1, Mar 2024

When Does IRMAA Kick In For 2025: A Comprehensive Guide

When Does IRMAA Kick In for 2025: A Comprehensive Guide

Related Articles: When Does IRMAA Kick In for 2025: A Comprehensive Guide

- Rundisney Events 2025: A Magical Marathon Extravaganza

- UEFA Champions League Final 2025: A Clash Of Titans

- Xbox Games List 2025: A Comprehensive Guide To The Future Of Gaming

- Teacher Education 2025: Reimagining The Profession For The Future

- Advantages And Disadvantages Of Internal Combustion Engines

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to When Does IRMAA Kick In for 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about When Does IRMAA Kick In for 2025: A Comprehensive Guide

When Does IRMAA Kick In for 2025: A Comprehensive Guide

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge imposed on high-income Medicare Part B and Part D beneficiaries. It was introduced in 2007 as part of the Medicare Improvements for Patients and Providers Act (MIPPA) to help fund the Medicare program. IRMAA is adjusted annually based on changes in the cost of living.

Who is Subject to IRMAA?

IRMAA applies to individuals who are enrolled in Medicare Part B (medical insurance) and/or Part D (prescription drug coverage) and whose income exceeds certain thresholds. The income thresholds are based on the individual’s modified adjusted gross income (MAGI) from two years prior.

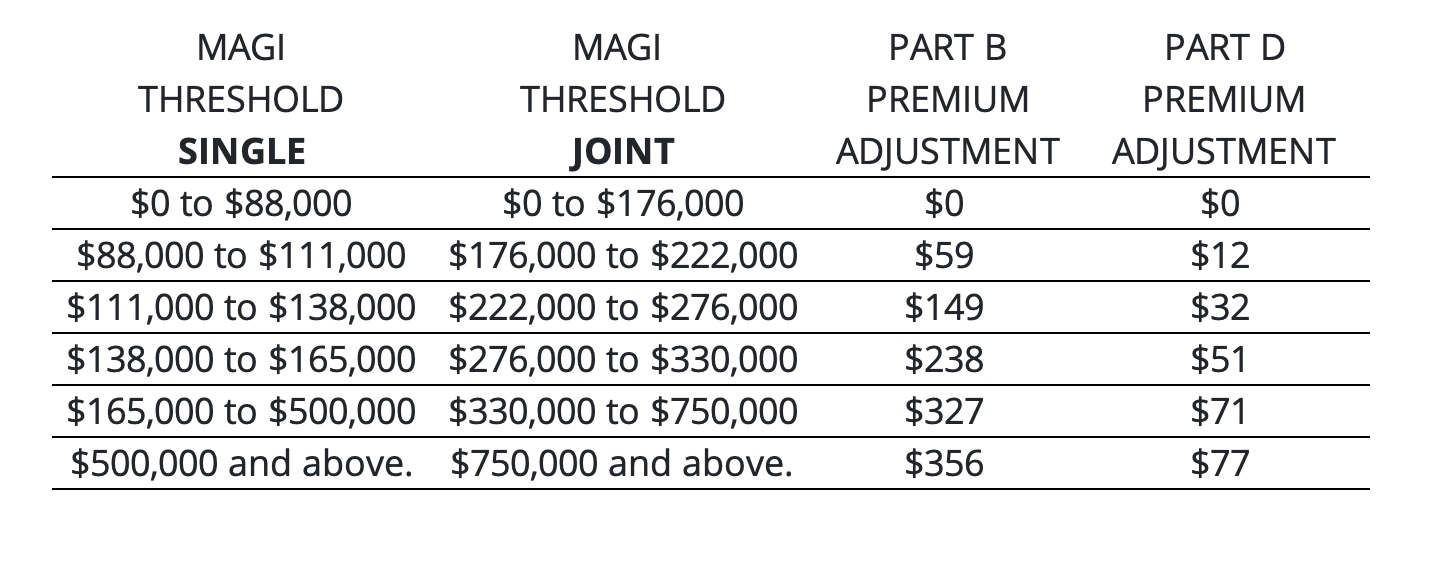

IRMAA Income Thresholds for 2025

The IRMAA income thresholds for 2025, which are based on 2023 MAGI, are as follows:

| Filing Status | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| Part B | $97,000 | $194,000 | $127,000 | $145,000 |

| Part D | $88,000 | $176,000 | $116,000 | $134,000 |

When Does IRMAA Kick In?

IRMAA kicks in for individuals who exceed the income thresholds for the year in which they are enrolled in Medicare Part B and/or Part D. For example, if an individual exceeds the income threshold for 2025 in 2023, they will be subject to IRMAA when they enroll in Medicare Part B and/or Part D in 2025.

IRMAA Surcharge Amounts for 2025

The IRMAA surcharge amounts for 2025 are as follows:

| Income Range | Part B Surcharge | Part D Surcharge |

|---|---|---|

| $97,000 – $128,400 | $121.80 | $33.70 |

| $128,401 – $160,200 | $162.90 | $44.60 |

| $160,201 – $194,000 | $218.10 | $58.40 |

| $194,001 – $228,400 | $273.30 | $73.20 |

| $228,401 – $262,800 | $329.40 | $88.00 |

| $262,801 – $298,200 | $385.50 | $102.80 |

| $298,201 – $334,600 | $442.50 | $117.60 |

| $334,601 – $372,400 | $499.50 | $132.40 |

| $372,401 – $411,200 | $557.40 | $147.20 |

| Over $411,200 | $615.30 | $162.00 |

Calculating Your IRMAA Surcharge

To calculate your IRMAA surcharge, you will need to determine your MAGI from two years prior and compare it to the income thresholds. If you exceed the income threshold, you will need to pay the corresponding surcharge.

For example, if your MAGI in 2023 was $150,000, you would be subject to an IRMAA surcharge of $162.90 for Part B and $44.60 for Part D in 2025.

How to Pay Your IRMAA Surcharge

Your IRMAA surcharge will be added to your monthly Medicare Part B and/or Part D premium. You can pay your premium online, by mail, or over the phone.

Exemptions and Reductions

There are certain exemptions and reductions available for IRMAA. For example, individuals who receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) are exempt from IRMAA. Additionally, individuals who have low incomes may qualify for a reduction in their IRMAA surcharge.

Conclusion

IRMAA is a surcharge that is imposed on high-income Medicare Part B and Part D beneficiaries. It is important to understand when IRMAA kicks in and how to calculate your surcharge. If you have any questions about IRMAA, you should contact the Social Security Administration or Medicare.

Closure

Thus, we hope this article has provided valuable insights into When Does IRMAA Kick In for 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

- 0

- By admin