22, Nov 2023

TSP Lifecycle 2025 Fund: A Comprehensive Overview

TSP Lifecycle 2025 Fund: A Comprehensive Overview

Related Articles: TSP Lifecycle 2025 Fund: A Comprehensive Overview

- 20253 Leif Ln, Hayward, CA 94541: A Haven Of Tranquility And Modernity

- 2025 Orlando Holidays: A Comprehensive Guide To The Ultimate Vacation Destination

- 2025 BMW M3 With LCI: A Comprehensive Overview

- Monster Jam World Finals 2025: A Thrill-Packed Extravaganza In The Heart Of Las Vegas

- National Strategic Plan For Tuberculosis (TB) 2017-2025

Introduction

With great pleasure, we will explore the intriguing topic related to TSP Lifecycle 2025 Fund: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about TSP Lifecycle 2025 Fund: A Comprehensive Overview

TSP Lifecycle 2025 Fund: A Comprehensive Overview

Introduction

The Thrift Savings Plan (TSP) is a retirement savings and investment program for federal employees and members of the uniformed services. The TSP offers a variety of investment funds, including the Lifecycle 2025 Fund. This fund is designed to provide a target-date retirement investment option for participants who plan to retire in or around the year 2025.

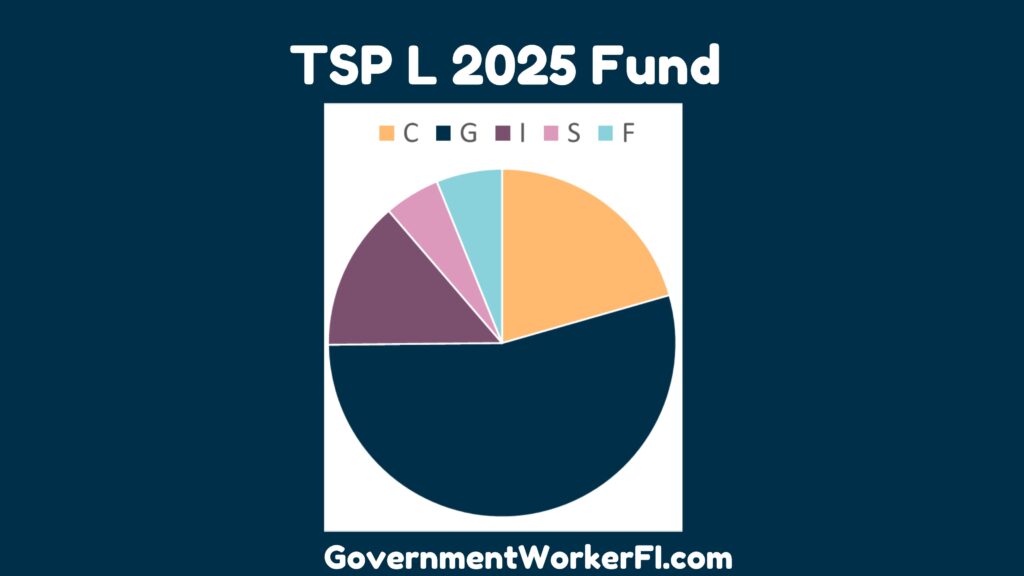

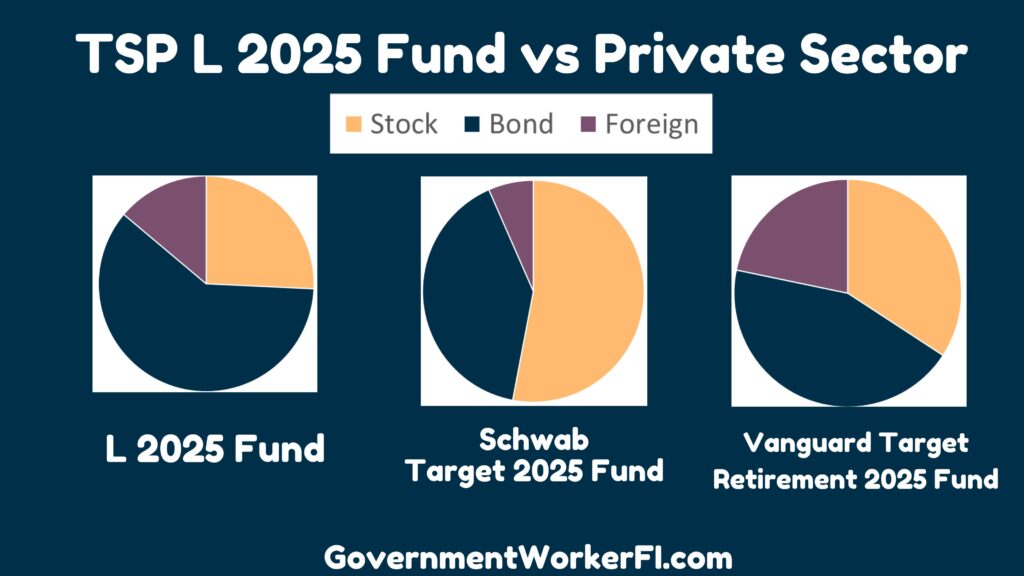

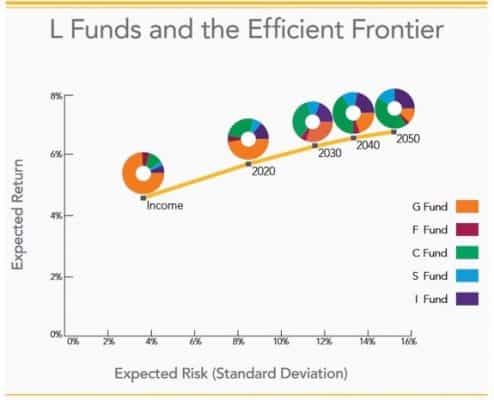

Investment Strategy

The TSP Lifecycle 2025 Fund is a professionally managed fund that invests in a mix of domestic and international stocks, bonds, and other assets. The fund’s asset allocation is designed to provide a balance of growth potential and risk management. As participants approach their target retirement date, the fund’s asset allocation gradually shifts from more aggressive investments, such as stocks, to more conservative investments, such as bonds.

Target Retirement Date

The TSP Lifecycle 2025 Fund is designed for participants who plan to retire in or around the year 2025. However, participants can choose to invest in this fund regardless of their actual retirement date. The fund’s asset allocation will automatically adjust as participants approach their target retirement date.

Risk and Return

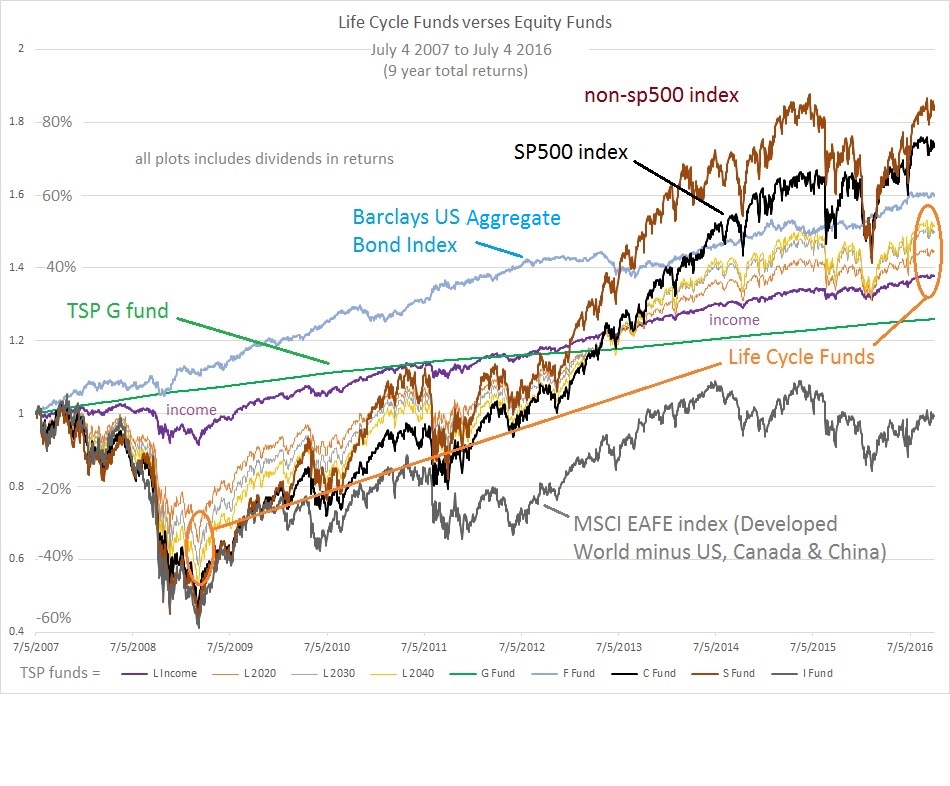

The TSP Lifecycle 2025 Fund is a moderately aggressive investment option. As such, it has the potential to generate higher returns than more conservative investment options, but it also carries more risk. The fund’s historical returns have varied, but it has generally performed well over the long term.

Fees

The TSP Lifecycle 2025 Fund has an expense ratio of 0.049%, which is very low compared to other similar investment funds. This means that participants can keep more of their investment earnings.

Eligibility

The TSP Lifecycle 2025 Fund is available to all TSP participants, including federal employees, members of the uniformed services, and former participants who have rolled over their TSP accounts to an IRA.

How to Invest

Participants can invest in the TSP Lifecycle 2025 Fund through their TSP account. Participants can choose to invest a specific dollar amount or a percentage of their contributions. Participants can also choose to have their contributions automatically invested in the fund.

Benefits of Investing in the TSP Lifecycle 2025 Fund

There are several benefits to investing in the TSP Lifecycle 2025 Fund, including:

- Professional management: The fund is professionally managed by a team of investment experts.

- Target-date retirement: The fund’s asset allocation is designed to provide a target-date retirement investment option.

- Low fees: The fund has an expense ratio of 0.049%, which is very low compared to other similar investment funds.

- Convenience: Participants can invest in the fund through their TSP account.

Risks of Investing in the TSP Lifecycle 2025 Fund

There are also some risks associated with investing in the TSP Lifecycle 2025 Fund, including:

- Investment risk: The fund is invested in a mix of stocks, bonds, and other assets, which means that it is subject to market risk.

- Target retirement date risk: The fund’s asset allocation is designed to provide a target-date retirement investment option. However, if participants retire before or after their target retirement date, the fund’s asset allocation may not be appropriate for their needs.

- Inflation risk: The fund’s investments are subject to inflation risk, which means that the value of the fund’s investments may decrease over time due to inflation.

Conclusion

The TSP Lifecycle 2025 Fund is a target-date retirement investment option that is designed for participants who plan to retire in or around the year 2025. The fund offers a professionally managed investment strategy with a low expense ratio. However, it is important to understand the risks associated with investing in the fund before making an investment decision.

Closure

Thus, we hope this article has provided valuable insights into TSP Lifecycle 2025 Fund: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin