28, Oct 2023

Will Tax Brackets Change In 2026?

Will Tax Brackets Change in 2026?

Related Articles: Will Tax Brackets Change in 2026?

- Current Boston Marathon Qualifying Times: A Comprehensive Guide

- 2025 Toyota RAV4: A Symphony Of Colors To Enchant Every Eye

- Dodge Challenger 2025 RT: The Last Of The Muscle Car Legends

- The First Internal Combustion Engine In The World

- Saskatchewan Summer Games 2025: A Celebration Of Sport And Community

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Will Tax Brackets Change in 2026?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Will Tax Brackets Change in 2026?

Will Tax Brackets Change in 2026?

Tax brackets are the income ranges that determine the tax rate you pay. The higher your income, the higher your tax bracket and the more taxes you pay. Tax brackets are adjusted each year for inflation, but they can also be changed by Congress.

In 2022, the Tax Cuts and Jobs Act (TCJA) made significant changes to the tax brackets. The TCJA lowered tax rates for most Americans and increased the standard deduction. The TCJA also indexed the tax brackets to inflation, which means that they will automatically adjust each year for inflation.

The TCJA is scheduled to expire in 2025. If the TCJA expires, the tax brackets will revert to their pre-TCJA levels. This would mean that most Americans would pay higher taxes.

Congress could extend the TCJA or make other changes to the tax brackets before they expire. However, it is also possible that the tax brackets will revert to their pre-TCJA levels.

What would happen if the tax brackets revert to their pre-TCJA levels?

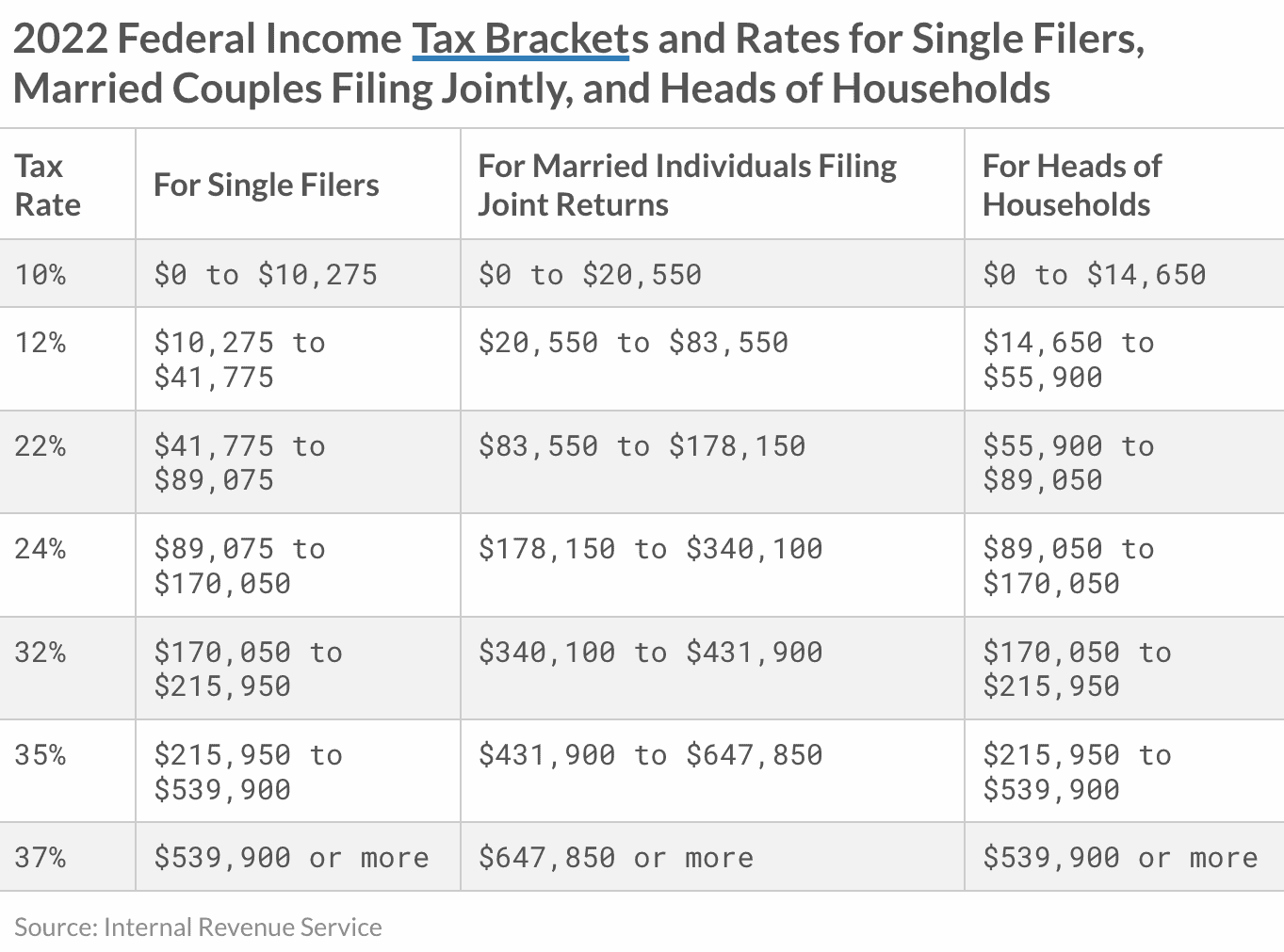

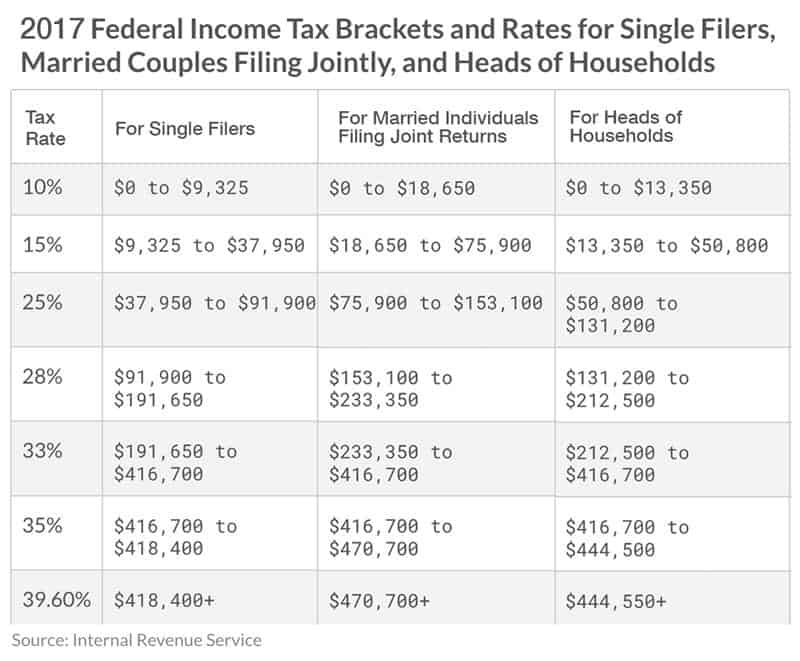

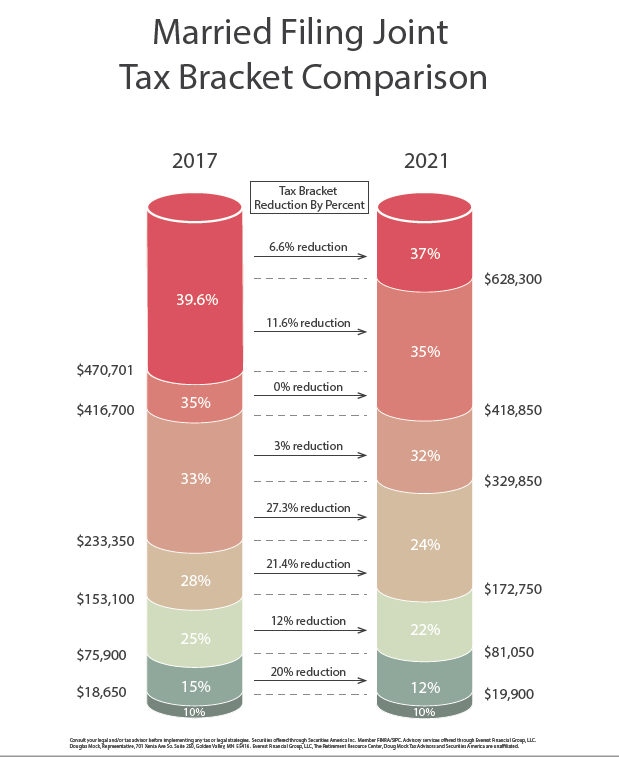

If the tax brackets revert to their pre-TCJA levels, most Americans would pay higher taxes. The following table shows the current tax brackets and the pre-TCJA tax brackets.

| Tax Filing Status | Current Tax Brackets | Pre-TCJA Tax Brackets |

|---|---|---|

| Single | 10%, 12%, 22%, 24%, 32%, 35%, 37% | 10%, 15%, 25%, 28%, 33%, 35%, 39.6% |

| Married Filing Jointly | 10%, 12%, 22%, 24%, 32%, 35%, 37% | 10%, 15%, 25%, 28%, 33%, 35%, 39.6% |

| Married Filing Separately | 10%, 12%, 22%, 24%, 32%, 35%, 37% | 10%, 15%, 25%, 28%, 33%, 35%, 39.6% |

| Head of Household | 10%, 12%, 22%, 24%, 32%, 35%, 37% | 10%, 15%, 25%, 28%, 33%, 35%, 39.6% |

As you can see, the pre-TCJA tax brackets are higher than the current tax brackets. This means that if the tax brackets revert to their pre-TCJA levels, most Americans would pay more in taxes.

What could Congress do to change the tax brackets?

Congress could extend the TCJA or make other changes to the tax brackets before they expire. Congress could also make the tax brackets more progressive, which would mean that higher-income earners would pay a higher percentage of their income in taxes.

It is important to note that any changes to the tax brackets would need to be approved by both the House of Representatives and the Senate. It is also possible that President Biden would veto any changes to the tax brackets.

What should you do?

If you are concerned about the possibility of the tax brackets reverting to their pre-TCJA levels, you should consider taking steps to reduce your taxable income. You can do this by contributing to a retirement account, such as a 401(k) or IRA. You can also deduct certain expenses from your taxes, such as mortgage interest and charitable donations.

You should also stay informed about any changes to the tax brackets. You can do this by reading the news and following tax experts on social media.

Conclusion

The tax brackets are scheduled to expire in 2025. If the TCJA expires, the tax brackets will revert to their pre-TCJA levels. This would mean that most Americans would pay higher taxes.

Congress could extend the TCJA or make other changes to the tax brackets before they expire. However, it is also possible that the tax brackets will revert to their pre-TCJA levels.

If you are concerned about the possibility of the tax brackets reverting to their pre-TCJA levels, you should consider taking steps to reduce your taxable income. You should also stay informed about any changes to the tax brackets.

Closure

Thus, we hope this article has provided valuable insights into Will Tax Brackets Change in 2026?. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin