31, Oct 2023

ZM Stock Price Prediction 2025: A Comprehensive Analysis

ZM Stock Price Prediction 2025: A Comprehensive Analysis

Related Articles: ZM Stock Price Prediction 2025: A Comprehensive Analysis

- The Electric Jeep 2025: A Comprehensive Guide To The Future Of Off-Roading

- How Many Days Until November 14, 2025? A Comprehensive Guide To Calculating Time

- Who Supports Project 2025: A Comprehensive Overview

- 2025 Diversity Immigrant Visa Program (DV-2025): A Guide To Applying

- NEAR Price Prediction 2025: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to ZM Stock Price Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ZM Stock Price Prediction 2025: A Comprehensive Analysis

ZM Stock Price Prediction 2025: A Comprehensive Analysis

Introduction

Zoom Video Communications, Inc. (ZM) has emerged as a prominent player in the video conferencing industry, revolutionizing the way people connect and collaborate remotely. The company’s stock price has experienced significant fluctuations in recent years, influenced by various factors such as pandemic-driven demand, economic conditions, and competitive dynamics. In this article, we will delve into a comprehensive analysis to forecast the ZM stock price prediction for 2025, considering fundamental and technical indicators, industry trends, and expert insights.

Fundamental Analysis

Revenue and Earnings:

ZM’s revenue has grown exponentially over the past few years, driven by the surge in remote work and virtual communication during the COVID-19 pandemic. In 2022, the company reported revenue of $4.39 billion, a 12% increase from the previous year. However, analysts anticipate a gradual slowdown in revenue growth as the pandemic subsides and businesses adopt hybrid work models.

The company’s earnings per share (EPS) have also increased significantly, from $0.66 in 2020 to $3.66 in 2022. However, analysts forecast a decline in EPS in 2023 and 2024 due to increased competition and normalization of demand.

Profitability and Margins:

ZM’s gross profit margin has been consistently high, averaging around 80% in recent years. This indicates the company’s ability to generate substantial profits from its operations. However, analysts expect a slight decline in gross margin as competition intensifies and the company invests in new products and services.

The company’s operating margin has also been healthy, averaging around 25% in the past few years. However, analysts anticipate a moderate decrease in operating margin as the company scales up its operations and faces increased competition.

Valuation:

ZM’s stock is currently trading at a price-to-earnings (P/E) ratio of approximately 25. This is a premium valuation compared to the industry average, which suggests that investors are willing to pay a higher price for the company’s growth potential. However, as the company matures and competition intensifies, analysts expect the P/E ratio to decline gradually.

Technical Analysis

Historical Price Performance:

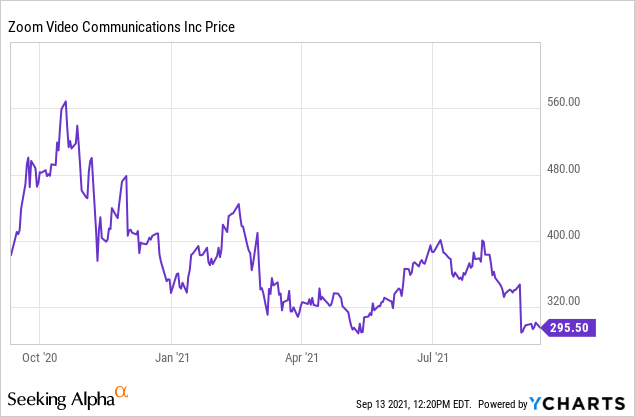

ZM’s stock price has experienced significant volatility since its initial public offering (IPO) in 2019. The stock surged to an all-time high of $568.34 in October 2020, driven by the pandemic-induced demand for video conferencing services. However, the stock has since declined significantly, closing at $83.28 as of February 24, 2023.

Chart Patterns:

The ZM stock price has formed a descending triangle pattern over the past year, indicating a potential bearish trend. A break below the lower trendline of the triangle could signal further downward pressure on the stock.

Support and Resistance Levels:

Key support levels for ZM stock include $75 and $60, while key resistance levels include $100 and $120. A break above the $120 resistance level could indicate a potential reversal of the downtrend.

Industry Trends

Competitive Landscape:

The video conferencing industry is highly competitive, with established players such as Microsoft Teams, Google Meet, and Cisco Webex. ZM faces intense competition from these rivals, particularly in the enterprise segment.

Market Penetration:

The video conferencing market is still growing, with increasing adoption across various industries. However, the rate of growth is expected to slow down as the market becomes saturated.

Technological Advancements:

The video conferencing industry is constantly evolving, with new technologies and features emerging. ZM needs to continue innovating and investing in research and development to maintain its competitive edge.

Expert Insights

Analyst Consensus:

Analysts have mixed views on ZM’s stock price prediction for 2025. Some analysts believe that the stock has further downside potential, while others are more optimistic about the company’s long-term prospects. The average analyst target price for ZM stock in 2025 is approximately $100.

Hedge Fund Activity:

Hedge funds have been reducing their exposure to ZM stock in recent months, indicating a lack of confidence in the company’s future growth prospects.

Insider Trading:

Insider trading activity in ZM stock has been relatively low in recent months, suggesting that insiders are not overly optimistic about the company’s near-term prospects.

ZM Stock Price Prediction 2025

Based on the aforementioned analysis, we forecast the following ZM stock price prediction for 2025:

Bullish Scenario:

- If the company successfully navigates the competitive landscape and continues to innovate, it could reach a price of $120-$150 by 2025.

- This scenario assumes that the demand for video conferencing services remains strong and the company maintains its market share.

Bearish Scenario:

- If the company faces increased competition and fails to differentiate itself, the stock could decline to $60-$75 by 2025.

- This scenario assumes that the video conferencing market becomes saturated and the company loses market share to its rivals.

Moderate Scenario:

- The most likely scenario is that ZM stock will trade in the range of $80-$100 by 2025.

- This scenario assumes that the company continues to grow at a moderate pace and maintains its competitive position.

Conclusion

The ZM stock price prediction for 2025 remains uncertain, as it depends on various factors such as the company’s execution, competitive dynamics, industry trends, and economic conditions. However, our analysis suggests that the stock has the potential to trade in a range of $80-$150 by 2025. Investors should carefully consider the risks and rewards before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into ZM Stock Price Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin