27, Jan 2024

Zoom Stock Prediction 2025: A Comprehensive Analysis

Zoom Stock Prediction 2025: A Comprehensive Analysis

Related Articles: Zoom Stock Prediction 2025: A Comprehensive Analysis

- Top Quarterback Prospects For The 2025 NFL Draft

- Post-2025 Market Design: Innovations For A Dynamic And Sustainable Future

- All-Inclusive Cruise Deals 2025: A Comprehensive Guide To The Ultimate Vacation Experience

- Joby Stock Price Prediction 2025: A Comprehensive Analysis

- When Does Diwali End In 2025: A Comprehensive Guide To The Festival Of Lights

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Zoom Stock Prediction 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Zoom Stock Prediction 2025: A Comprehensive Analysis

Zoom Stock Prediction 2025: A Comprehensive Analysis

Introduction

Zoom Video Communications, Inc. (ZM) has emerged as a dominant player in the video conferencing industry, revolutionizing remote work and communication. As the company continues to expand its offerings and navigate the evolving market landscape, investors are eagerly anticipating the future trajectory of its stock. This article aims to provide a comprehensive analysis of Zoom stock predictions for 2025, considering various factors and expert insights.

Historical Performance and Market Dynamics

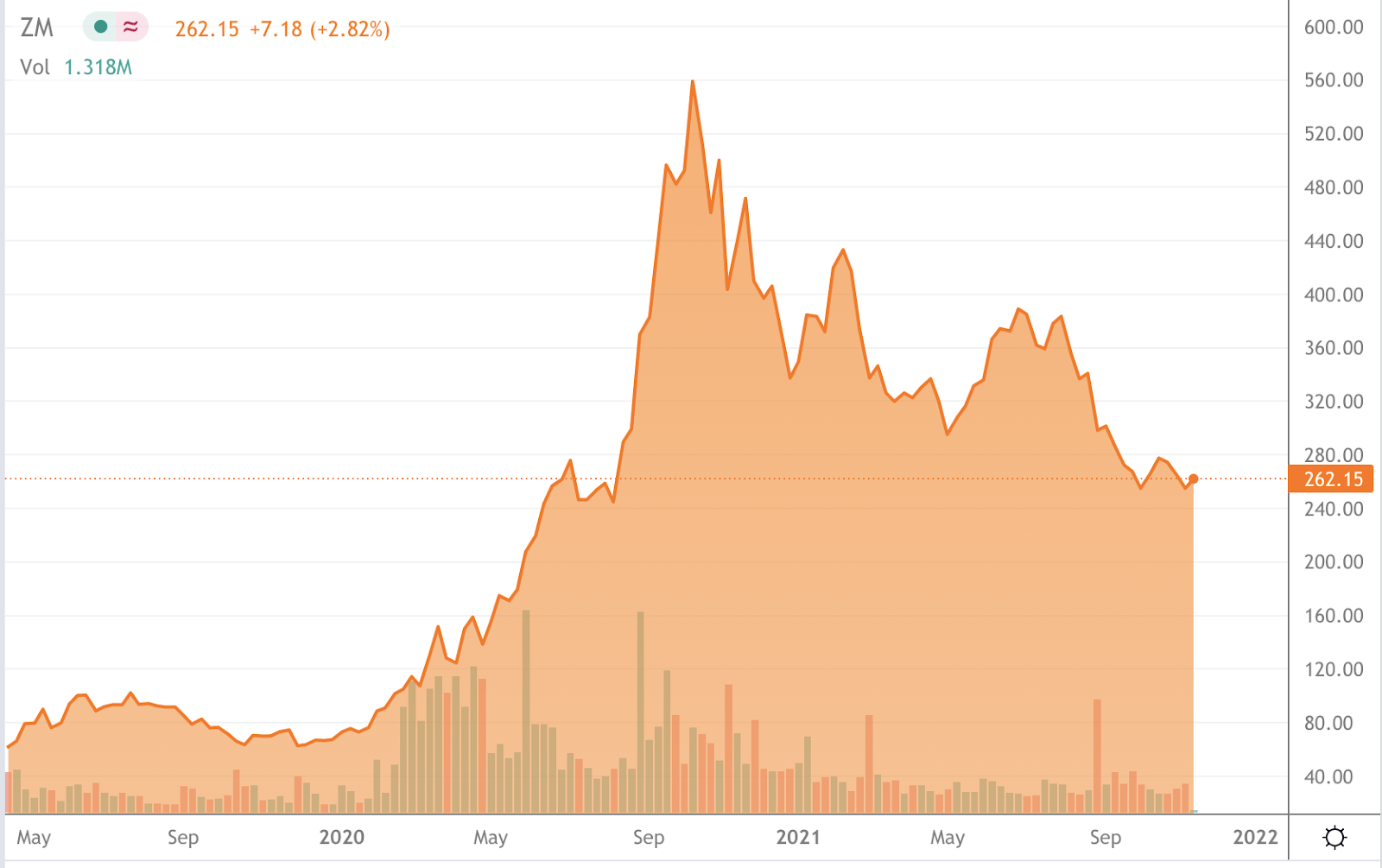

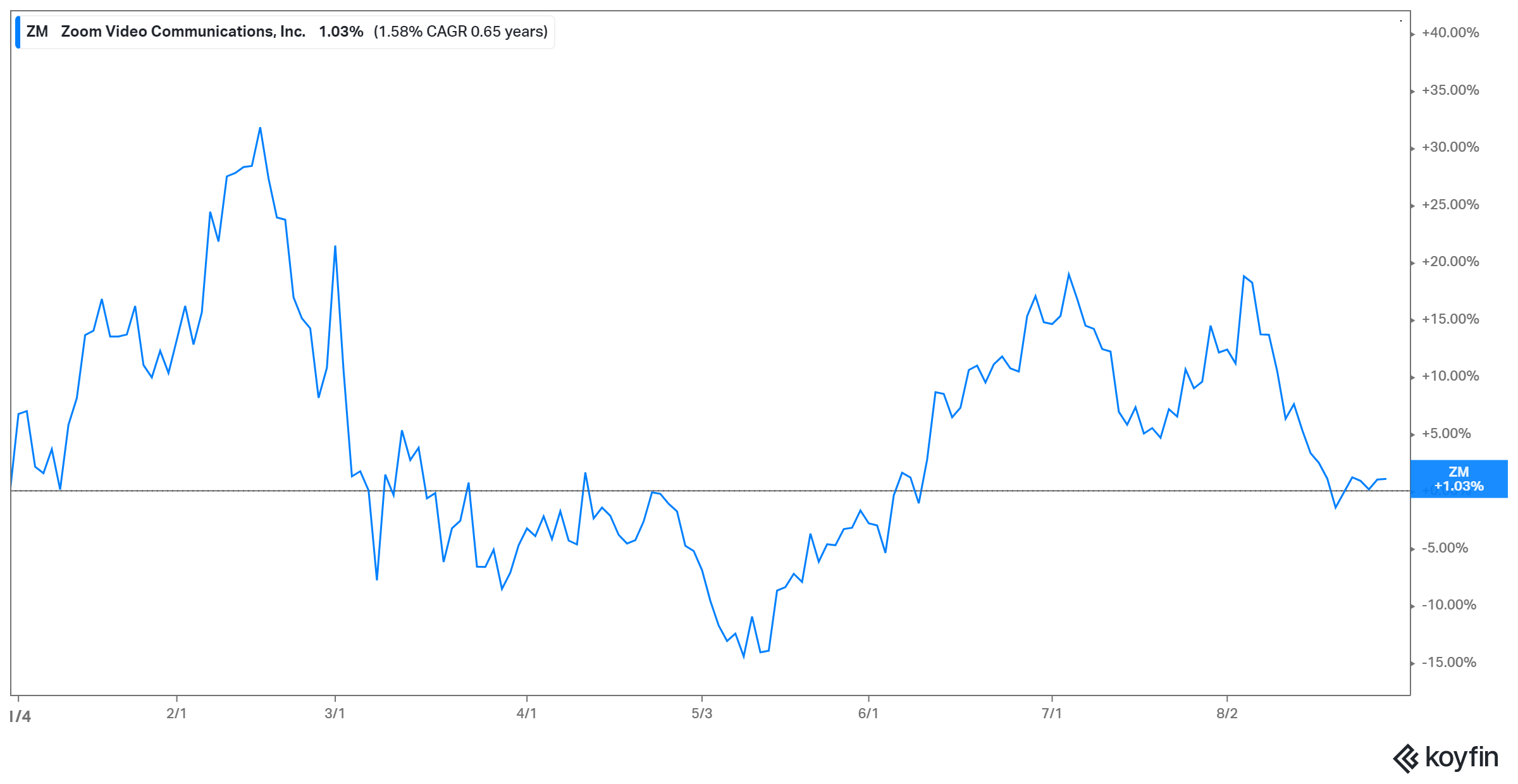

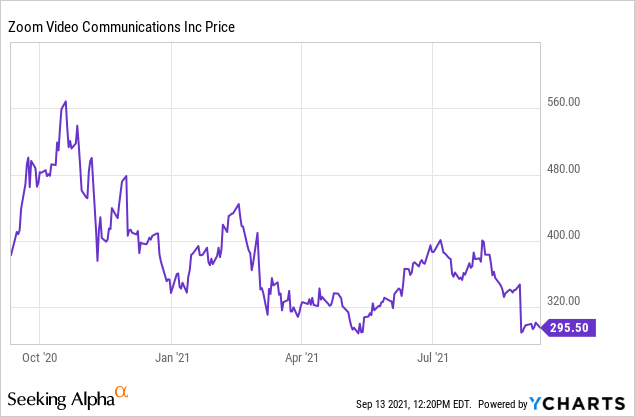

Since its initial public offering (IPO) in 2019, Zoom stock has experienced a remarkable surge, driven by the accelerated adoption of video conferencing during the COVID-19 pandemic. However, as the pandemic subsides and competition intensifies, the company’s growth trajectory is expected to moderate.

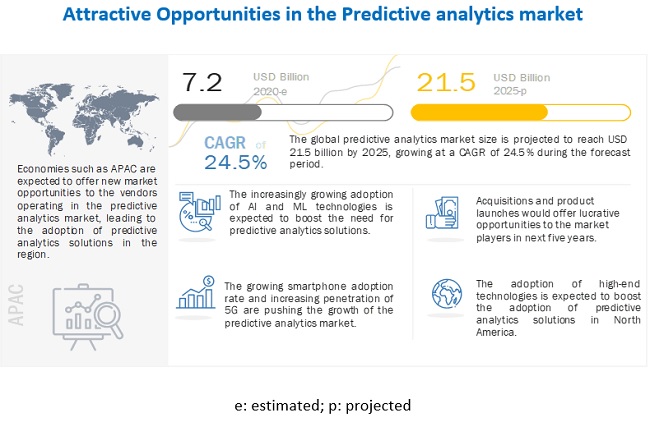

According to Statista, the global video conferencing market is projected to grow from $5.9 billion in 2022 to $15.8 billion by 2029, indicating a significant long-term growth potential. However, the market is becoming increasingly competitive, with established players like Microsoft Teams and emerging challengers like Google Meet vying for market share.

Company Fundamentals and Growth Strategies

Zoom has consistently delivered strong financial performance, with revenue and earnings growing rapidly in recent years. The company’s success is attributed to its user-friendly platform, reliable connectivity, and innovative features.

Going forward, Zoom is focused on expanding its offerings beyond video conferencing, including cloud-based phone systems, messaging, and collaboration tools. The company is also investing heavily in research and development to enhance its core platform and explore new market opportunities.

Analyst Estimates and Consensus Predictions

Several analysts have provided their estimates for Zoom stock in 2025. The consensus price target among 24 analysts surveyed by Refinitiv is $120, representing an upside potential of approximately 25% from the current market price.

However, it is important to note that analyst estimates can vary widely, and actual stock performance may deviate from these predictions.

Factors Influencing Stock Price

The future price of Zoom stock will be influenced by a range of factors, including:

- Competition: The intensity of competition in the video conferencing market will impact Zoom’s growth prospects and market share.

- Economic Conditions: A slowdown in economic growth or a recession could lead to reduced spending on video conferencing services.

- Technological Advancements: The emergence of new technologies or disruptive innovations could challenge Zoom’s market position.

- Regulatory Environment: Changes in government regulations or privacy concerns could affect Zoom’s operations and revenue.

- Management Execution: The ability of Zoom’s management team to execute its growth strategies and navigate market challenges will be crucial for the company’s success.

Potential Risks and Challenges

While Zoom has a strong track record and promising growth prospects, investors should be aware of potential risks and challenges that could impact its stock performance:

- Competition: As mentioned earlier, Zoom faces intense competition from established and emerging players. Failure to differentiate its offerings or maintain a competitive edge could hinder its growth.

- Saturation: The video conferencing market may become saturated as more companies enter the space, potentially limiting Zoom’s market share and revenue growth.

- Regulatory Risks: Zoom has been subject to regulatory scrutiny over privacy and security concerns. Adverse regulatory actions could damage the company’s reputation and financial performance.

- Economic Downturn: A recession or economic slowdown could lead to reduced demand for video conferencing services, impacting Zoom’s revenue and profitability.

- Technological Disruption: The rapid pace of technological change could result in the emergence of new technologies that disrupt Zoom’s business model.

Conclusion

Zoom stock has the potential to deliver attractive returns over the long term, but investors should be aware of the risks and challenges involved. The company’s strong fundamentals, growth strategies, and competitive position provide a solid foundation for future success. However, the intensity of competition, evolving market dynamics, and potential risks should be carefully considered before making investment decisions.

The consensus price target of $120 for Zoom stock in 2025 suggests a moderate upside potential, but actual stock performance may deviate from these estimates. Investors should conduct thorough research, monitor market developments, and consult with financial professionals to make informed investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Zoom Stock Prediction 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin