FSA maximum rollover limit for 2025, employers and employees should keep the following in mind:

- Plan design: Employers should review their FSA plan design to ensure that it allows for the maximum rollover amount.

- Communication: Employers should communicate the changes in the FSA maximum rollover limit to employees so that they are aware of their options.

- FSA usage: Employees should carefully consider their healthcare expenses and estimate how much they will need to contribute to their FSA.

- Rollover strategy: Employees should develop a rollover strategy to maximize their savings and minimize their financial burden.

Conclusion

The increase in the FSA maximum rollover limit for 2025 provides employers and employees with greater flexibility and savings opportunities. By understanding the implications of this change, employers and employees can optimize their FSA plans to meet their specific needs.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

Closure

Thus, we hope this article has provided valuable insights into FSA Maximum Rollover 2025: What You Need to Know. We appreciate your attention to our article. See you in our next article!

- 0

- By admin