2, May 2024

Schedule A (Form 1040): Itemized Deductions For 2025

Schedule A (Form 1040): Itemized Deductions for 2025

Related Articles: Schedule A (Form 1040): Itemized Deductions for 2025

- 2025 Kia K5 GT: A Symphony Of Power And Sophistication

- Mlk Day 2025

- MTAC E2025: Transforming The Future Of Mobility

- Lee County School Calendar 2024-2025: A Comprehensive Guide

- 2025 Willingdon Avenue: A Contemporary Masterpiece In Burnaby’s Vibrant Heart

Introduction

With great pleasure, we will explore the intriguing topic related to Schedule A (Form 1040): Itemized Deductions for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Schedule A (Form 1040): Itemized Deductions for 2025

Schedule A (Form 1040): Itemized Deductions for 2025

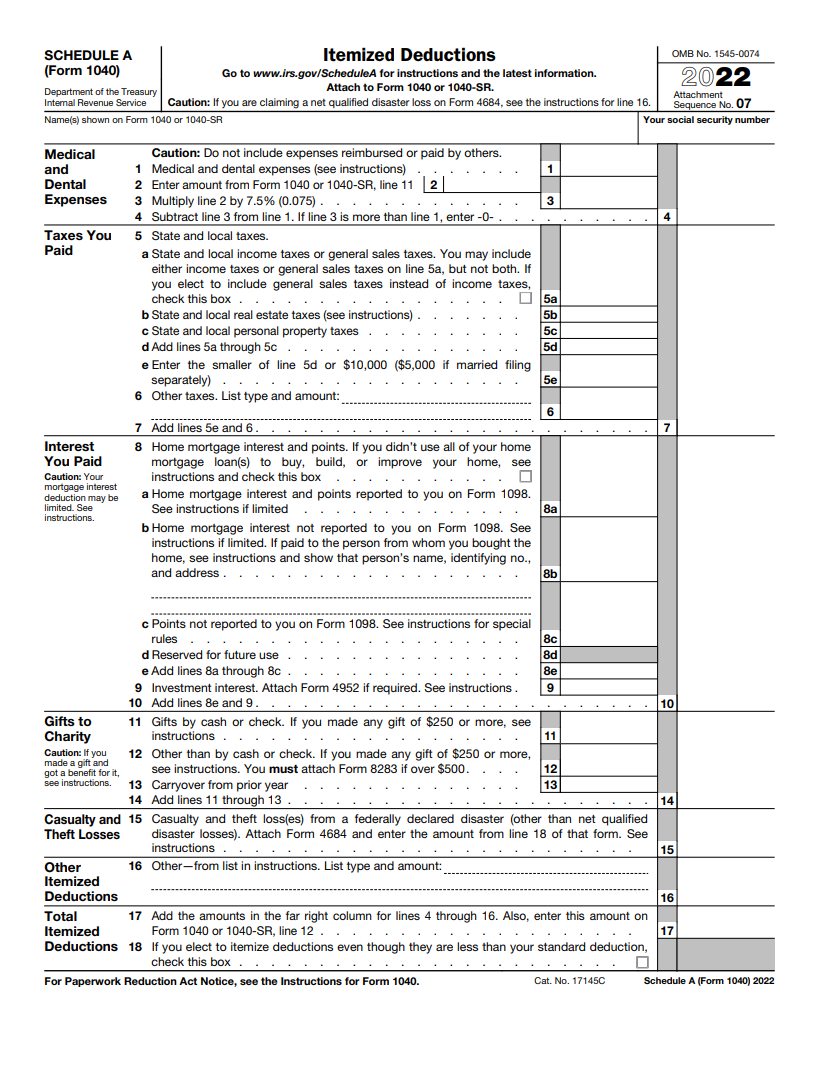

Schedule A (Form 1040) is used to report itemized deductions on your federal income tax return. Itemized deductions are expenses that you can deduct from your taxable income to reduce the amount of taxes you owe.

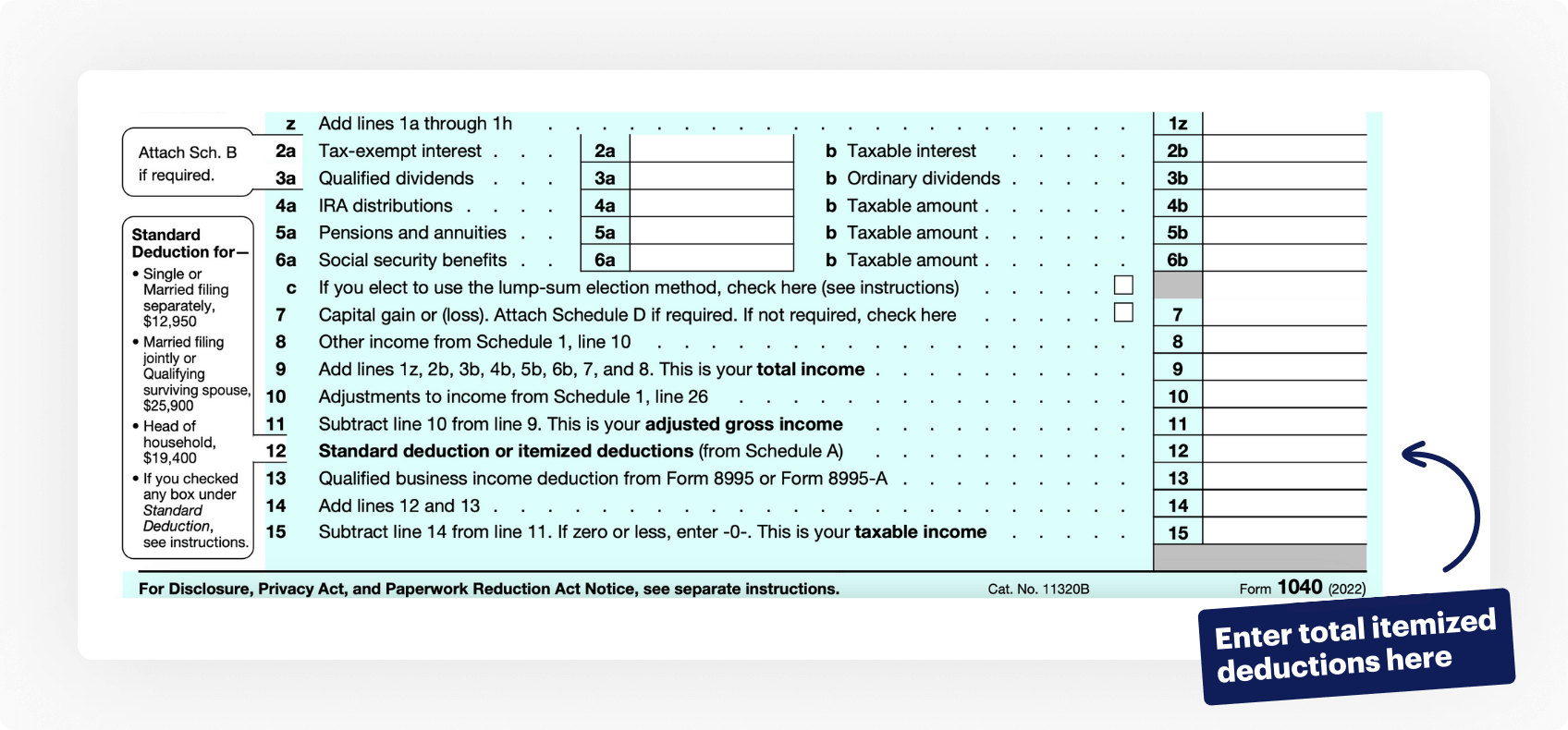

To itemize deductions, you must exceed the standard deduction amount. For 2025, the standard deduction amounts are:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

If your itemized deductions are greater than the standard deduction, you can claim them on Schedule A.

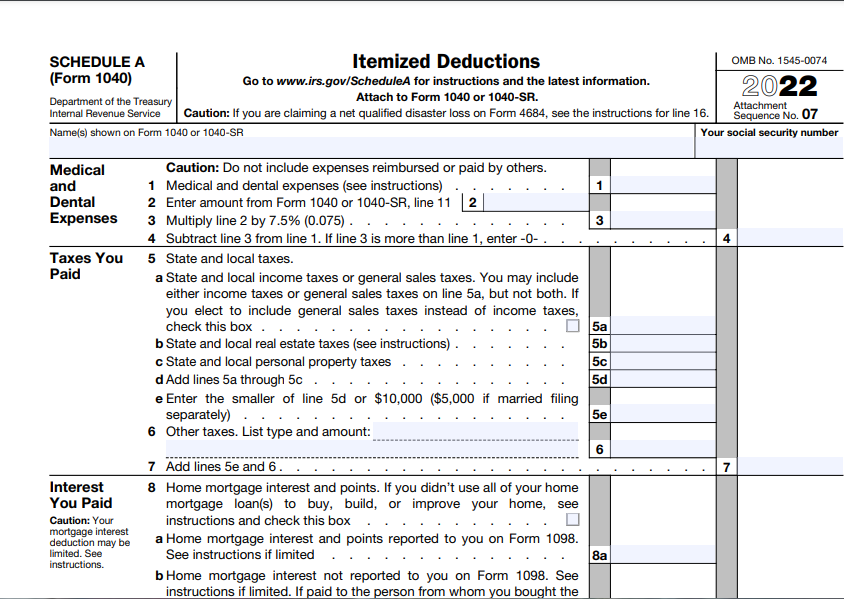

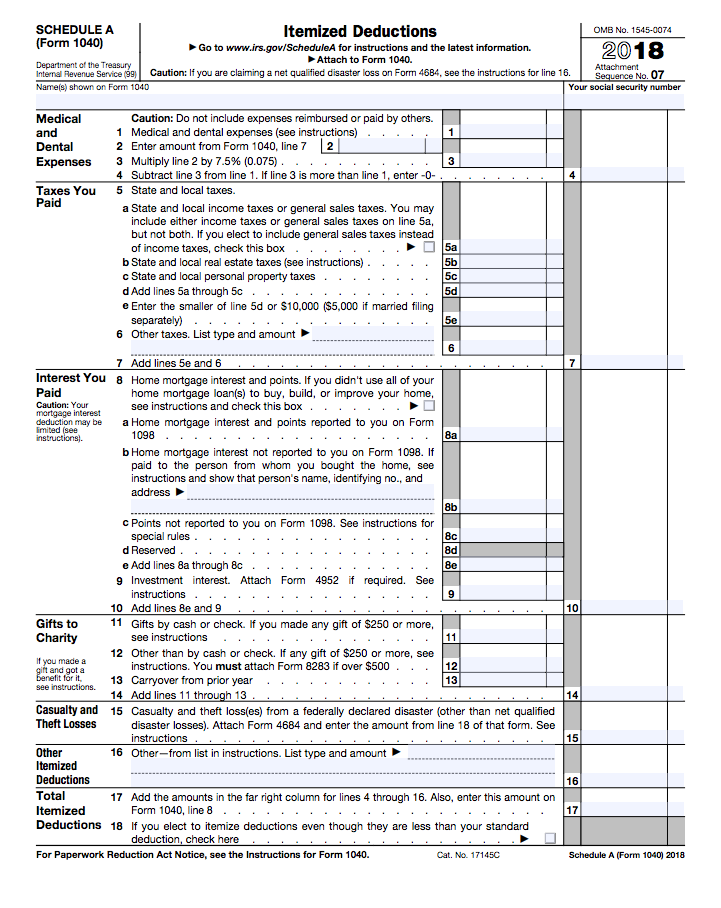

Eligible Itemized Deductions

The following expenses are eligible for itemized deductions:

- Medical and dental expenses: These expenses include amounts paid for doctor’s visits, hospital stays, prescription drugs, and dental care. You can deduct these expenses if they exceed 7.5% of your adjusted gross income (AGI).

- Taxes: You can deduct state and local income taxes, real estate taxes, and personal property taxes.

- Interest: You can deduct interest paid on a mortgage, home equity loan, or other qualified debt.

- Charitable contributions: You can deduct donations made to qualified charities.

- Casualty and theft losses: You can deduct losses from casualty events, such as hurricanes, floods, or fires, and from theft.

- Job expenses: You can deduct certain expenses related to your job, such as unreimbursed travel expenses and home office expenses.

- Other miscellaneous expenses: You can deduct certain other expenses, such as alimony payments, gambling losses, and certain legal fees.

How to Fill Out Schedule A

To fill out Schedule A, follow these steps:

- Gather your documentation. You will need to have documentation to support your itemized deductions, such as receipts, bills, and bank statements.

- Complete Part I: Medical and Dental Expenses. List your medical and dental expenses, and calculate the amount that exceeds 7.5% of your AGI.

- Complete Part II: Taxes You Paid. List your state and local income taxes, real estate taxes, and personal property taxes.

- Complete Part III: Interest You Paid. List your mortgage interest, home equity loan interest, and other qualified interest.

- Complete Part IV: Charitable Contributions. List your donations to qualified charities.

- Complete Part V: Casualty and Theft Losses. List any casualty or theft losses that you incurred.

- Complete Part VI: Job Expenses and Certain Miscellaneous Expenses. List any job expenses or other miscellaneous expenses that you incurred.

- Total your deductions. Add up the amounts from each part to get your total itemized deductions.

- Compare your deductions to the standard deduction. If your itemized deductions are greater than the standard deduction, you can claim them on your tax return.

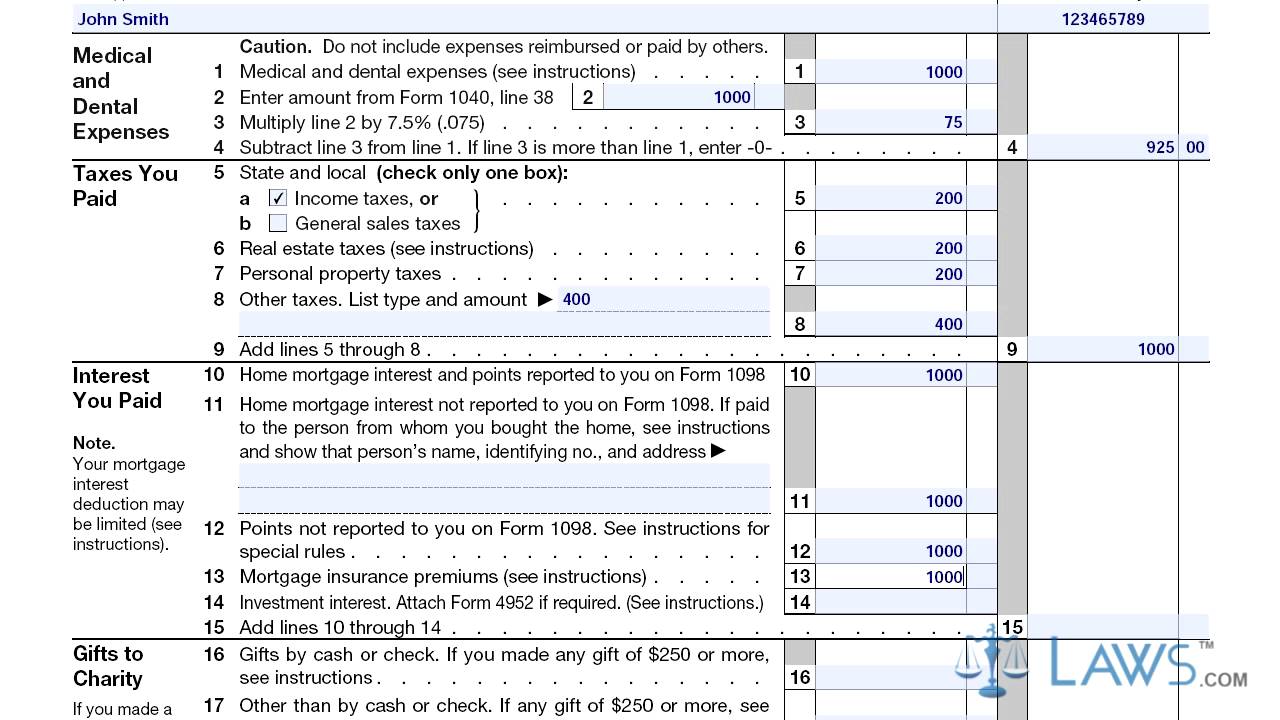

Example

Here is an example of how to fill out Schedule A:

- Medical and dental expenses: You paid $10,000 in medical expenses. Your AGI is $100,000. Your deductible medical expenses are $2,500 (10,000 – 7.5% of 100,000).

- Taxes: You paid $5,000 in state income taxes and $2,000 in real estate taxes.

- Interest: You paid $6,000 in mortgage interest.

- Charitable contributions: You donated $2,000 to a qualified charity.

- Job expenses: You incurred $1,000 in unreimbursed travel expenses.

Your total itemized deductions are $16,500 ($2,500 + $5,000 + $2,000 + $6,000 + $1,000). If the standard deduction for your filing status is $13,850, you would benefit from itemizing your deductions.

Additional Information

- You can use Form 8283 to claim certain itemized deductions that are subject to a phase-out based on your AGI.

- If you are audited by the IRS, you may be asked to provide documentation to support your itemized deductions.

- You can find more information about itemized deductions on the IRS website.

Closure

Thus, we hope this article has provided valuable insights into Schedule A (Form 1040): Itemized Deductions for 2025. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin