10, Jul 2023

Home Prices In 2025: A Comprehensive Forecast

Home Prices in 2025: A Comprehensive Forecast

Related Articles: Home Prices in 2025: A Comprehensive Forecast

- Upcoming Movies In 2025: A Cinematic Odyssey Awaits

- 2025 Calendar With Indian Holidays PDF

- Interest Rates Prediction For The UK In 2025: A Comprehensive Analysis

- 2025 3rd Ave N, Birmingham, AL 35203: A Comprehensive Overview

- Where Is The 2026 NFL Draft? A Comprehensive Analysis Of Potential Host Cities

Introduction

With great pleasure, we will explore the intriguing topic related to Home Prices in 2025: A Comprehensive Forecast. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Home Prices in 2025: A Comprehensive Forecast

Home Prices in 2025: A Comprehensive Forecast

The housing market is a complex and ever-evolving landscape, influenced by a myriad of economic, social, and political factors. Predicting future home prices is a challenging endeavor, but by analyzing historical trends, current market conditions, and expert insights, we can gain valuable insights into the potential trajectory of the market in the coming years.

Historical Trends

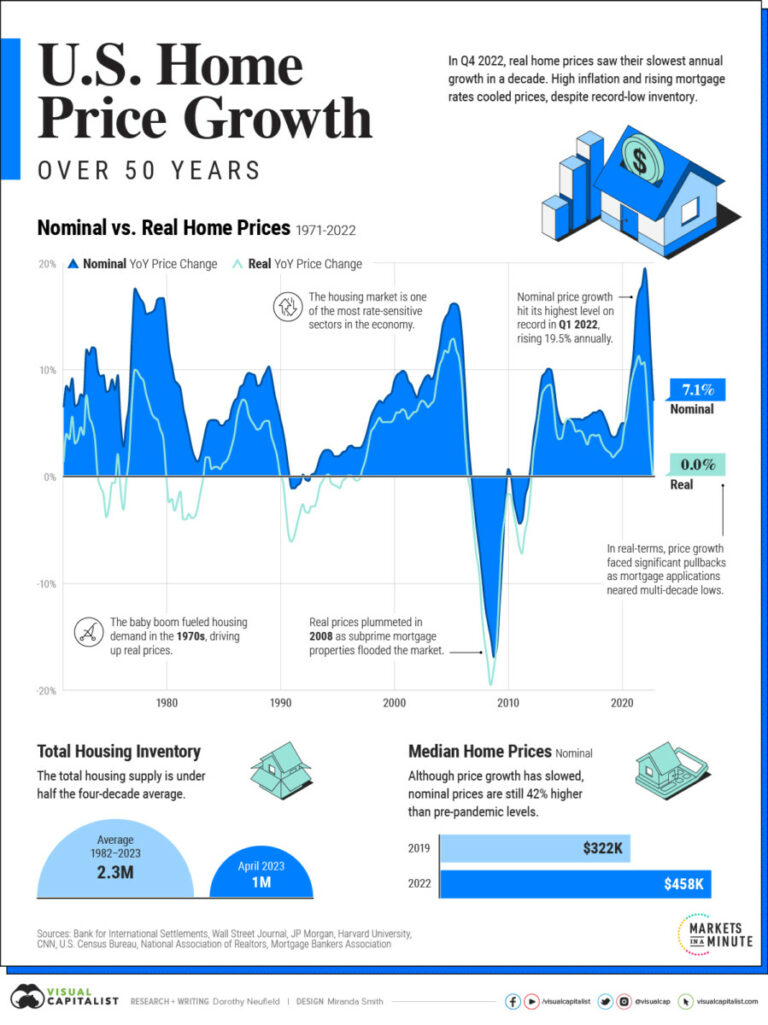

Over the past century, home prices in the United States have generally trended upwards, with occasional periods of decline during economic downturns. The long-term appreciation of home values has been driven by factors such as population growth, increasing incomes, and low interest rates.

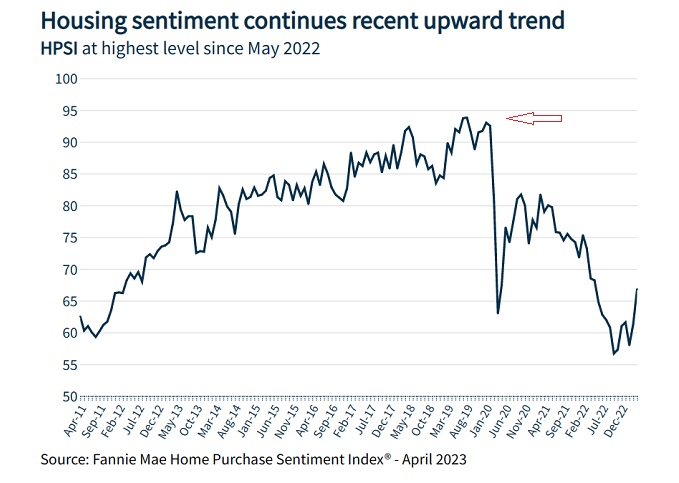

In recent years, home prices have experienced a particularly sharp increase, fueled by strong demand from millennials entering the housing market, low inventory levels, and record-low mortgage rates. However, the rapid appreciation has raised concerns about affordability and the potential for a housing bubble.

Current Market Conditions

The current housing market is characterized by several key factors:

- High Demand: Demand for housing remains strong, driven by a growing population, low interest rates, and a desire for more space during the COVID-19 pandemic.

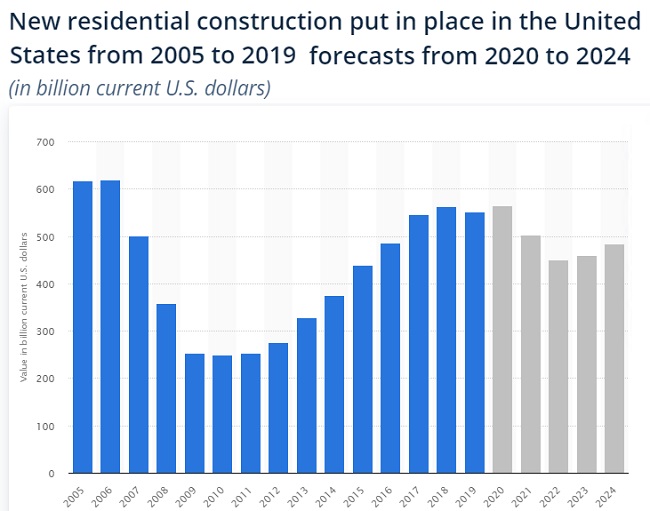

- Low Supply: Inventory levels are historically low, with the number of homes for sale at a 15-year low. This supply shortage has pushed prices higher and made it difficult for buyers to find affordable options.

- Rising Interest Rates: The Federal Reserve has begun raising interest rates to combat inflation, which is expected to increase mortgage rates and make homeownership more expensive.

- Economic Uncertainty: The global economic outlook is uncertain due to factors such as the war in Ukraine, supply chain disruptions, and rising inflation. This uncertainty could impact consumer confidence and the housing market.

Expert Forecasts

Leading economists and housing experts have varying opinions on the future trajectory of home prices. Some predict that prices will continue to rise, albeit at a slower pace than in recent years. Others believe that the market is due for a correction, with prices potentially declining in some areas.

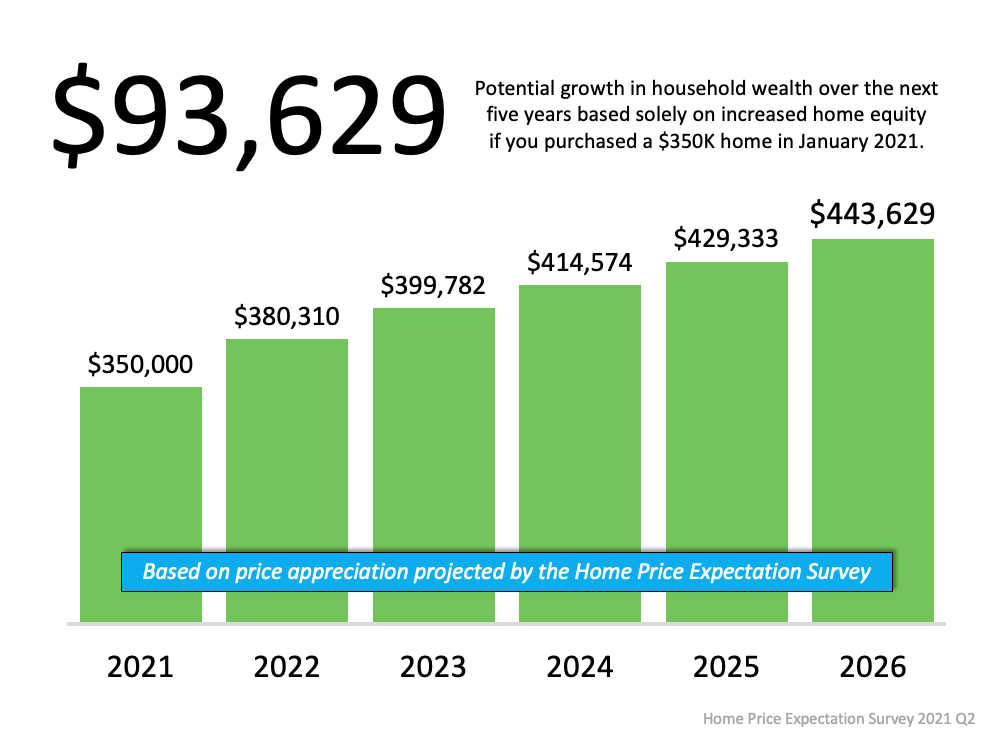

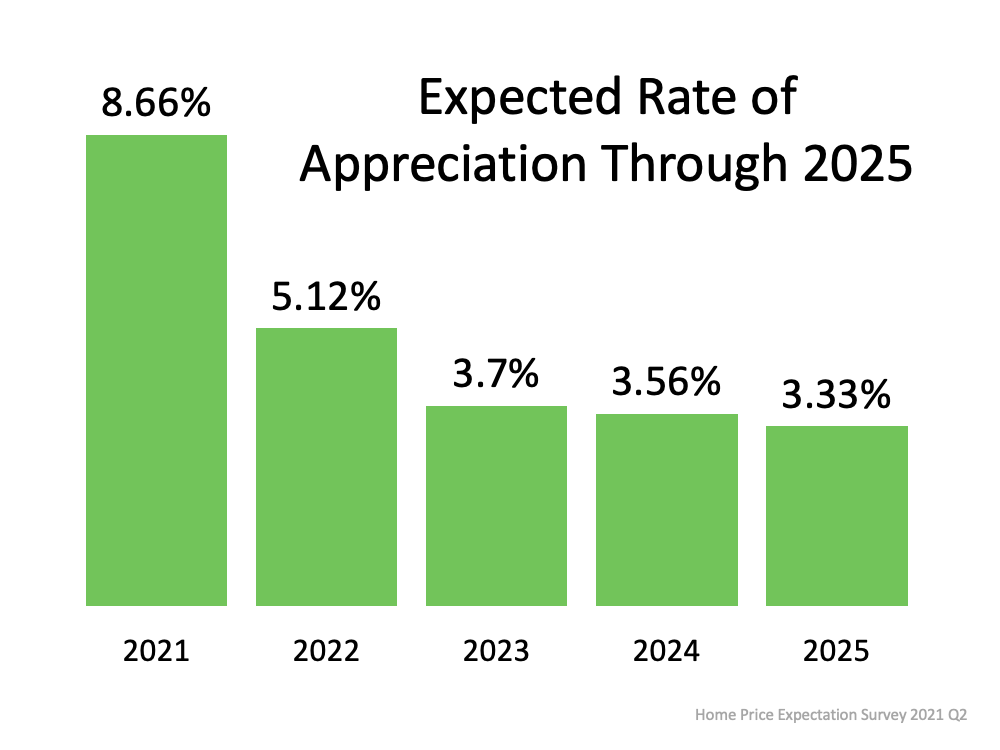

According to a survey conducted by Fannie Mae, the median home price in the United States is projected to increase by 3.3% in 2023, 2.8% in 2024, and 2.5% in 2025. However, the survey also notes that there is a significant amount of uncertainty surrounding these forecasts due to the current economic environment.

Factors Influencing Future Prices

Several factors are expected to influence home prices in 2025:

- Interest Rates: The level of mortgage rates will have a significant impact on affordability and demand. If rates continue to rise, it could slow the pace of price appreciation.

- Economic Growth: The overall health of the economy will play a role in consumer confidence and the demand for housing. Strong economic growth could support higher prices, while a recession could lead to a decline.

- Inventory Levels: The supply of homes for sale will continue to be a key factor. If inventory levels remain low, prices are likely to continue to rise.

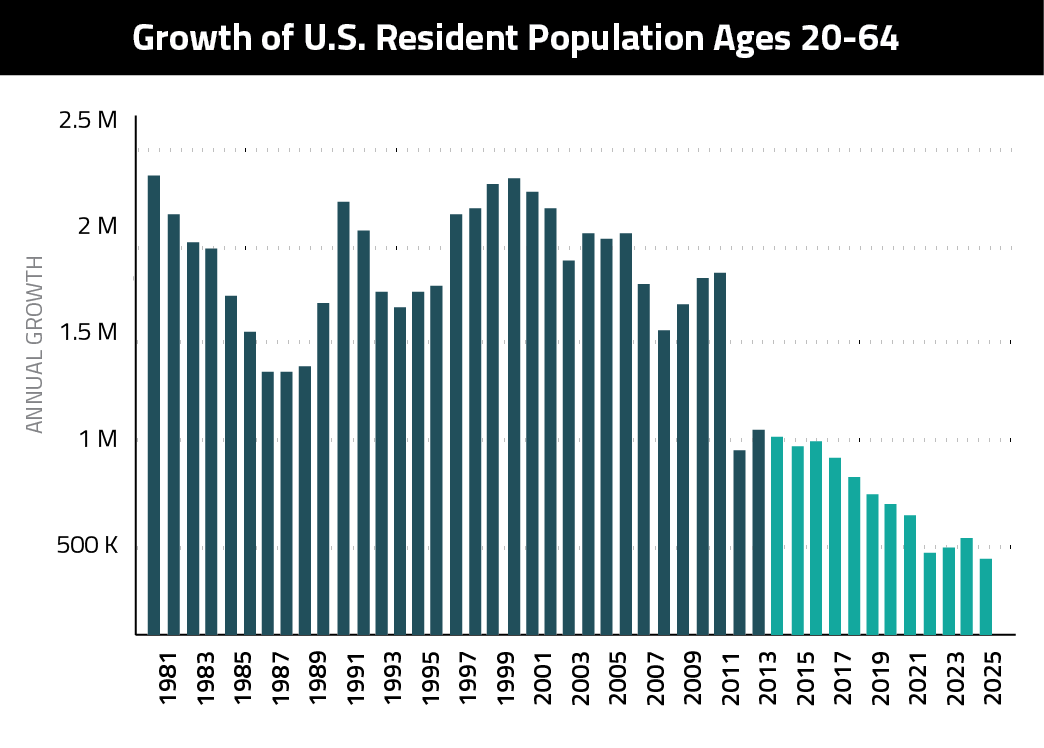

- Demographic Trends: The aging population and the growing number of millennials entering the housing market will continue to drive demand for housing.

- Government Policies: Government policies related to housing, such as tax incentives and regulations, can also impact prices.

Potential Scenarios

Based on the current market conditions and expert forecasts, several potential scenarios could unfold for home prices in 2025:

- Continued Appreciation: If demand remains strong, supply remains low, and interest rates stabilize, home prices could continue to appreciate, albeit at a slower pace than in recent years.

- Modest Decline: If interest rates rise significantly or the economy enters a recession, home prices could experience a modest decline in some areas.

- Significant Correction: If the housing market experiences a bubble-like situation, where prices have become unsustainable, a significant correction could occur, leading to a sharp decline in prices.

Conclusion

Predicting home prices in 2025 is a complex undertaking, and the future trajectory of the market is uncertain. However, by analyzing historical trends, current market conditions, and expert insights, we can gain a better understanding of the potential scenarios that may unfold.

While the housing market is likely to continue to face challenges in the coming years, including rising interest rates and low inventory levels, the long-term fundamentals of the market remain strong. Population growth, increasing incomes, and a desire for homeownership will continue to support demand for housing.

As always, prospective homebuyers and sellers should consult with real estate professionals to make informed decisions based on their individual circumstances and local market conditions.

Closure

Thus, we hope this article has provided valuable insights into Home Prices in 2025: A Comprehensive Forecast. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin