3, Jan 2024

Standard Deductions For Married Couples Over 65 In 2025

Standard Deductions for Married Couples Over 65 in 2025

Related Articles: Standard Deductions for Married Couples Over 65 in 2025

- 2025 Forester Price: A Comprehensive Guide

- 2025 Federal Government Pay Period Calendar

- TV Show Revivals: A Nostalgic Embrace Of The Past

- On This Day: 2025

- Olympic Medal Count 2026: A Comprehensive Analysis

Introduction

With great pleasure, we will explore the intriguing topic related to Standard Deductions for Married Couples Over 65 in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Deductions for Married Couples Over 65 in 2025

Standard Deductions for Married Couples Over 65 in 2025

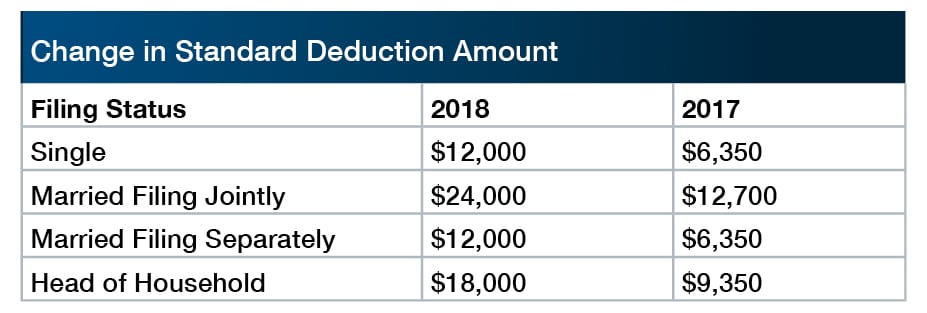

The standard deduction is a specific amount that you can deduct from your taxable income before calculating your taxes. It is a dollar-for-dollar reduction, meaning that it directly reduces the amount of income that is subject to taxation. The standard deduction varies depending on your filing status and age.

For married couples filing jointly, the standard deduction for 2025 is $27,700 if one spouse is over 65, and $30,800 if both spouses are over 65. This is an increase from the standard deduction of $26,900 for married couples filing jointly in 2024.

The standard deduction is a valuable tax break, especially for those with lower incomes. It can reduce your taxable income by a significant amount, which can result in lower taxes owed.

Who Qualifies for the Increased Standard Deduction?

To qualify for the increased standard deduction for married couples over 65, you must meet the following requirements:

- You must be married and filing a joint tax return.

- You or your spouse must be age 65 or older by the end of the tax year.

How to Claim the Standard Deduction

You can claim the standard deduction on your tax return by checking the box labeled "Standard Deduction" on Form 1040. You do not need to itemize your deductions to claim the standard deduction.

Itemizing Deductions vs. Taking the Standard Deduction

If you have a lot of deductible expenses, you may be able to reduce your taxable income even further by itemizing your deductions. However, itemizing deductions is only beneficial if your total itemized deductions exceed the standard deduction.

To determine if you should itemize your deductions, you can compare your potential itemized deductions to the standard deduction for your filing status. If your itemized deductions are greater than the standard deduction, then you should itemize your deductions. Otherwise, you should take the standard deduction.

Conclusion

The standard deduction is a valuable tax break that can reduce your taxable income and lower your taxes owed. For married couples over 65, the standard deduction is even higher, providing even greater tax savings. If you are married and over 65, be sure to claim the increased standard deduction on your tax return.

Additional Information

- The standard deduction is indexed for inflation each year. This means that the standard deduction will increase over time to keep pace with the rising cost of living.

- You can only claim the standard deduction once per tax return. This means that if you are married and filing a joint tax return, you cannot claim the standard deduction for yourself and your spouse separately.

- The standard deduction is phased out for high-income taxpayers. This means that the standard deduction is reduced by a certain amount for taxpayers with incomes above a certain threshold.

Closure

Thus, we hope this article has provided valuable insights into Standard Deductions for Married Couples Over 65 in 2025. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin