31, Mar 2024

What Will Happen To House Prices In 2025: A Comprehensive Analysis

What Will Happen to House Prices in 2025: A Comprehensive Analysis

Related Articles: What Will Happen to House Prices in 2025: A Comprehensive Analysis

- Where Is The 2026 NFL Draft? A Comprehensive Analysis Of Potential Host Cities

- How To Sync Phone And Computer Calendar: A Comprehensive Guide

- Astoria, New York: A Vibrant Melting Pot With A Rich Tapestry Of Cultures

- Lee County School Calendar 2024-2025: A Comprehensive Guide

- NEAR Price Prediction 2025: A Comprehensive Analysis

Introduction

With great pleasure, we will explore the intriguing topic related to What Will Happen to House Prices in 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about What Will Happen to House Prices in 2025: A Comprehensive Analysis

What Will Happen to House Prices in 2025: A Comprehensive Analysis

The real estate market is a complex and ever-changing landscape, making it challenging to predict future trends with certainty. However, by analyzing current market conditions, economic indicators, and expert forecasts, we can gain insights into what may happen to house prices in 2025.

Current Market Conditions

The current real estate market is characterized by:

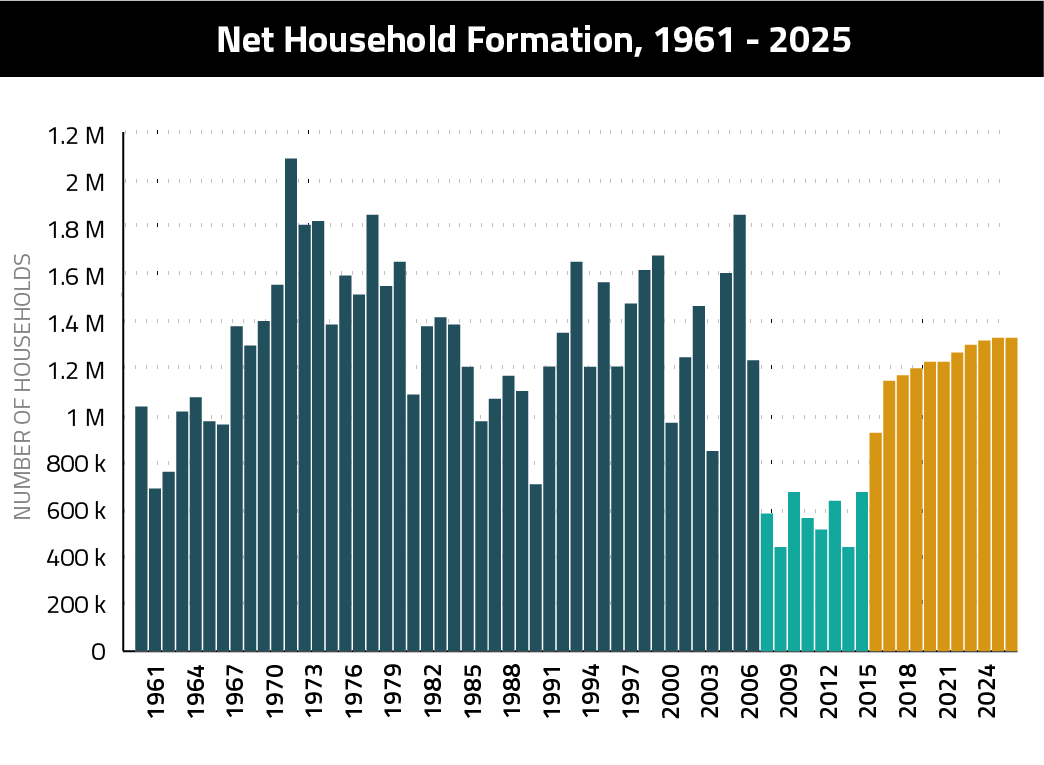

- High demand: Low interest rates, a growing population, and a shortage of available homes have fueled strong demand for housing.

- Low supply: Construction has not kept pace with demand, leading to a limited inventory of homes for sale.

- Rising prices: The imbalance between supply and demand has pushed prices higher, with many markets experiencing double-digit growth.

Economic Indicators

Economic indicators that can influence house prices include:

- Interest rates: Low interest rates make it cheaper to borrow money for a mortgage, boosting affordability and stimulating demand.

- Inflation: Rising inflation can erode the purchasing power of buyers, making it harder for them to afford homes.

- Economic growth: A strong economy leads to increased job creation and higher incomes, which can support housing demand.

Expert Forecasts

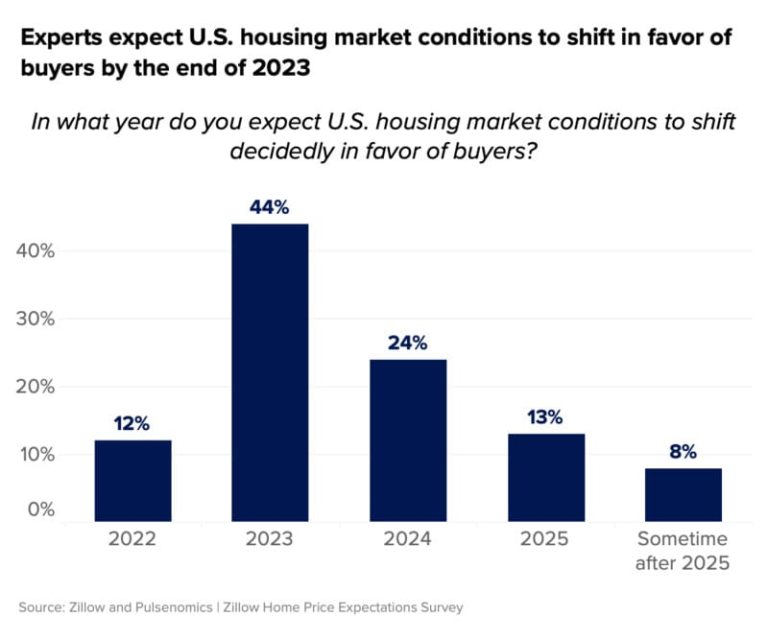

Industry experts have varying opinions on the future of house prices. Some predict continued growth, while others anticipate a slowdown or even a correction. Here are some notable forecasts:

- National Association of Realtors (NAR): The NAR forecasts a 5.7% increase in home prices in 2025.

- CoreLogic: CoreLogic predicts a 5.4% increase in home prices over the next five years.

- Fannie Mae: Fannie Mae forecasts a 3.5% increase in home prices in 2025.

Factors Influencing Future Prices

Several factors will likely influence house prices in 2025:

- Interest rate environment: The Federal Reserve is expected to raise interest rates gradually over the next few years, which could cool demand and slow price growth.

- Supply and demand dynamics: The shortage of available homes is likely to persist, supporting prices. However, new construction may gradually increase supply, easing upward pressure.

- Economic conditions: A strong economy with low unemployment and rising wages can boost housing demand and support prices. Conversely, an economic downturn could reduce demand and lead to a price correction.

- Government policies: Government policies, such as tax incentives and affordable housing programs, can impact housing affordability and demand.

Regional Variations

House price trends can vary significantly by region. Factors such as job growth, population demographics, and local economic conditions can influence local market dynamics. For example, markets with strong job growth and a high influx of new residents may experience higher price growth than areas with slower economic growth.

Potential Scenarios

Based on the current market conditions, economic indicators, and expert forecasts, several potential scenarios could unfold for house prices in 2025:

- Continued growth: If the economy remains strong and interest rates stay low, house prices could continue to rise at a moderate pace.

- Slowdown: If interest rates rise faster than expected or the economy weakens, price growth could slow down.

- Correction: In a worst-case scenario, a significant economic downturn could lead to a correction in house prices, resulting in a decline in values.

Implications for Buyers and Sellers

The potential scenarios outlined above have implications for both buyers and sellers in the housing market.

- Buyers: If house prices continue to rise, buyers may need to adjust their budgets or consider purchasing in a less competitive market. If prices slow down or correct, buyers may have more negotiating power and find more affordable options.

- Sellers: In a continued growth scenario, sellers may be able to command higher prices for their homes. However, in a slowdown or correction, they may need to be more realistic about their asking prices and be prepared to negotiate.

Conclusion

Predicting the future of house prices is not an exact science, but by considering current market conditions, economic indicators, and expert forecasts, we can gain valuable insights into potential trends. While continued growth is a possibility, a slowdown or even a correction cannot be ruled out. Buyers and sellers should carefully consider the potential scenarios and make informed decisions based on their individual circumstances and financial goals.

Closure

Thus, we hope this article has provided valuable insights into What Will Happen to House Prices in 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin