27, Feb 2024

Google Share Price Forecast 2025: A Comprehensive Analysis

Google Share Price Forecast 2025: A Comprehensive Analysis

Related Articles: Google Share Price Forecast 2025: A Comprehensive Analysis

- 2025 Toyota 4Runner Redesign: A Bold Evolution Of An Off-Road Icon

- Australian Masters Games 2025: A Sporting Spectacle For The Over-30s

- 2025 Toyota Camry: A Vision Of Automotive Excellence

- Winnebago Revel Fuel Economy: A Comprehensive Guide

- 2025 IRMAA Brackets Based On 2025 Income

Introduction

With great pleasure, we will explore the intriguing topic related to Google Share Price Forecast 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Google Share Price Forecast 2025: A Comprehensive Analysis

Google Share Price Forecast 2025: A Comprehensive Analysis

Introduction

Google, the tech behemoth that has revolutionized the digital landscape, has consistently been a subject of fascination for investors. With its dominance in search, advertising, and cloud computing, Google’s financial performance has been closely scrutinized, and its future trajectory remains a topic of keen interest. This article aims to provide a comprehensive analysis of Google’s share price forecast for 2025, exploring various factors that may influence its future performance.

Historical Performance and Key Metrics

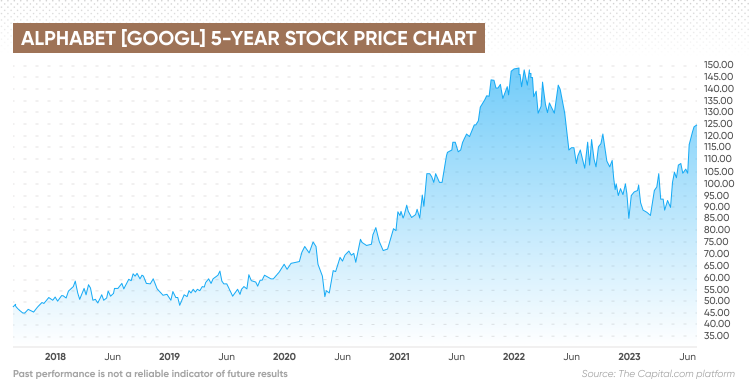

Over the past decade, Google’s stock has exhibited remarkable growth, outperforming the broader market indices. As of June 2023, Google’s share price stood at approximately $1,200, representing a significant increase from its initial public offering price of $85 in 2004.

Key financial metrics that have contributed to Google’s success include:

- Revenue: Google’s primary source of revenue stems from advertising, with Google Ads and YouTube Ads being its major contributors. The company’s revenue has grown steadily over the years, driven by the expansion of digital advertising and Google’s dominance in the search market.

- Earnings per Share (EPS): EPS measures a company’s profitability on a per-share basis. Google’s EPS has consistently exceeded analysts’ expectations, indicating strong earnings growth and profitability.

- Profit Margin: Google enjoys high profit margins, reflecting the efficiency of its business model and the scalability of its operations. The company’s profit margins have remained relatively stable over the years, despite increasing competition.

Factors Influencing Google’s Share Price Forecast

Several factors are likely to influence Google’s share price trajectory in the coming years. These include:

- Continued Growth in Digital Advertising: Digital advertising remains a key driver of Google’s revenue, and the industry is projected to continue growing in the years ahead. Google’s dominance in search and its ability to target users effectively position it well to benefit from this growth.

- Expansion into New Markets: Google has been actively expanding into new markets, such as cloud computing, artificial intelligence, and hardware. These initiatives have the potential to create new revenue streams and enhance the company’s long-term growth prospects.

- Regulatory Environment: Google’s business practices have come under scrutiny from regulators in various jurisdictions. Antitrust concerns, privacy issues, and tax avoidance allegations could potentially impact the company’s financial performance if they result in fines, penalties, or changes in regulations.

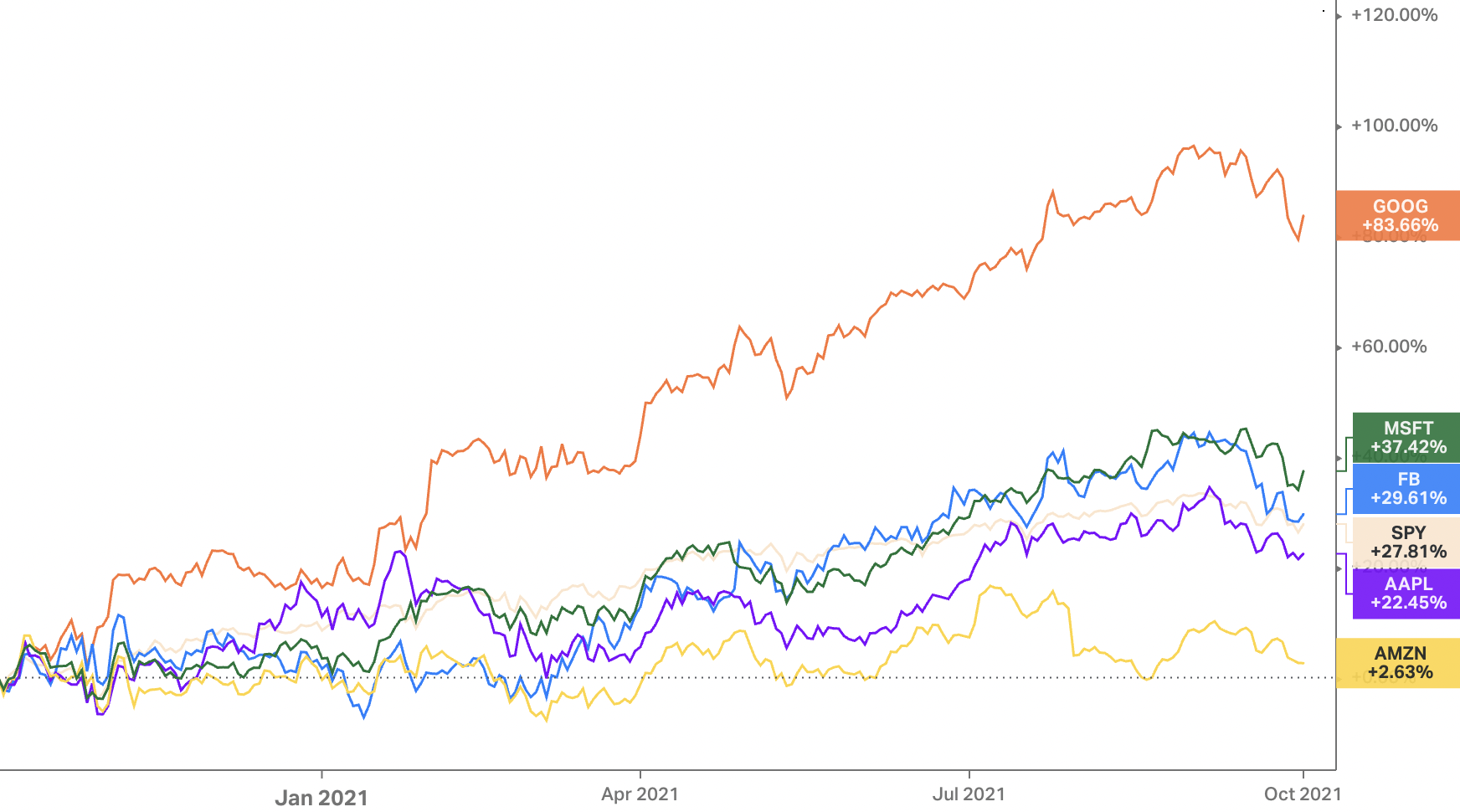

- Competition: Google faces intense competition from other tech giants, such as Amazon, Microsoft, and Apple. These competitors offer similar products and services, and their success could potentially erode Google’s market share and profitability.

Analysts’ Consensus and Share Price Targets

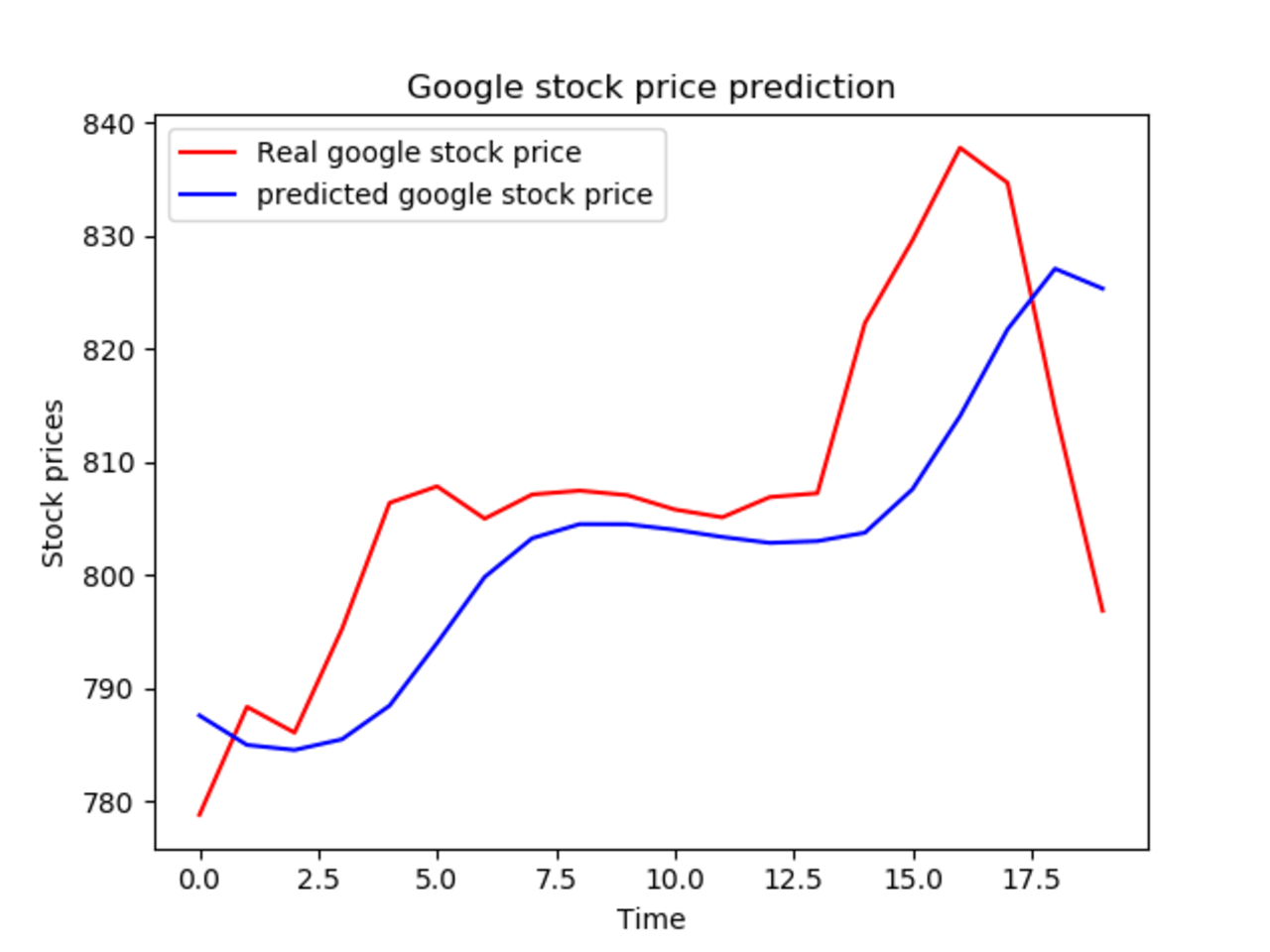

Based on the factors discussed above, analysts have formulated various share price targets for Google in 2025. The consensus among analysts suggests that Google’s share price could continue to rise, although the pace of growth may moderate compared to the past decade.

A recent survey of analysts yielded the following share price targets:

- Median Target: $1,550

- High Target: $1,800

- Low Target: $1,250

The median target of $1,550 implies an upside potential of approximately 29% from Google’s current share price. The high target of $1,800 suggests a potential upside of 50%, while the low target of $1,250 indicates a potential downside of 13%.

Potential Risks and Opportunities

While Google’s future prospects appear bright, there are potential risks and opportunities that could affect its share price performance.

Risks:

- Economic Downturn: A global economic downturn could lead to a decrease in advertising spending, which would negatively impact Google’s revenue and profitability.

- Regulatory Headwinds: Increased regulatory scrutiny could result in fines, penalties, or changes in regulations that could hinder Google’s growth and profitability.

- Competition: Intensifying competition from other tech giants could erode Google’s market share and profitability.

Opportunities:

- Cloud Computing: Google’s cloud computing platform, Google Cloud, has the potential to become a major growth driver in the years ahead.

- Artificial Intelligence: Google’s investments in artificial intelligence could lead to the development of new products and services that enhance the company’s competitive advantage.

- Emerging Markets: Google has a significant opportunity to expand its presence in emerging markets, where internet penetration and digital advertising are growing rapidly.

Conclusion

Google’s share price forecast for 2025 remains a topic of speculation and analysis. While the company’s historical performance and strong financial metrics suggest a positive outlook, several factors could influence its future trajectory. Analysts’ consensus indicates that Google’s share price is likely to continue rising in the coming years, although the pace of growth may moderate compared to the past decade. Investors should carefully consider the potential risks and opportunities associated with Google’s business before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Google Share Price Forecast 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin