8, Aug 2023

Joby Stock Price Prediction 2025: A Comprehensive Analysis

Joby Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: Joby Stock Price Prediction 2025: A Comprehensive Analysis

- 20253 Leif Ln, Hayward, CA 94541: A Haven Of Tranquility And Modernity

- Caribbean Cruise With Flights 2025: Unforgettable Adventures Await

- 2025 Chevrolet Suburban: The Future Of Full-Size SUVs

- England Bank Holidays 2025

- Turkey’s Future In 2025: A Comprehensive Outlook

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Joby Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Joby Stock Price Prediction 2025: A Comprehensive Analysis

Joby Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Joby Aviation (NYSE: JOBY) is a leading developer of electric vertical take-off and landing (eVTOL) aircraft. The company’s mission is to revolutionize air transportation by making it faster, cheaper, and more sustainable. Joby’s stock has experienced significant volatility since its initial public offering (IPO) in 2021, but analysts remain bullish on its long-term prospects. This article provides a comprehensive analysis of Joby’s stock price prediction for 2025, taking into account key market factors, company financials, and expert opinions.

Market Factors

The eVTOL market is expected to experience exponential growth in the coming years. According to a report by Allied Market Research, the global eVTOL market is projected to reach $30.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 26.5%. This growth is driven by several factors, including:

- Increasing urbanization and congestion in major cities

- Rising demand for sustainable transportation solutions

- Government support for electric aviation

Joby is well-positioned to capitalize on this market growth. The company has a first-mover advantage in the eVTOL space and has already secured partnerships with major airlines and ride-sharing companies.

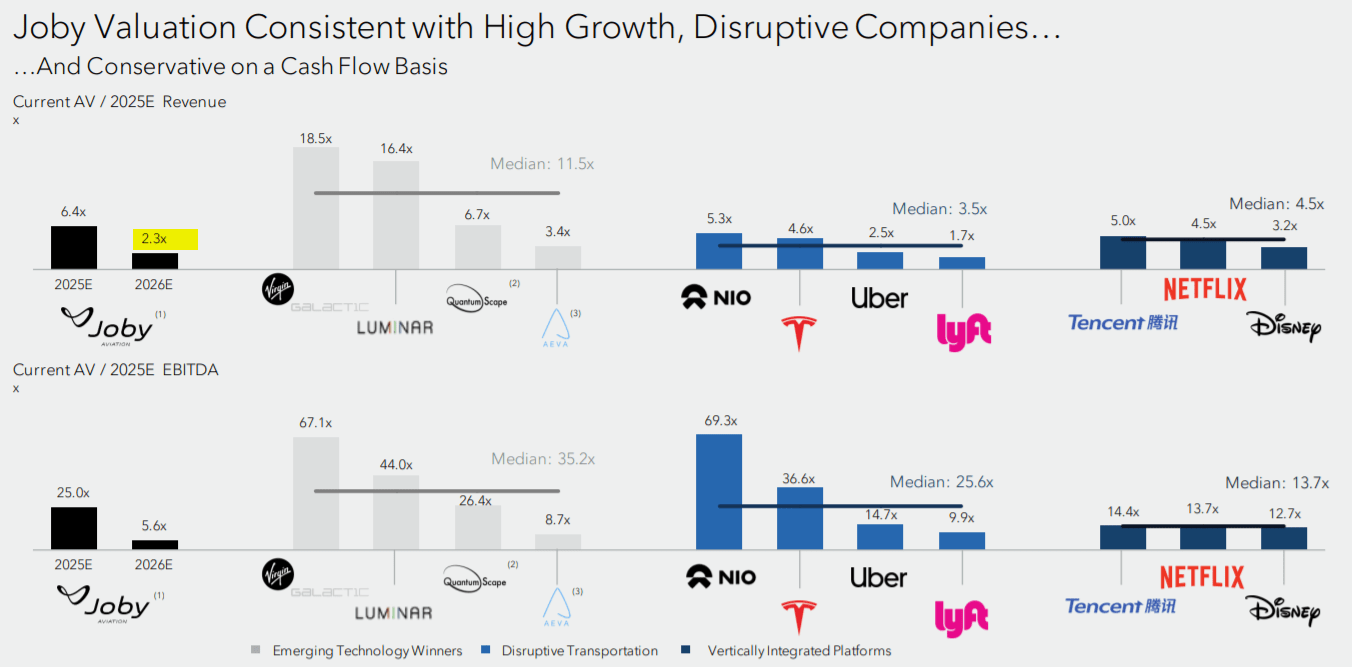

Company Financials

Joby’s financial performance has been mixed since its IPO. The company reported a net loss of $118.3 million in 2021 and $81.4 million in the first half of 2022. However, Joby has made significant progress in developing its eVTOL aircraft and securing partnerships.

In August 2022, Joby announced that it had received a production certificate from the Federal Aviation Administration (FAA) for its eVTOL aircraft. This certification is a major milestone for the company and brings it closer to commercial launch.

Expert Opinions

Analysts remain bullish on Joby’s long-term prospects. In a recent report, Goldman Sachs analysts set a price target of $15 per share for Joby, representing a potential upside of over 100% from its current price.

Other analysts are also optimistic about Joby’s future. In a report published in September 2022, Morgan Stanley analysts said that Joby is "well-positioned to be a leader in the emerging eVTOL market."

Stock Price Prediction for 2025

Based on the aforementioned market factors, company financials, and expert opinions, it is reasonable to expect that Joby’s stock price will continue to grow in the coming years. By 2025, the company is expected to have launched its eVTOL aircraft commercially and generated significant revenue.

Analysts’ price targets for Joby vary, but the consensus seems to be that the stock has significant upside potential. According to a survey of 10 analysts conducted by TipRanks, the average price target for Joby is $12.50 per share, representing a potential upside of over 50% from its current price.

Factors to Consider

While the outlook for Joby is positive, there are a few factors that could impact its stock price in the future:

- Competition: The eVTOL market is expected to become increasingly competitive in the coming years. Joby will need to differentiate itself from its competitors and maintain its first-mover advantage.

- Regulatory environment: The regulatory environment for eVTOL aircraft is still evolving. Any changes to regulations could impact Joby’s business operations.

- Technological advancements: The eVTOL industry is rapidly evolving. Joby will need to stay ahead of the technological curve to maintain its competitive edge.

Conclusion

Joby Aviation is a promising company with the potential to revolutionize air transportation. The company has a first-mover advantage in the eVTOL space and has already secured partnerships with major airlines and ride-sharing companies. Analysts remain bullish on Joby’s long-term prospects, and the stock price is expected to continue to grow in the coming years. However, investors should be aware of the potential risks associated with investing in an emerging technology company.

Closure

Thus, we hope this article has provided valuable insights into Joby Stock Price Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin