19, Oct 2023

NIO Stock Forecast 2025: A Comprehensive Analysis Of Potential Growth And Challenges

NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges

Related Articles: NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges

- Spy Shots Of 2025 Jaguar F-Type Being Tested: A Glimpse Into The Future

- 2025 Porsche 911 GT2 RS: A Symphony Of Power And Precision

- 2025 Camry Hybrid AWD: A Revolution In Fuel Efficiency And All-Weather Performance

- 2025 Lexus RX 350: A Comprehensive Review

- Jewish Holidays In 2025

Introduction

With great pleasure, we will explore the intriguing topic related to NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges

NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges

Introduction

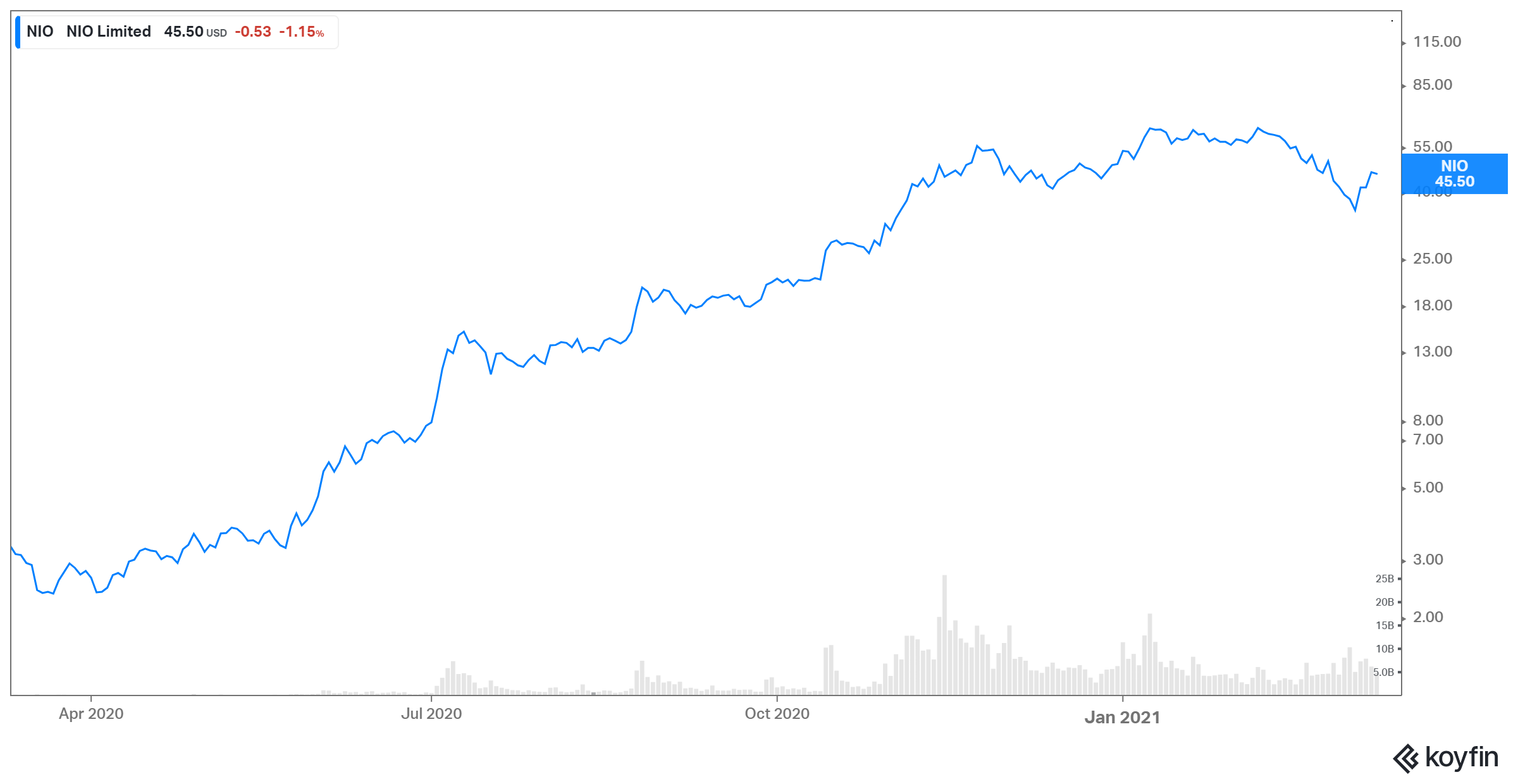

NIO (NYSE: NIO), a leading Chinese electric vehicle (EV) manufacturer, has captured the attention of investors worldwide. With its innovative designs, advanced technology, and aggressive expansion plans, NIO has emerged as a formidable competitor in the rapidly growing EV market. This article aims to provide a comprehensive analysis of NIO’s stock forecast for 2025, exploring potential growth drivers, challenges, and key factors that could influence its future performance.

Market Overview and Industry Trends

The global EV market is experiencing exponential growth, driven by rising environmental concerns, government incentives, and technological advancements. NIO operates in a highly competitive industry alongside established players such as Tesla, BYD, and Volkswagen. The company’s ability to differentiate itself through innovation and strategic partnerships will be crucial for its long-term success.

NIO’s Competitive Advantages

NIO has established several competitive advantages that set it apart from its rivals:

- Innovative Designs: NIO’s vehicles feature sleek and futuristic designs that appeal to a discerning customer base.

- Advanced Technology: The company invests heavily in research and development, incorporating cutting-edge technologies into its vehicles, such as autonomous driving capabilities and advanced battery systems.

- Customer-Centric Approach: NIO prioritizes customer satisfaction through its comprehensive ecosystem, which includes charging infrastructure, mobile applications, and exclusive membership programs.

- Strategic Partnerships: NIO has forged partnerships with technology giants such as Tencent and Baidu, leveraging their expertise in artificial intelligence and cloud computing.

Growth Drivers for NIO

Several factors are expected to contribute to NIO’s potential growth in the coming years:

- Expanding Product Portfolio: NIO plans to introduce a range of new models, including sedans, SUVs, and electric sports cars, catering to a wider customer base.

- Geographic Expansion: The company is actively expanding its presence in international markets, such as Europe and North America, tapping into new growth opportunities.

- Battery Technology Advancements: NIO’s investments in battery research are expected to yield significant improvements in range and charging speed, enhancing the overall driving experience.

- Government Support: Governments worldwide are implementing favorable policies to promote EV adoption, creating a supportive environment for NIO’s growth.

Challenges for NIO

Despite its strong fundamentals, NIO faces several challenges that could impact its future performance:

- Intense Competition: The EV market is highly competitive, with numerous established and emerging players vying for market share.

- Supply Chain Disruptions: The global semiconductor shortage and other supply chain disruptions could affect NIO’s production capacity and delivery schedules.

- Regulatory Uncertainties: NIO operates in a highly regulated industry, and changes in government policies could impact its operations and profitability.

- Economic Downturns: Economic downturns could lead to reduced consumer spending and impact demand for EVs.

NIO Stock Forecast 2025

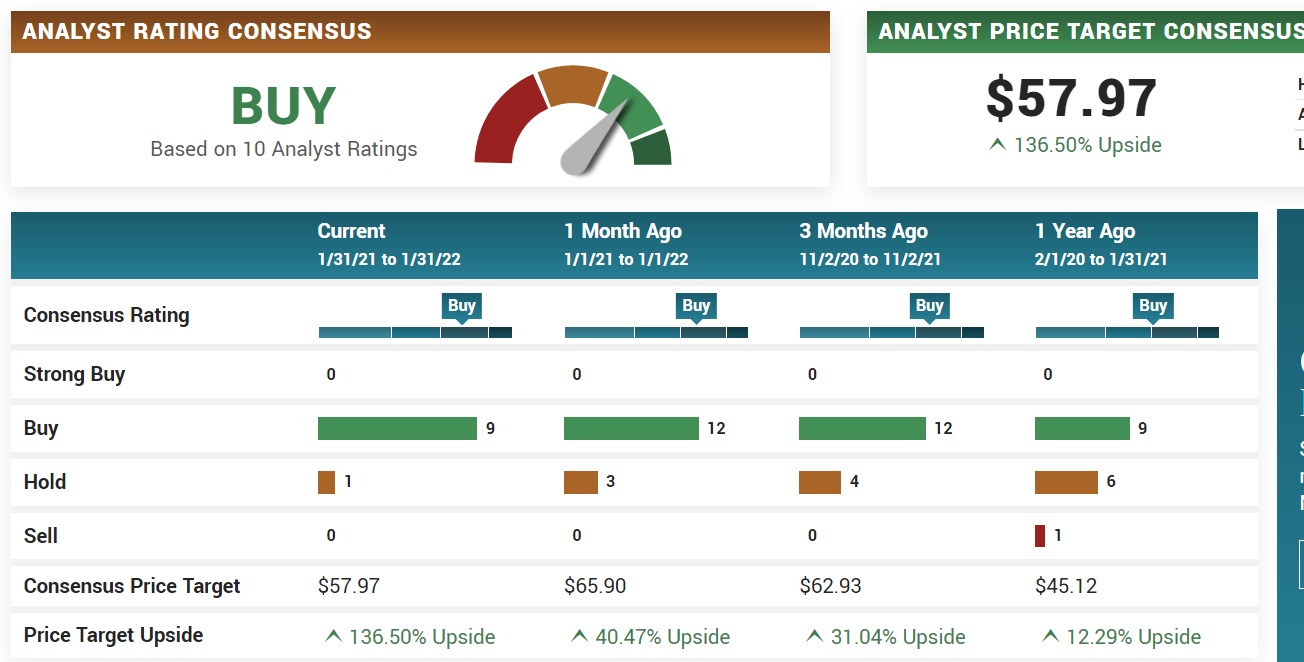

Based on an analysis of the market overview, industry trends, growth drivers, and challenges, analysts have provided varying forecasts for NIO’s stock performance in 2025.

- Bullish Forecast: Some analysts predict that NIO’s stock could reach $100 or higher by 2025, citing the company’s strong fundamentals, growth potential, and favorable market conditions.

- Bearish Forecast: Other analysts are more cautious, suggesting that NIO’s stock could face headwinds due to intense competition, supply chain disruptions, and regulatory uncertainties.

- Consensus Forecast: A consensus among analysts suggests that NIO’s stock could trade in the range of $50-$75 by 2025, reflecting a balance between growth potential and potential challenges.

Key Factors to Monitor

Investors should closely monitor several key factors that could influence NIO’s stock performance in 2025:

- Sales Volume and Market Share: NIO’s ability to increase its sales volume and gain market share will be crucial for its financial growth.

- New Product Launches: The success of NIO’s new vehicle models will be closely watched by investors.

- Geographic Expansion: NIO’s progress in expanding into international markets will be a key indicator of its global growth potential.

- Battery Technology Advancements: Improvements in battery technology could significantly impact NIO’s competitive advantage and market demand.

- Regulatory Environment: Changes in government policies and regulations could have a direct impact on NIO’s operations and profitability.

Conclusion

NIO is well-positioned to capitalize on the growing EV market with its innovative designs, advanced technology, and customer-centric approach. However, the company faces significant challenges in a highly competitive industry. Analysts’ forecasts for NIO’s stock in 2025 vary, but a consensus suggests potential growth within a range of $50-$75. Investors should carefully monitor key factors such as sales volume, new product launches, geographic expansion, battery technology advancements, and the regulatory environment to make informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into NIO Stock Forecast 2025: A Comprehensive Analysis of Potential Growth and Challenges. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin