28, Nov 2023

FSA Rollover To Next Year: Maximizing Your Tax Savings

FSA Rollover to Next Year: Maximizing Your Tax Savings

Related Articles: FSA Rollover to Next Year: Maximizing Your Tax Savings

- 2025 Ram 1500: A Revolution In Pickup Truck Technology

- Conference On Crimes Against Women 2025

- 2025 Nissan Rogue MSRP: A Comprehensive Analysis

- AstroSeek GMT Ephemeris 2025: An In-Depth Guide

- World Expo 2025: Embracing The Future Of Healthcare, Sustainability, And Technology

Introduction

With great pleasure, we will explore the intriguing topic related to FSA Rollover to Next Year: Maximizing Your Tax Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FSA Rollover to Next Year: Maximizing Your Tax Savings

FSA Rollover to Next Year: Maximizing Your Tax Savings

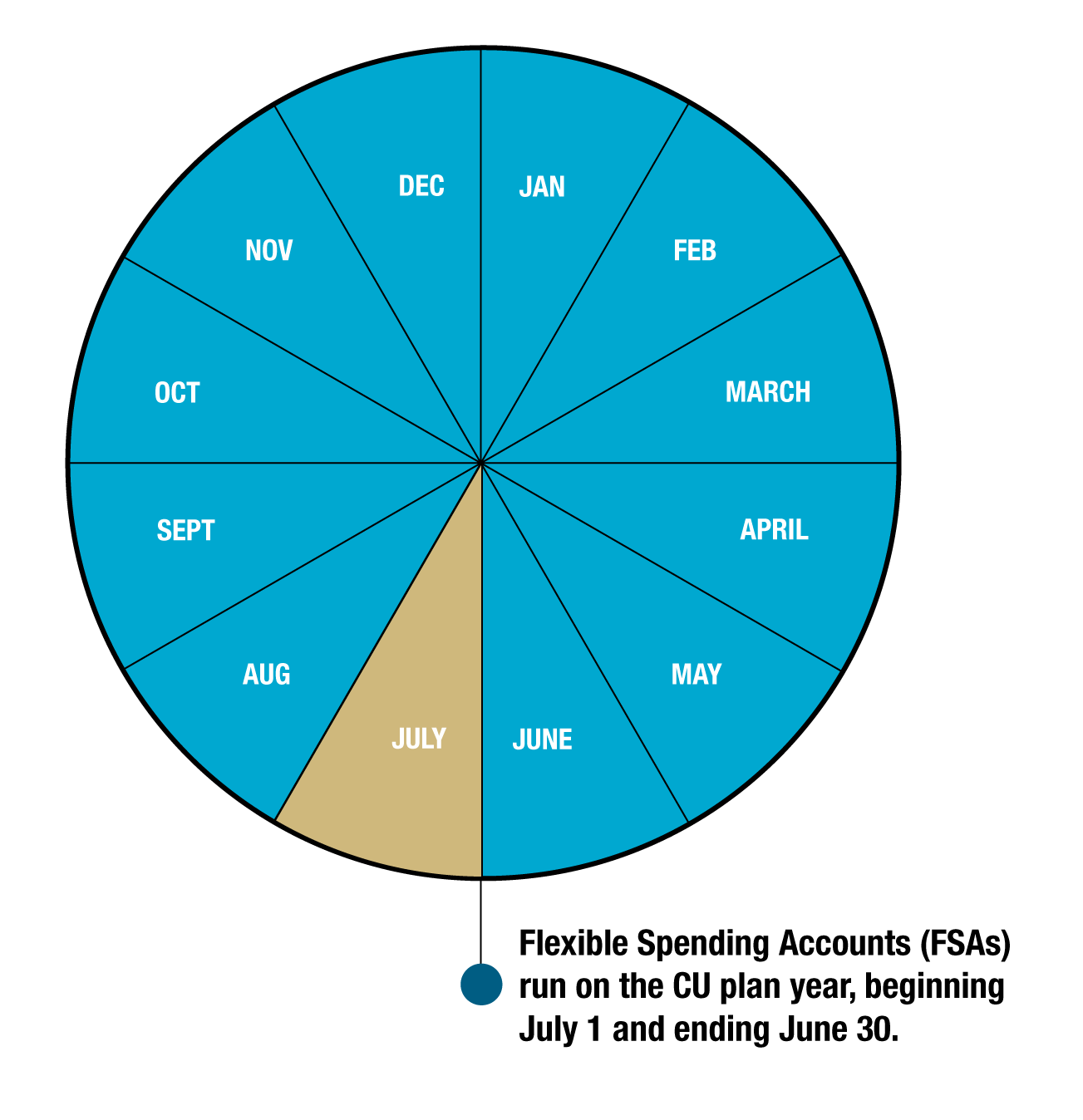

Flexible Spending Accounts (FSAs) are employer-sponsored plans that allow employees to set aside pre-tax dollars to cover qualified medical and dependent care expenses. By utilizing FSAs, individuals can reduce their taxable income and save money on healthcare costs.

One of the key features of FSAs is the ability to roll over unused funds to the following year. This rollover provision provides flexibility in managing healthcare expenses and allows individuals to maximize their tax savings. However, it is important to understand the rules and limitations surrounding FSA rollovers to ensure proper utilization.

Understanding FSA Rollover Eligibility

Not all FSAs allow for rollovers. The following types of FSAs are eligible for rollovers:

- Health FSAs (HFSAs): These FSAs cover qualified medical expenses, such as doctor’s visits, prescription drugs, and dental care.

- Dependent Care FSAs (DCFSAs): These FSAs cover expenses related to the care of dependent children or elderly adults, such as daycare, babysitting, and adult day care.

Rollover Limits and Restrictions

The amount of funds that can be rolled over from one year to the next is limited. The maximum rollover amount for 2023 is:

- HFSAs: $610

- DCFSAs: $2,750

Any unused funds exceeding these limits will be forfeited at the end of the plan year.

Grace Period for Rollovers

Employers typically provide a grace period after the end of the plan year to allow employees to roll over unused funds. This grace period usually lasts for 2.5 months, from January 1 to March 15. During this time, employees can transfer their remaining FSA balance to the next plan year.

Advantages of FSA Rollover

Rolling over FSA funds to the next year offers several advantages:

- Increased Tax Savings: By rolling over unused funds, individuals can continue to reduce their taxable income and save money on healthcare expenses.

- Flexibility in Managing Expenses: Rollovers provide flexibility in managing healthcare expenses throughout the year. Individuals can plan for anticipated medical or dependent care costs and use their FSA funds accordingly.

- Protection Against Forfeiture: Rolling over unused funds prevents them from being forfeited at the end of the plan year, ensuring that the funds are utilized for qualified expenses.

Disadvantages of FSA Rollover

While rollovers provide benefits, they also have some potential disadvantages:

- Use-It-or-Lose-It Rule: Unused funds that are not rolled over will be forfeited at the end of the grace period.

- Limited Rollover Amount: The maximum rollover amount is limited, which may not be sufficient for individuals with substantial healthcare expenses.

- Potential Tax Consequences: If rolled-over funds are not used for qualified expenses in the subsequent year, they may be subject to income tax and a 20% penalty.

Best Practices for FSA Rollover

To maximize the benefits of FSA rollovers, consider the following best practices:

- Plan Ahead: Estimate your expected healthcare expenses for the year and contribute an appropriate amount to your FSA.

- Monitor Your Balance: Regularly check your FSA balance to track your spending and identify any potential surplus.

- Plan for Rollovers: If you anticipate having unused funds, plan to roll them over during the grace period.

- Use Your Funds Wisely: Prioritize qualified expenses and use your FSA funds to cover eligible costs.

- Consider a Health Savings Account (HSA): HSAs offer more flexibility in rolling over funds and provide additional tax benefits, but eligibility is restricted to individuals with high-deductible health plans (HDHPs).

Conclusion

FSA rollovers provide a valuable tool for maximizing tax savings and managing healthcare expenses. By understanding the eligibility requirements, limitations, and best practices, individuals can effectively utilize this feature to enhance their financial well-being. However, it is important to consult with a tax professional or financial advisor to ensure proper implementation and to avoid any potential tax consequences.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

Closure

Thus, we hope this article has provided valuable insights into FSA Rollover to Next Year: Maximizing Your Tax Savings. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin