27, Feb 2024

Square Stock Price Forecast 2025: An In-Depth Analysis

Square Stock Price Forecast 2025: An In-Depth Analysis

Related Articles: Square Stock Price Forecast 2025: An In-Depth Analysis

- 2025 Yearly Calendar With Holidays

- Flag Day: A Symbol Of National Pride And Unity

- Morocco To Host 2025 Africa Cup Of Nations

- Disney World Crowd Calendar 2025: A Comprehensive Guide To Planning Your Visit

- 2025 UK Election Prediction: A Comprehensive Analysis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Square Stock Price Forecast 2025: An In-Depth Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Square Stock Price Forecast 2025: An In-Depth Analysis

Square Stock Price Forecast 2025: An In-Depth Analysis

Introduction

Square, Inc. (SQ) has emerged as a fintech giant, revolutionizing the payment processing industry with its innovative solutions. Its stock price has witnessed remarkable growth in recent years, driven by the company’s strong financial performance and expansion into new markets. As we look towards 2025, analysts and investors are eagerly anticipating the future trajectory of Square’s stock price. This article presents a comprehensive analysis of the factors that will shape Square’s stock price in the years to come, providing insights into its potential growth trajectory.

Historical Performance

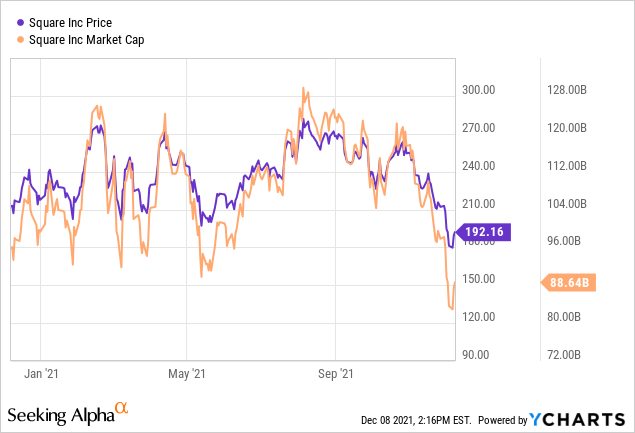

Square’s stock price has exhibited a remarkable upward trend since its initial public offering (IPO) in 2015. The company’s revenue has grown exponentially, primarily driven by the adoption of its payment processing solutions by small businesses and consumers. In 2021, Square’s revenue reached $17.7 billion, a significant increase from $10.6 billion in 2020.

The company’s gross profit margin has also improved steadily, indicating its ability to generate higher profits from its operations. In 2021, Square’s gross profit margin stood at 46%, compared to 41% in 2020. This growth has been attributed to the company’s focus on higher-margin products and services, such as its Cash App and business lending solutions.

Market Dynamics

The fintech industry is experiencing rapid growth and transformation, driven by technological advancements and changing consumer preferences. Square is well-positioned to capitalize on these trends, given its strong brand recognition and innovative product offerings.

1. Growth in Digital Payments:

The shift towards digital payments is accelerating globally, creating a significant opportunity for Square. The company’s payment processing solutions are designed to meet the needs of small businesses and consumers, enabling them to accept payments securely and efficiently. As the adoption of digital payments continues to grow, Square is expected to benefit from increased transaction volume and revenue.

2. Expansion of Cash App:

Square’s Cash App has emerged as a popular peer-to-peer payment and financial services platform. The app allows users to send and receive money, invest in stocks and cryptocurrencies, and manage their finances. Cash App has experienced rapid growth in recent years, and its continued expansion is expected to contribute to Square’s overall revenue growth.

3. Business Lending:

Square has entered the business lending market through its Square Capital platform. The platform provides small businesses with access to capital, enabling them to grow and expand their operations. Business lending is a high-margin business, and Square’s expansion in this area could further boost its profitability.

Company Strategy

Square’s management team has outlined a clear strategy for continued growth and innovation. The company plans to:

1. Enhance Payment Processing Solutions:

Square will continue to invest in its payment processing platform, introducing new features and improving its efficiency. The company is also focused on expanding its reach into new markets and industries.

2. Grow Cash App:

Cash App will remain a key focus area for Square. The company plans to introduce new features, such as bill pay and insurance, to increase its utility and attract more users.

3. Expand Business Lending:

Square will continue to expand its business lending offerings, providing small businesses with access to capital and financial support. The company believes that business lending can be a significant growth driver in the years to come.

Financial Projections

Analysts have provided a range of financial projections for Square in the years leading up to 2025. According to consensus estimates, Square’s revenue is expected to reach $34.5 billion in 2025, representing a compound annual growth rate (CAGR) of 15.6%. The company’s gross profit margin is projected to improve to 48%, driven by the growth of higher-margin products and services.

Stock Price Forecast

Based on the financial projections and market dynamics discussed above, analysts have provided stock price forecasts for Square in 2025. The average analyst price target for Square in 2025 is $150, with a range of estimates between $130 and $180. This implies a potential upside of 30-50% from the current stock price.

Factors to Consider

While the stock price forecast for Square appears promising, investors should consider the following factors that could impact its performance:

1. Competition:

Square faces competition from other fintech companies, including PayPal, Stripe, and Klarna. The intensity of competition could limit Square’s growth potential and put pressure on its margins.

2. Regulatory Environment:

The fintech industry is subject to regulatory oversight, which can impact Square’s operations and profitability. Changes in regulations could affect the company’s ability to offer certain products and services.

3. Economic Conditions:

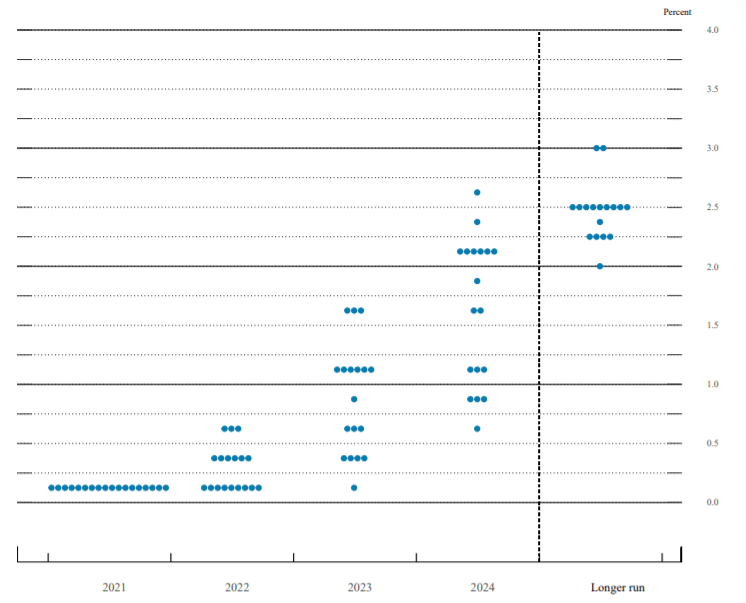

Economic conditions, such as interest rates and economic growth, can impact Square’s business. A slowdown in economic activity could reduce the demand for Square’s payment processing and lending solutions.

Conclusion

Square is well-positioned to continue its growth trajectory in the years to come. The company’s strong brand recognition, innovative product offerings, and expansion into new markets make it a compelling investment opportunity. While the stock price forecast for 2025 is subject to various factors, the overall outlook for Square remains positive. Investors should carefully consider the company’s financial performance, market dynamics, and competitive landscape before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Square Stock Price Forecast 2025: An In-Depth Analysis. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin