16, Sep 2023

Should I Buy A House In 2024 Or 2025? A Comprehensive Analysis

Should I Buy a House in 2024 or 2025? A Comprehensive Analysis

Related Articles: Should I Buy a House in 2024 or 2025? A Comprehensive Analysis

- Africa Cup Of Nations U23 2025: A Comprehensive Overview

- 2025 Willingdon Avenue: A Contemporary Masterpiece In Burnaby’s Vibrant Heart

- Joby Stock Price Prediction 2025: A Comprehensive Analysis

- Xbox Games List 2025: A Comprehensive Guide To The Future Of Gaming

- Post-2025 Market Design: Innovations For A Dynamic And Sustainable Future

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Should I Buy a House in 2024 or 2025? A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Should I Buy a House in 2024 or 2025? A Comprehensive Analysis

Should I Buy a House in 2024 or 2025? A Comprehensive Analysis

The decision of whether to purchase a house is a significant one, and it’s crucial to consider all factors before making a choice. With the fluctuating housing market and economic uncertainty, many potential buyers are wondering whether 2024 or 2025 would be a more favorable time to enter the market. This article will delve into the key factors that will influence the housing market in these years, providing insights to help you make an informed decision.

Factors to Consider:

1. Economic Conditions:

The overall economic health of the country plays a pivotal role in shaping the housing market. Economic growth, interest rates, and unemployment levels are key indicators to monitor. If the economy is strong, it can lead to increased demand for housing, which could drive up prices. However, if the economy weakens, it can reduce demand and potentially lead to lower prices.

2. Interest Rates:

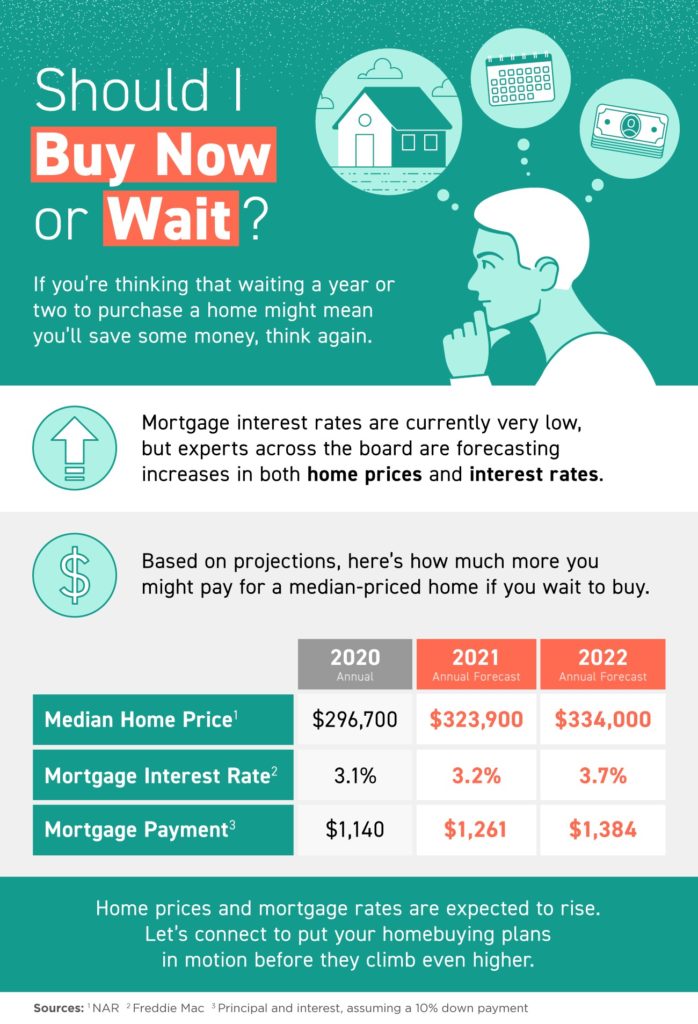

Interest rates have a significant impact on the cost of borrowing for a mortgage. Higher interest rates make it more expensive to purchase a house, while lower interest rates make it more affordable. The Federal Reserve’s monetary policy will influence interest rates in the coming years.

3. Housing Inventory:

The supply of available homes on the market affects prices. A low housing inventory can lead to bidding wars and higher prices, while a high inventory can create a buyer’s market with more negotiating power. The construction industry’s pace and the number of existing homes for sale will influence inventory levels.

4. Home Prices:

The median home price is a key indicator of the housing market’s health. If home prices are rising rapidly, it can make it more challenging for buyers to afford a home. However, if prices are relatively stable or declining, it can present a more favorable opportunity to purchase.

2024 Outlook:

Economic Conditions:

Economic forecasts predict moderate economic growth in 2024, with a gradual increase in GDP and employment. This positive economic outlook could stimulate demand for housing.

Interest Rates:

The Federal Reserve is expected to continue raising interest rates in 2024 to combat inflation. This could make it more expensive to finance a mortgage, potentially slowing down the housing market.

Housing Inventory:

Housing inventory is expected to remain relatively low in 2024 due to ongoing supply chain issues and labor shortages in the construction industry. This could lead to continued competition among buyers and potentially higher home prices.

Home Prices:

Home prices are projected to continue rising in 2024, albeit at a slower pace than in recent years. The combination of strong demand and limited supply is likely to keep upward pressure on prices.

2025 Outlook:

Economic Conditions:

Economic growth is expected to moderate further in 2025, with potential for a slight slowdown. This could reduce demand for housing and potentially stabilize home prices.

Interest Rates:

The Federal Reserve may begin to lower interest rates in 2025 to support economic growth. This could make it more affordable to purchase a home, increasing demand.

Housing Inventory:

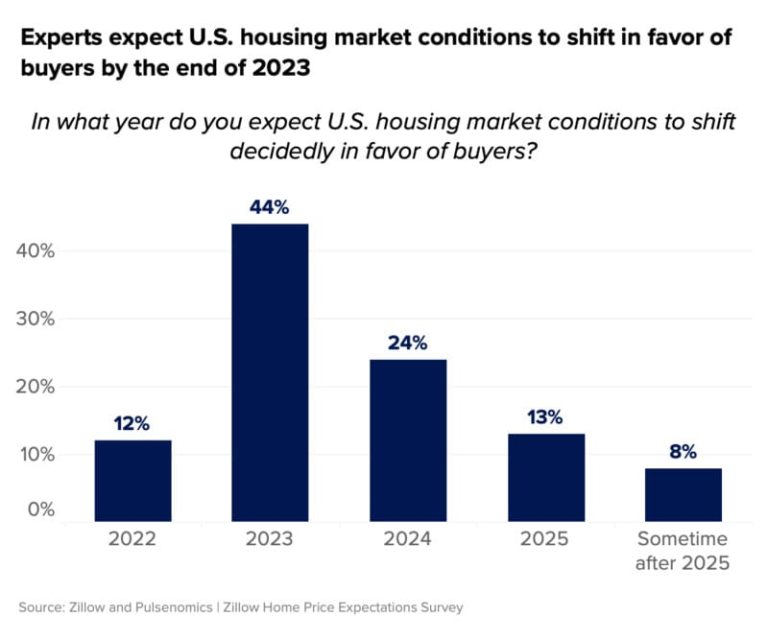

Housing inventory is projected to gradually increase in 2025 as construction activity picks up. This could ease the supply constraints and potentially lead to more favorable conditions for buyers.

Home Prices:

Home prices are expected to remain elevated in 2025 but may start to stabilize or even decline slightly as demand moderates and inventory improves.

Conclusion:

Deciding whether to buy a house in 2024 or 2025 depends on your individual circumstances and financial situation. If you can afford to purchase a home in 2024, you may benefit from lower interest rates and a potentially more competitive market. However, if you’re not in a rush and can wait until 2025, you may encounter more favorable conditions with lower home prices and potentially more housing inventory.

It’s important to note that the housing market is cyclical, and it’s impossible to predict with certainty what will happen in the future. However, by considering the factors outlined in this article, you can make an informed decision that aligns with your financial goals and time frame. Consulting with a real estate agent and financial advisor can also provide valuable insights and help you navigate the homebuying process.

Closure

Thus, we hope this article has provided valuable insights into Should I Buy a House in 2024 or 2025? A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!

- 0

- By admin