10, Dec 2023

Halliburton Stock Outlook 2025: A Comprehensive Analysis

Halliburton Stock Outlook 2025: A Comprehensive Analysis

Related Articles: Halliburton Stock Outlook 2025: A Comprehensive Analysis

- War Of The Worlds Live 2025: An Immersive Spectacle Of Extraterrestrial Terror

- 2025 World Triathlon Championship Finals: A Thrilling Convergence Of Elite Athletes

- How To Train Your Dragon: Live-Action Epic Soars Into Theaters In 2025

- New Year’s Eve Countdown 2025: A Global Celebration Of Hope And Renewal

- Mlk Day 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Halliburton Stock Outlook 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Halliburton Stock Outlook 2025: A Comprehensive Analysis

Halliburton Stock Outlook 2025: A Comprehensive Analysis

Introduction

Halliburton (NYSE: HAL) is a global leader in energy services, providing solutions for the entire life cycle of an oil and gas field. The company has a diverse portfolio of businesses, including drilling, completion, production, and project management. Halliburton operates in over 80 countries and employs approximately 50,000 people.

In recent years, Halliburton has faced challenges due to the downturn in the oil and gas industry. However, the company has taken steps to improve its financial performance, including reducing costs and divesting non-core assets. As a result, Halliburton is now well-positioned to benefit from the recovery in the oil and gas market.

Industry Outlook

The global oil and gas industry is expected to grow significantly in the coming years. Rising demand for energy, particularly in developing countries, is driving this growth. Additionally, the transition to cleaner energy sources is creating new opportunities for oil and gas companies.

Halliburton is well-positioned to benefit from these trends. The company has a strong track record of innovation and is investing heavily in new technologies. Halliburton is also expanding its presence in emerging markets, where the growth potential is particularly strong.

Company Outlook

Halliburton has a number of key strengths that will help it to succeed in the future. These strengths include:

- A diverse portfolio of businesses: Halliburton provides a wide range of services to the oil and gas industry. This diversification helps to reduce the company’s risk profile.

- A global presence: Halliburton operates in over 80 countries. This global reach gives the company a competitive advantage in winning new contracts.

- A strong financial position: Halliburton has a strong balance sheet and is generating positive cash flow. This financial strength gives the company the flexibility to invest in new technologies and expand its operations.

Risks

Despite its strengths, Halliburton faces a number of risks. These risks include:

- The volatility of the oil and gas industry: The oil and gas industry is cyclical. This volatility can impact Halliburton’s financial performance.

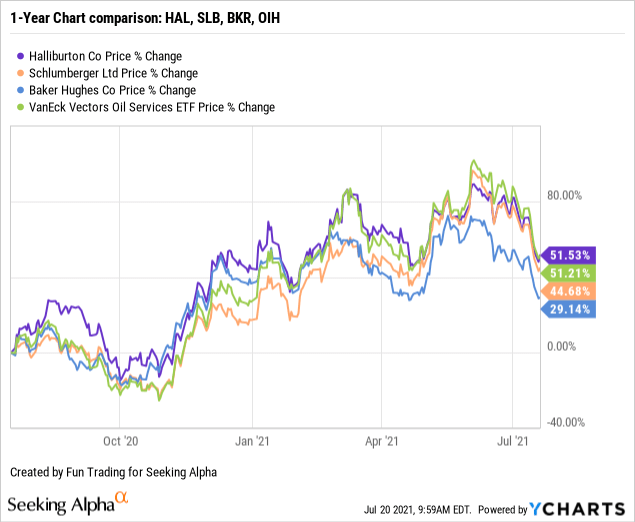

- Competition: Halliburton faces competition from a number of large and well-established companies. This competition can make it difficult for Halliburton to win new contracts and grow its market share.

- Regulatory changes: The oil and gas industry is heavily regulated. Changes in regulations can impact Halliburton’s operations and financial performance.

Stock Outlook

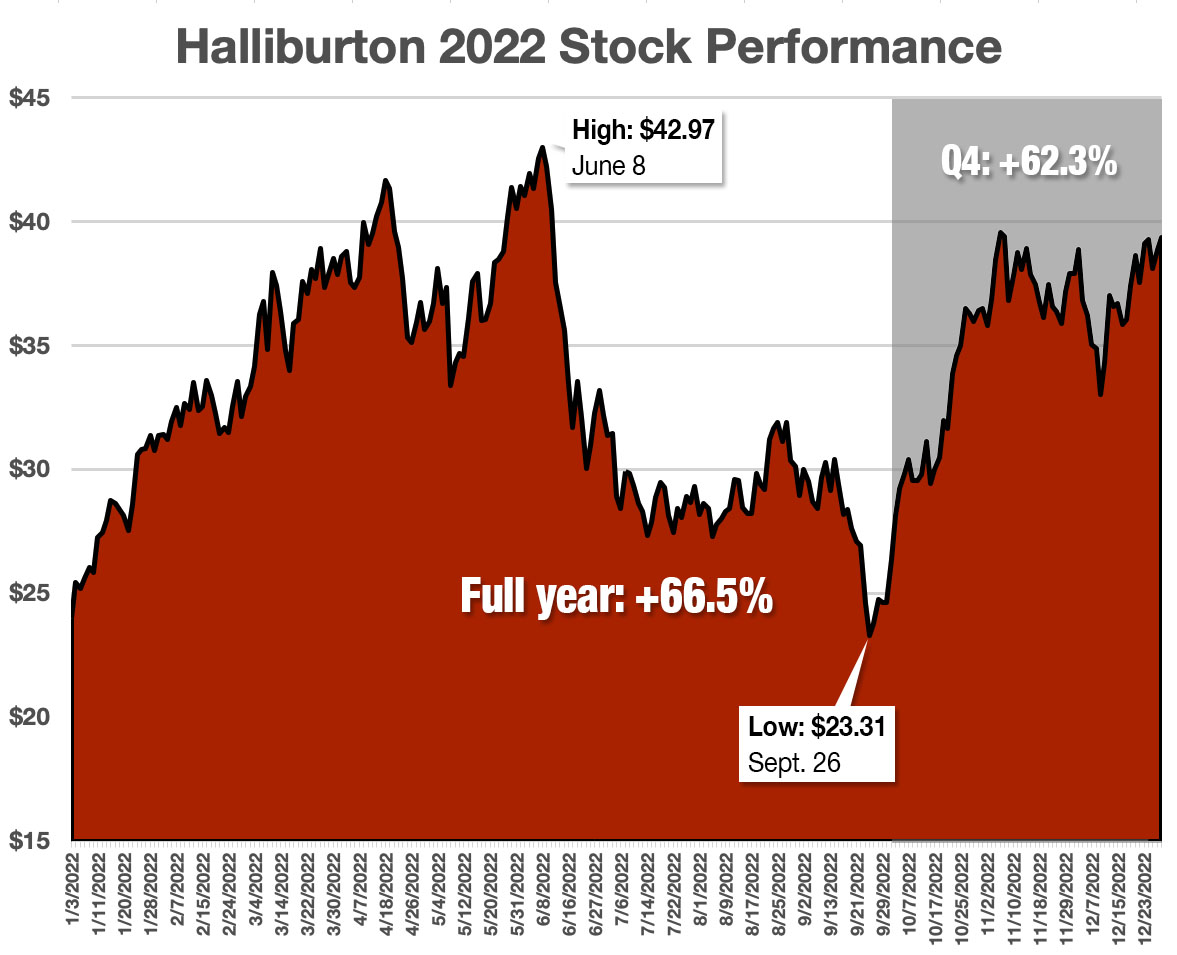

Analysts are generally positive on Halliburton’s stock outlook. The consensus price target for Halliburton is $45.00, which represents a potential upside of over 20% from the current price.

There are a number of factors that support a positive outlook for Halliburton’s stock. These factors include:

- The recovery in the oil and gas industry: The oil and gas industry is recovering from the downturn of the past few years. This recovery is expected to continue in the coming years, which will benefit Halliburton.

- Halliburton’s strong financial position: Halliburton has a strong balance sheet and is generating positive cash flow. This financial strength gives the company the flexibility to invest in new technologies and expand its operations.

- Halliburton’s commitment to innovation: Halliburton is a leader in innovation. The company is investing heavily in new technologies that will help it to improve its efficiency and reduce its costs.

Conclusion

Halliburton is a well-positioned company in a growing industry. The company has a number of strengths that will help it to succeed in the future. Analysts are generally positive on Halliburton’s stock outlook, and the company’s stock is currently trading at a discount to its fair value. As a result, Halliburton is a stock that investors should consider adding to their portfolios.

Disclaimer

The information contained in this article is for informational purposes only and should not be construed as investment advice. Investors should always conduct their own research before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Halliburton Stock Outlook 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!

- 0

- By admin