20, Aug 2023

The TSP L 2025 Fund: A Retirement Savings Powerhouse For Federal Employees

The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees

Related Articles: The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees

- Earth Defense Force 2025: A Comprehensive Guide To Achievements

- Footwear Design Forecast: Summer 2025

- Lovely Inu Coin Price Prediction 2025: A Comprehensive Analysis

- Canada Federal Election 2025: A Battle For The Future

- When Will The Solar Storm Hit?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees

The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees

The Thrift Savings Plan (TSP) is a retirement savings and investment program available to federal employees and members of the uniformed services. Among its various investment options, the L 2025 Fund stands out as a compelling choice for those nearing retirement in 2025 or beyond.

Investment Strategy

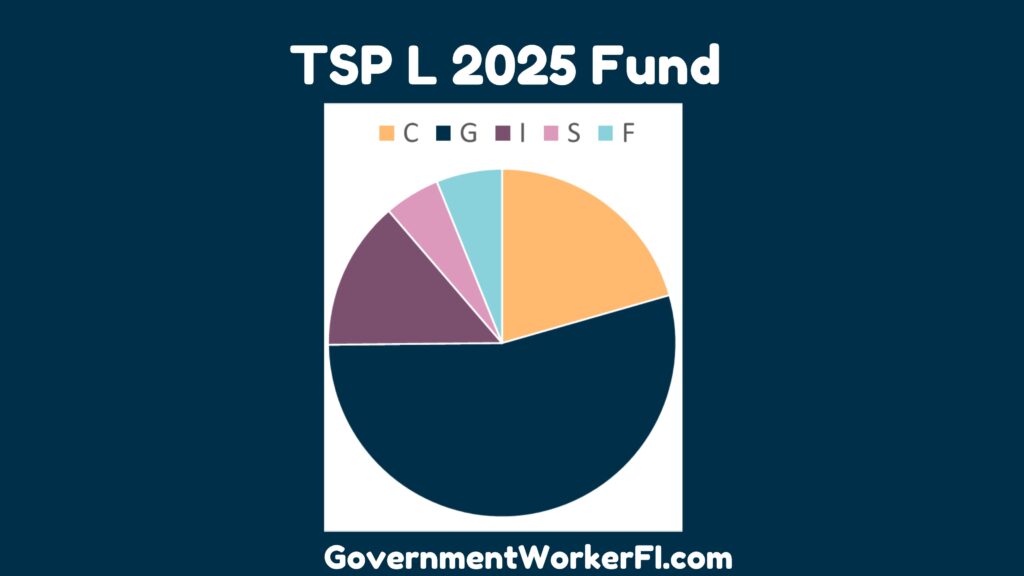

The TSP L 2025 Fund is a lifecycle fund designed to provide a balanced portfolio of stocks and bonds that gradually shifts towards more conservative investments as the target retirement date approaches. The fund’s asset allocation is as follows:

- Stocks (80%): Primarily consists of large-cap U.S. stocks, with a focus on growth companies.

- Bonds (20%): Comprises a blend of U.S. Treasury bonds, corporate bonds, and international bonds.

Target Retirement Date

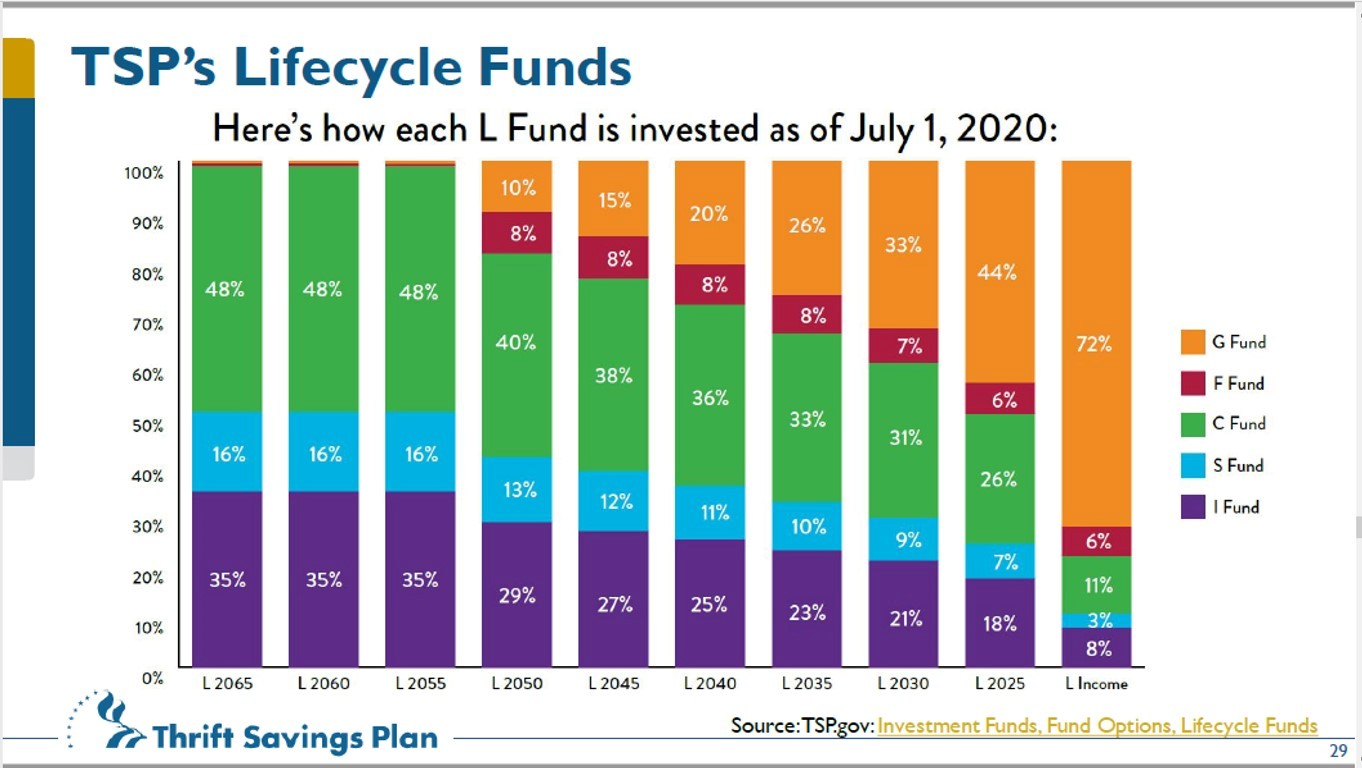

The L 2025 Fund is specifically designed for individuals who plan to retire in or around 2025. As the target retirement date approaches, the fund’s asset allocation becomes more conservative, reducing the exposure to stocks and increasing the allocation to bonds. This gradual shift is intended to preserve capital and reduce volatility as investors near retirement.

Benefits of the L 2025 Fund

- Automatic Asset Allocation: The fund’s asset allocation is managed by the TSP, eliminating the need for investors to make investment decisions.

- Diversification: The fund provides a well-diversified portfolio across asset classes and sectors, reducing investment risk.

- Target Retirement Focus: The fund’s asset allocation is tailored to the specific retirement needs of individuals nearing retirement in 2025.

- Professional Management: The TSP is managed by a board of trustees and investment professionals, ensuring prudent oversight of the fund’s investments.

- Low Fees: The TSP offers some of the lowest investment fees in the industry, maximizing returns for participants.

Suitability for Investors

The L 2025 Fund is generally suitable for federal employees and members of the uniformed services who:

- Are within 10-15 years of retirement.

- Are comfortable with a moderate level of investment risk.

- Seek a balanced portfolio with exposure to both stocks and bonds.

- Do not have the time or expertise to manage their own investments.

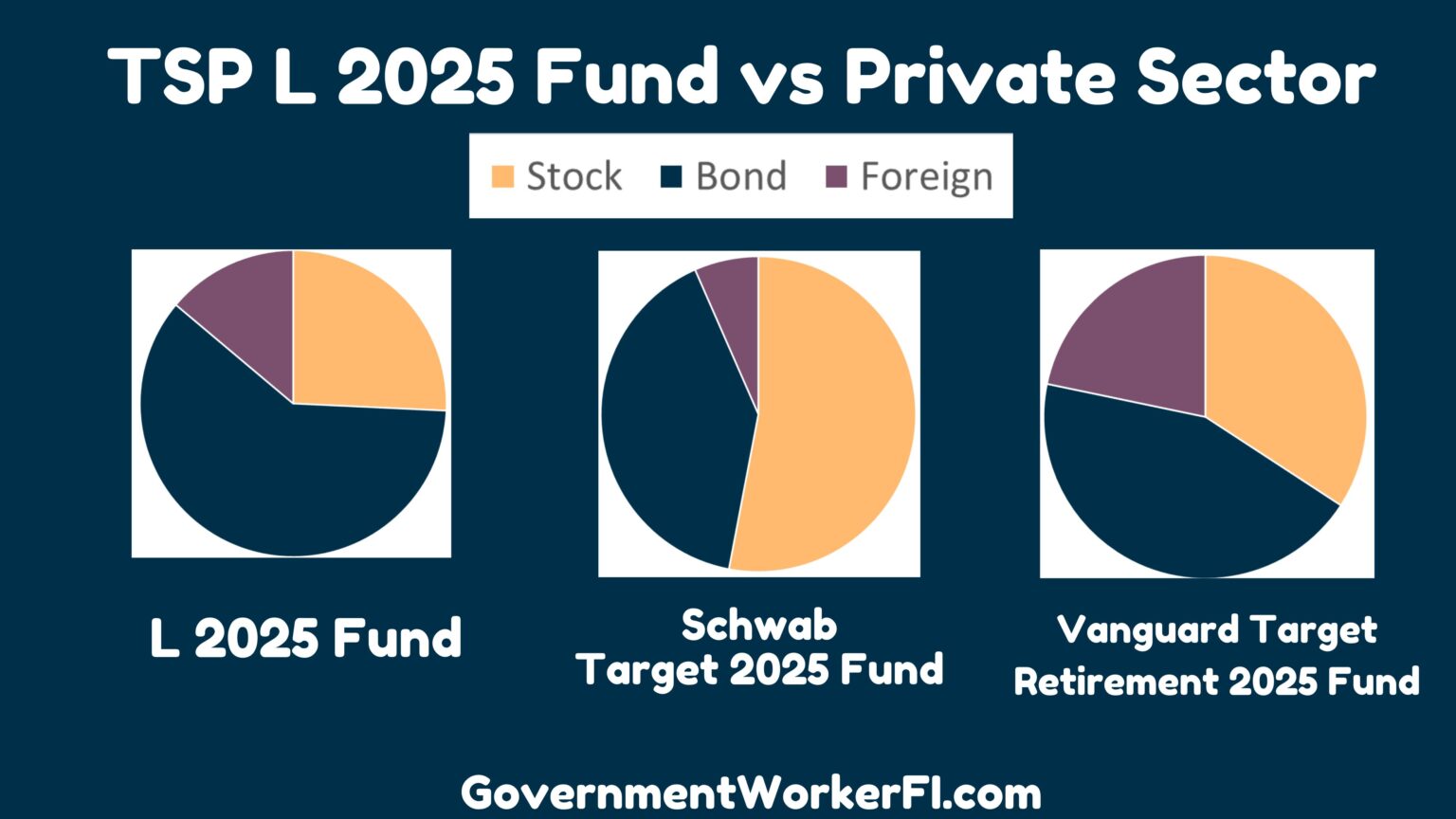

Comparison to Other TSP Funds

The L 2025 Fund differs from other TSP lifecycle funds in the following ways:

- Target Retirement Date: The L 2025 Fund has a specific target retirement date of 2025, while other lifecycle funds have different target retirement dates.

- Asset Allocation: The L 2025 Fund has a more conservative asset allocation than lifecycle funds with earlier target retirement dates.

- Investment Mix: The L 2025 Fund invests primarily in U.S. stocks and bonds, while other lifecycle funds may include international investments.

Conclusion

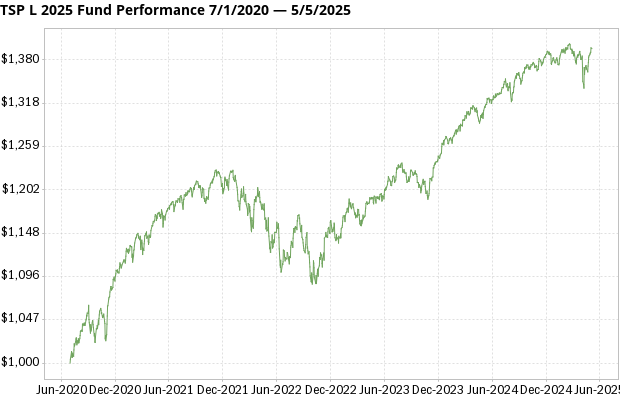

The TSP L 2025 Fund is an excellent choice for federal employees and members of the uniformed services who are nearing retirement in or around 2025. Its balanced portfolio, automatic asset allocation, and low fees provide a convenient and cost-effective way to save for retirement. By investing in the L 2025 Fund, investors can benefit from a professional investment strategy that aligns with their retirement goals.

Closure

Thus, we hope this article has provided valuable insights into The TSP L 2025 Fund: A Retirement Savings Powerhouse for Federal Employees. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin