27, Dec 2023

Projected Standard Deduction For 2025: A Comprehensive Guide

Projected Standard Deduction for 2025: A Comprehensive Guide

Related Articles: Projected Standard Deduction for 2025: A Comprehensive Guide

- CR2032 Button Cell Battery: A Compact Powerhouse For Electronics

- 2025 Gubernatorial Elections: A Look At Key Races And Candidates

- Button Cell Batteries 2025: A Comprehensive Guide

- 2025 3rd Ave N, Birmingham, AL 35203: A Comprehensive Overview

- Around 2010: A Decade Of Technological And Social Transformation

Introduction

With great pleasure, we will explore the intriguing topic related to Projected Standard Deduction for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected Standard Deduction for 2025: A Comprehensive Guide

Projected Standard Deduction for 2025: A Comprehensive Guide

Introduction

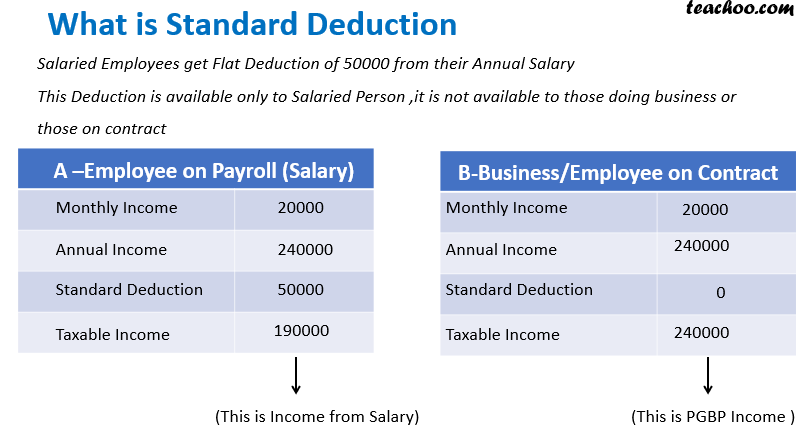

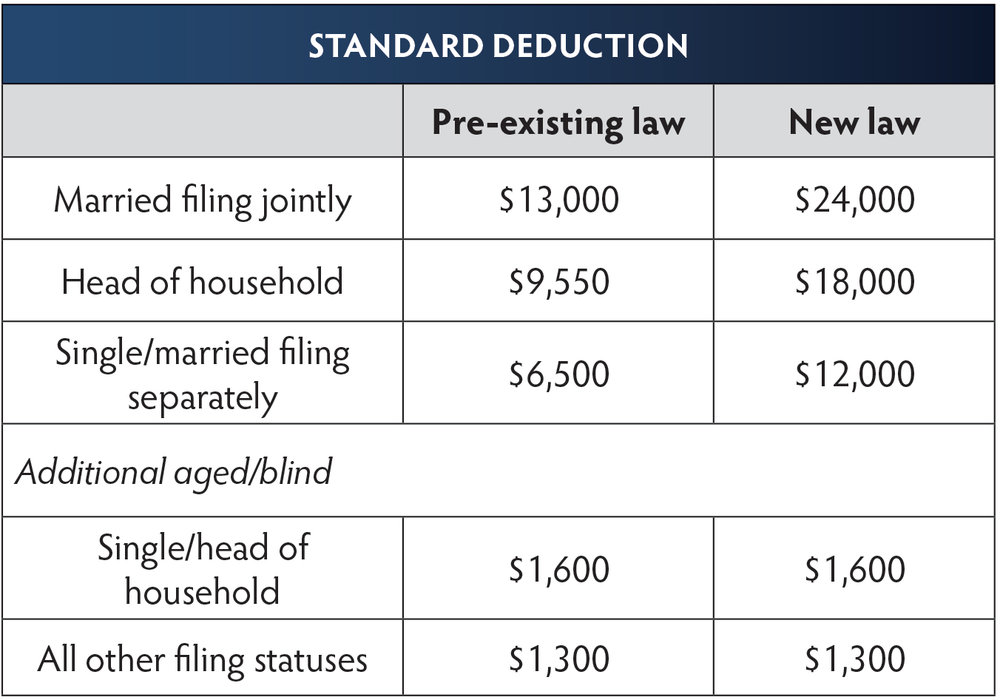

The standard deduction is a specific dollar amount that taxpayers can subtract from their taxable income before calculating their federal income tax liability. It is a simplified method of itemizing deductions, which allows taxpayers to avoid the hassle of tracking and itemizing individual expenses. The standard deduction amount varies depending on filing status, and it is adjusted annually for inflation.

Projected Standard Deduction for 2025

The projected standard deduction amounts for 2025, based on the latest inflation estimates, are as follows:

- Single: $14,050

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

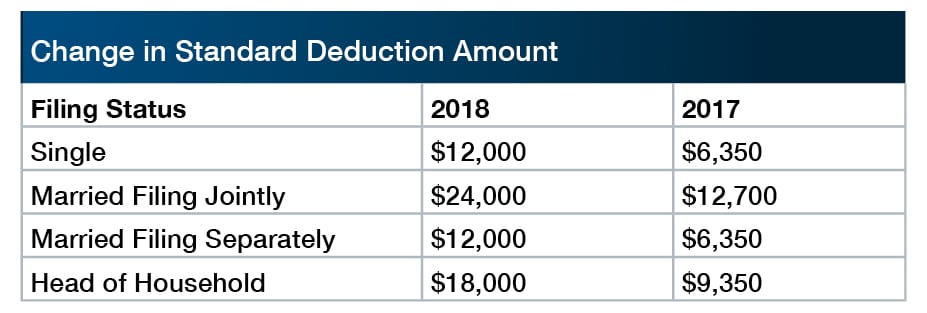

Comparison to 2024 Standard Deductions

Compared to the 2024 standard deduction amounts, the projected 2025 standard deductions represent a modest increase of approximately 2.5%. This increase is primarily driven by inflation adjustments.

- Single: $13,850 (2024) vs. $14,050 (2025)

- Married filing jointly: $27,300 (2024) vs. $27,700 (2025)

- Married filing separately: $13,650 (2024) vs. $13,850 (2025)

- Head of household: $20,500 (2024) vs. $20,800 (2025)

Impact on Taxpayers

The projected increase in the standard deduction for 2025 will have a positive impact on taxpayers, as it will effectively reduce their taxable income. This means that taxpayers will owe less in federal income taxes.

- Single taxpayers: The projected increase of $200 in the standard deduction will save single taxpayers approximately $30 in federal income taxes.

- Married couples filing jointly: The projected increase of $400 in the standard deduction will save married couples filing jointly approximately $60 in federal income taxes.

Factors Affecting the Standard Deduction

The standard deduction is influenced by several factors, including:

- Inflation: The standard deduction is adjusted annually for inflation to ensure that it maintains its value over time.

- Tax policy: The standard deduction can be modified by tax legislation, such as the Tax Cuts and Jobs Act of 2017, which increased the standard deduction amounts.

- Filing status: The standard deduction amount varies depending on the taxpayer’s filing status, with higher deductions for married couples filing jointly.

Considerations for Taxpayers

When planning for 2025 taxes, taxpayers should consider the following:

- Maximize deductions: While the standard deduction is a valuable tax break, itemizing deductions may still be more beneficial for some taxpayers, especially those with significant expenses.

- Estimate tax liability: Taxpayers can use the projected standard deduction amounts to estimate their tax liability for 2025 and adjust their withholding or estimated tax payments accordingly.

- Consult a tax professional: Taxpayers with complex financial situations or who are unsure about their tax liability should consult a tax professional for guidance.

Conclusion

The projected standard deduction amounts for 2025 represent a modest increase over the 2024 amounts. This increase will provide taxpayers with additional tax savings and simplify the tax filing process for those who choose to use the standard deduction. Taxpayers should consider the projected standard deduction amounts when planning for 2025 taxes and consult a tax professional if necessary.

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Closure

Thus, we hope this article has provided valuable insights into Projected Standard Deduction for 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

- 0

- By admin