19, Apr 2024

Section 203(k) Financing: A Comprehensive Guide For Homebuyers

Section 203(k) Financing: A Comprehensive Guide for Homebuyers

Related Articles: Section 203(k) Financing: A Comprehensive Guide for Homebuyers

- Colors Of The 2025 Volvo XC30: A Symphony Of Sophistication And Style

- 2025 3rd Ave N, Birmingham, AL 35203: A Comprehensive Overview

- The Greatest Quarterback Prospects Of All Time: A Comprehensive Analysis

- When Will The Solar Storm Hit?

- 2025 E 71st St, Tulsa, OK 74136: A Luxurious Oasis In The Heart Of South Tulsa

Introduction

With great pleasure, we will explore the intriguing topic related to Section 203(k) Financing: A Comprehensive Guide for Homebuyers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Section 203(k) Financing: A Comprehensive Guide for Homebuyers

Section 203(k) Financing: A Comprehensive Guide for Homebuyers

Introduction

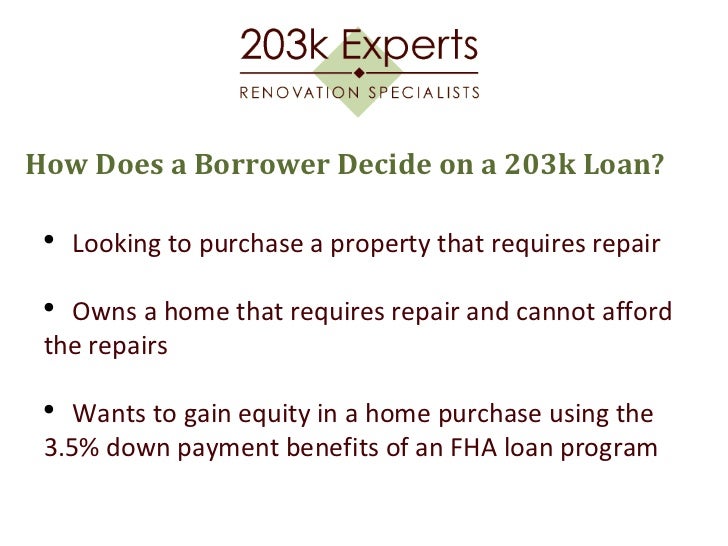

Purchasing a home is a significant financial endeavor that requires careful planning and consideration. For many prospective homeowners, obtaining affordable financing is a crucial aspect of the process. The Section 203(k) loan program, offered by the Federal Housing Administration (FHA), provides an innovative solution for homebuyers seeking to finance both the purchase and renovation of a property. This comprehensive guide delves into the intricacies of Section 203(k) financing, exploring its benefits, eligibility requirements, and the various types of renovations it covers.

Benefits of Section 203(k) Financing

- Combined financing: Section 203(k) loans allow homeowners to finance both the purchase of a property and the cost of necessary renovations into a single mortgage. This eliminates the need for separate financing and simplifies the borrowing process.

- Lower down payment: Compared to conventional loans, Section 203(k) loans typically require a lower down payment, making homeownership more accessible to individuals with limited savings.

- Flexible financing: The program offers two types of loans: the Standard 203(k) and the Limited 203(k). The Standard 203(k) covers major renovations, while the Limited 203(k) is designed for smaller repairs and upgrades.

- FHA insurance: Section 203(k) loans are backed by the FHA, which provides lenders with a level of security and encourages them to offer more favorable loan terms.

Eligibility Requirements

To qualify for Section 203(k) financing, borrowers must meet the following requirements:

- Credit score: A minimum credit score of 620 is typically required.

- Debt-to-income ratio: The borrower’s debt-to-income ratio, which measures the amount of monthly debt payments relative to income, should be below 43%.

- Property requirements: The property must be a single-family home or a two- to four-unit property that the borrower intends to occupy as their primary residence.

- Renovation plans: Detailed plans for the proposed renovations must be submitted to the lender for approval.

Types of Renovations Covered

Section 203(k) financing can cover a wide range of renovations, including:

- Structural repairs: This includes repairs to the foundation, roof, and load-bearing walls.

- Major systems upgrades: Upgrades to electrical, plumbing, and heating/cooling systems are eligible.

- Cosmetic improvements: Cosmetic renovations, such as kitchen and bathroom remodels, can also be included.

- Accessibility modifications: Renovations designed to improve accessibility for individuals with disabilities are covered.

Loan Process

The Section 203(k) loan process typically involves the following steps:

- Pre-approval: The borrower obtains pre-approval from a lender to determine their eligibility and loan amount.

- Property search: The borrower identifies a property that meets their needs and budget.

- Renovation plan development: The borrower develops a detailed plan for the proposed renovations, including estimated costs and timelines.

- Loan application: The borrower submits a loan application to the lender, along with the renovation plans.

- Loan approval: The lender reviews the loan application and renovation plans and approves the loan if all requirements are met.

- Closing: The loan is closed, and the borrower receives the funds for both the purchase and renovation costs.

- Renovation: The borrower hires a licensed contractor to complete the renovations according to the approved plans.

- Final inspection: Upon completion of the renovations, the lender conducts a final inspection to ensure the work meets the approved plans.

- Disbursement of funds: The remaining loan funds are disbursed to the contractor to cover the cost of the renovations.

Conclusion

Section 203(k) financing offers a comprehensive solution for homebuyers seeking to purchase and renovate a property. By combining financing for both the purchase and renovations, this program makes homeownership more accessible to individuals with limited savings. The flexible eligibility requirements and wide range of renovations covered make it a valuable option for those looking to create a home that meets their specific needs. By carefully considering the benefits, eligibility requirements, and loan process associated with Section 203(k) financing, prospective homeowners can make informed decisions and pursue their dream of homeownership.

:max_bytes(150000):strip_icc()/FHA203kloans-425c04160ace4051a9a31b731fe3e2ee.png)

Closure

Thus, we hope this article has provided valuable insights into Section 203(k) Financing: A Comprehensive Guide for Homebuyers. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin